Apollo Puts Stations Back on PE Radar

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

After a long hiatus, private-equity groups are getting more interested in TV station buys, spurred partly by Apollo Global Asset Management’s recent $3 billion deal for Cox Media stations and the firm’s aim to buy even more.

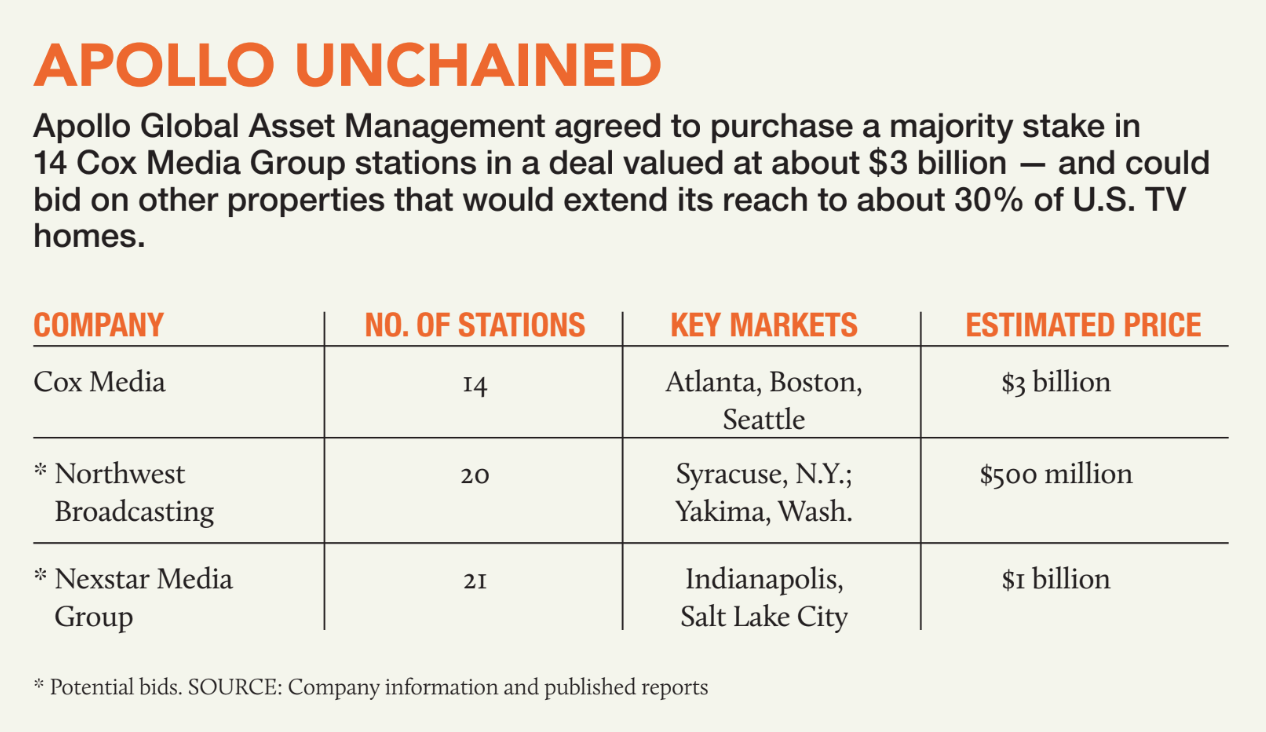

Apollo on Feb. 15 agreed to buy a majority interest in 14 Cox Media Group stations in markets including Seattle, Boston and Jacksonville, Florida, reaching about 31 million viewers. Apollo also is said to be close to a deal to acquire Northwest Broadcasting, a Michigan-based owner of about 20 TV stations in the Pacific Northwest, and is expected to bid for the 21 TV stations that Nexstar Media Group is readying to sell after Nexstar’s $6.4 billion purchase of Tribune Media closes. The for-sale Nexstar stations, which could include properties in Iowa, Connecticut, Virginia, Pennsylvania, Alabama, Indiana, Arkansas, Michigan, Tennessee and Utah, are expected to fetch at least $1 billion from a buyer.

At the Deutsche Bank Media, Internet and Technology conference in Palm Beach, Florida, on March 12, Tegna CEO David Lougee said it’s been clear for a while that private equity investors were looking for broadcasting deals.

Strength in Business Fundamentals

“We’ve known that PE recently, after sort of being down on the space, has gotten interested in the space again,” Lougee said. “We’ve got strong, growing cash-flow capabilities that are way more stable and way more predictable than many investors have believed. They get it and they see it, they see the synergies involved in the business. I’m not surprised they came in.”

Apollo has been quiet so far concerning its plans for the Cox stations — executives declined comment for this article — but reports have said that the intention is to create a larger media company with those stations as a cornerstone. If Apollo follows through with the three deals that have been speculated on [see chart], some analysts estimate it would have stations that reach about 30% of U.S. TV homes and would become the fifth-largest station group in the country.

Veteran broadcast analyst and Wolfe Research managing director Marci Ryvicker said that other PE funds — Providence Equity and Blackstone Group have been the most talked-about names — might be poking around station groups, mainly because of Apollo’s interest.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“I think this is very much Apollo-driven,” Ryvicker said. “I think they would like to roll up the space. … I think what Apollo is doing is, they’re combining a bunch of companies until they hit the cap.”

The “cap” is set by the FCC, limiting one company from owning stations that reach more than 39% — 78% if the discount for UHF stations is included — of U.S. TV households. While most industry players believe that the UHF discount will be eliminated and the overall cap raised to about 78%, others have pushed for the cap’s elimination altogether.

At the Deutsche Bank conference, Lougee predicted the cap would rise to between 60% and 78%. “That will open up more possibilities and opportunities for us,” he said.

With more regulatory room to buy stations, the question becomes not which station group is under the cap, but which ones are willing sellers, Ryvicker said. So far, it appears that larger groups like Gray Television, E.W. Scripps and Tegna are buyers, not sellers, she said.

“I think it is going to take some time for some of these companies to say ‘We’re ready to sell,’” Ryvicker said. “They’re not ready.”

Tegna, which owns stations that cover about 33% of the country, is expected to make moves to get bigger.

Mergers and acquisitions are “a very big part of our future strategy,” Lougee said at the Deutsche Bank conference. “We have enough scale today to do what we need to do. We absolutely believe in scale over the long term. We are poised to be a big consolidator.”

Most of the major players in private equity were involved in the industry in the earlier part of the 2000s, but exited by either selling out to larger station groups or via the federally supervised spectrum auctions.

Blackstone, through subsidiary LocusPoint Networks, owned more than a dozen stations at one point, but sold most of them in 2017 and 2018 in spectrum auctions and to other broadcasters.

Blackstone did not respond to a request for comment.

Providence Equity used to be a bigger player in broadcasting, but has since whittled down its holdings to stakes in Univision Communications, German broadcaster ProSiebenSat.1 Media and Hong Kong broadcaster TVB.

Providence Equity did not return a request for comment.

Cap Change May Be Next Catalyst

TV stations are attractive to private equity because they generate a lot of cash and don’t require heavy capital investments. This allows PE firms to load up the companies with debt and then deleverage quickly. After the obligatory three-to-five-year investment cycle typical of most private equity groups expires, they can either sell the stations to another buyer or take them public.

In the meantime, there are plenty of reasons to buy TV stations: a continued strong political ad market; robust retransmission-consent revenue; and the advent of the ATSC 3.0 standard which could open up the industry to new, data-driven businesses.

“The next big catalyst for the space will be the cap,” Ryvicker said. “I don’t know if that makes anyone feel like they’re a seller, but it will definitely get investment bankers knocking on people’s doors.”