Cable-Tec Expo: 5G: An Emerging ‘Frenemy’

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

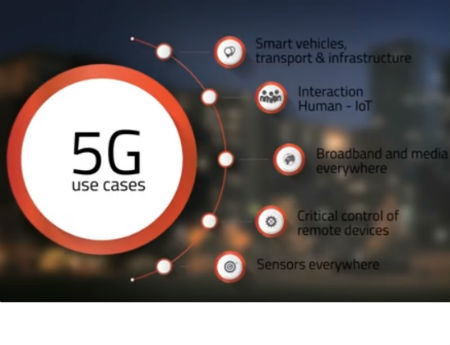

5G, the emerging next-gen mobile standard, aims to deliver fiber-like speeds through the air while also lending valuable support to the exploding Internet of Things marketplace as well as extremely low-latency capabilities that will be required for some new (and sometimes crazy-sounding) applications like self-driving cars.

For the cable industry, 5G poses both a threat and opportunity. While some competitive providers will be able to leverage 5G as way to deliver high-octane broadband to the home, cable operators will also have an opportunity to use it in much the same way. Plus, those big wireless connections will also need a beefy wireline connection to backhaul that traffic – something that MSOs already supply in spades to wireless carriers.

A 5G study from IHS recently took a look at potential use-cases for the technology and 79% of operators surveyed put IoT at the top, up from 55% in the firm’s 2015 study. Those operators also viewed ultra-low latency as 5G’s toughest technology challenge.

RELATED: Wheeler Puts Pedal to 5G Metal

5G “is a significant advancement in mobile connectivity,” Gordon Castle, head of industry area Mediacom, group function technology at Ericsson, said. Its applications run the gamut, from low-powered sensors for IoT, meters, to high-bandwidth service.

How high? He said a 5G demo at this year’s Mobile World Congress showed it pumping out 25 Gbps at given moments.

While that’s a look at burst speeds, the general target is about 1 Gbps per user, Ulf Wahlberg, VP, industry and research relations, group function technology, at Ericsson, said, calling it a “huge leap from 4G.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Cable operators, meanwhile, have made WiFi a key part of their high-speed Internet strategies, and some will be looking to expand their coverage beyond fixed locations. “And 5G could be part of that,” Castle said.

RELATED: Verizon Eyes ‘Wireless Fiber’ Launch in 2017

While pre-standard 5G has been powering recent demos and trials, commercial, standards-based offerings are still about four years out, according to most estimates.

And while 5G represents a new radio technology that promises gigabit-level speeds, it really can’t exist without being paired to a solid fixed-wired network.

“The only way to do that is to bring the cells in to about 200 yards, 500 yards, but…there's not enough spectrum to backhaul it,” Charles Cheevers, chief technology of consumer premises equipment at Arris, said. “You're going to have to go to ground very quickly with 5G small cells.”

He said those backhaul partnerships will be “critical,” noting that “the marriage of wired and wireless is starting to pick up again with 5G networks.”

And whether it’s Google Fiber, a mobile operator like Verizon or a cable operator, 5G could be an economically attractive way to serve a new subdivision without having to run wirelines into it.

Operators in that group could circumvent having to connect a wireline to the last 150 yards of a subscriber in a neighborhood, Cheevers said.

“The cable industry can leverage [5G] to augment their chest of tools and find the best way to deliver the best services to their customers,” agreed Belal Hamzeh, VP of wireless technology at CableLabs. “It offers the cable industry opportunities on both ends -- either as a front haul to deliver service or as backhaul that leverages the existing infrastructure.”