Executive of the Year: True Patriot

Patriot Media’s Jim Holanda helps push valuations with strong operations

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

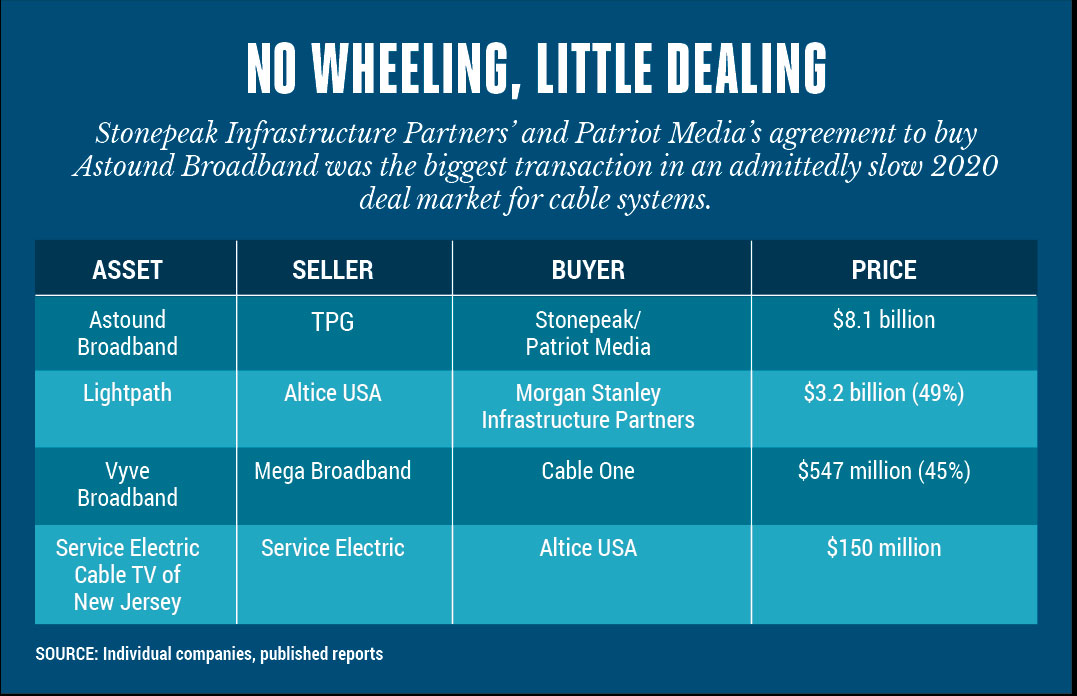

In a year dominated by a pandemic and a nationwide inability to agree on practically anything, Patriot Media not only managed to help engineer the biggest system sale of the year for private-equity giant TPG Capital — the $8.1 billion sale of Astound Broadband to Stonepeak Infrastructure Partners — but it came in a way that will likely positively affect cable valuations in the years to come.

Led by CEO Jim Holanda, Multichannel News’s 2020 Executive of the Year, Patriot has been a constant in Astound’s operations in its various forms for about a decade, starting with the 2010 purchase of RCN by Abry Partners. After Abry sold RCN and Grande Communications to TPG in 2016 for $2.25 billion, Patriot continued to manage the assets and help TPG build its cable stronghold, later adding Wave Broadband and enTouch Communications to the mix.

ALSO READ: Steve Simmons: The Original Patriot

Astound — there is still a question as to whether the new private-equity owners will keep the name — is the sixth-largest cable and broadband provider in the country, with about 1 million customers. But make no mistake, the company’s success over the years is a result of the astute stewardship of Patriot Media, which has steered somewhat disparate assets — a mixture of rural and urban systems, overbuilds and incumbent operations across eight states and the District of Columbia — through a business climate that could at times be hostile.

“[Holanda] has really become the face of the middle market broadband industry,” said Garrett Baker, managing director at Lazard and group head of middle market telecom, media & technology. “Once you get past the big MSOs — Comcast, Charter, Altice — he’s become the most visible and most respected executive in that next level. He’s really become the biggest voice in the room and the face of that part of the industry.”

In Cable Since the ’80s

Holanda got his start in the cable industry on somewhat of a lark. After graduating from The Ohio State University in 1987 with a degree in political science, he and a college friend moved to Southern California and started looking for jobs. In 1988, his college buddy, a former cable installer, found the same work with Comcast.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

“I had a college education and he had cable experience, so the deal was they had to hire us both because we only had one car,” Holanda said.

After six months as a cable installer, Holanda moved up to Comcast’s accounting department and, after taking some additional accounting and business courses, moved to the finance department. In 1995, shortly after Comcast purchased systems from Maclean-Hunter, it moved him to another finance job in New Jersey. He stayed in New Jersey for another three years, moving on to Charter Communications when an opportunity to run systems arose.

“I grew up on the finance side of the business, but I always wanted to be in operations,” Holanda remembered. “When Charter bought AT&T in St. Louis, [then-Charter CEO] Jerry Kent and [then-chief operating officer] Dave Barford asked me to be the general manager and vice president of operations for all of St. Louis and the whole market. It was my first operations role.”

Holanda helped Charter integrate the AT&T system and spent four years at

the company, rising to regional VP of operations for its Central Region. In 2003, he joined former Simmons Communications founder Steve Simmons in his new venture, Patriot Media.

“Steve’s a very convincing and compelling individual,” Holanda said, adding that Simmons drove home the point that getting the opportunity to build a company from the ground up doesn’t come often, even in the cable business. “I’ve learned over the last 18 years that I am, deep down, an entrepreneur.”

That last quality, Simmons added, was a key reason why Holanda was hired.

“He recognized the importance of equity,” Simmons said. “I could see he had a real entreprenuerial spirit. After two days of grueling interviews — I even gave him my projects to analyze and a written exercise — I hired him. Every year for 18 years I’ve been thankful that decision was made. He’s been spectacular.”

The going was anything but easy from the start. Patriot’s first system was a property in the Princeton, New Jersey area that needed a lot of work.

“The Central New Jersey system, it was a complete and utter mess when we bought it,” Simmons said. Patriot had to create call centers, rebuild the plant, redo the channel lineup, overhaul technical operations and how people were trained and completely revamp the marketing systems and strategy.

“I don’t want to skip over the challenges the Patriot Media team had when we entered Central New Jersey,” Simmons continued, adding that when he initially met with the mayors of the communities the systems served prior to buying the properties, he learned they had banded together to try to get the old owner ousted. About 12 months after Patriot bought the systems, those same mayors got together to praise the company for the massive changes they made.

“It was a real turnaround,” Simmons said.

Patriot sold that system to Comcast in 2007, and soon after bought Puerto Rico cable operator Choice Cable TV, with the help of its Princeton system backer, Spectrum Equity Associates. That was just before the 2008 global recession, a period when deals were falling apart as banks and other financial institutions began tightening their belts. By applying the same strategy it used in Princeton, Patriot got Choice Cable back on its feet.

“We owned that asset for seven and a half years, tripled cash flow over that period of time and made significant investments,” Holanda said.

While running Choice Cable, Patriot and Spectrum Equity hooked up with Boston private-equity firm Abry Partners to look at its next target, then-publicly traded overbuilder RCN. Abry bought RCN in 2010 for about $1.2 billion, naming Simmons chairman and Holanda CEO of the overbuilder.

The RCN deal also gave Holanda and the Patriot team first-hand, early exposure to the true power of broadband. Simmons remembered that RCN wasn’t necessarily a distressed company, but it needed work. But the company had already proven it wasn’t afraid of getting down in the dirt.

“I think they realized that even though some of these businesses had challenging competitive profiles, they still had underlying positive trends, specifically around broadband,” Baker said. “They [Patriot] were able to take challenged businesses and put them together, created synergies, created growth strategies and eventually built a great business out of it.”

Still, overbuilders had a reputation of being tough businesses that require a lot of investment and face stiff competition from incumbents. Despite those drawbacks, RCN had something its competitors didn’t, Holanda said.

Spotted Key Asset at RCN

“Clearly, after 20 years of being on the traditional side of the incumbent cable business, I never thought I would own or operate an overbuilder,” Holanda said. But as the companies conducted their due diligence, they found that RCN’s networks, built in the late 1990s and early 2000s, had two to three times the fiber of traditional cable networks, and much more excess fiber capacity per node. While the average cable system had 500 to 700 homes per node, RCN had built to under 150 homes per node.

“That network advantage was something that jumped out at us right away,” Holanda said. “It took us a little while to wrap our heads around that overbuilder nomenclature, but at the end of the day, a customer is a customer.

“And whether you’re competing against a telephone company for those customers or a cable and telephone company, we’ve always seen competition ever since the satellite guys got into the video business, so we were used to it and not afraid of it,” he added. “Obviously, it turned out to be a really good gamble.”

That was evident in the rising valuation of the company. TPG bought RCN and much smaller Grande Communications in 2016 for about $2.5 billion — more than twice the original price Abry paid — keeping Patriot as an equity partner. In 2018, the company bought Northwest broadband company Wave Broadband for $2.36 billion and enTouch Communications was added earlier this year. Collectively, the assets are known as Astound Broadband.

The mix of Astound’s assets, in rural, urban and midsized markets, has also proven to be an advantage, something larger cable operators are just beginning to see. For the past couple of years, Charter Communications and Comcast have been edging out their networks to smaller areas adjacent to their service footprints to take advantage of the demand for high-speed internet service.

Those moves by bigger companies haven't impacted Patriot’s or Astound’s business, Holanda said.

“It hasn’t impacted us other than it kind of reaffirms the strategy that we’ve been pursuing for the last eight years,” Holanda said. “We already knew it was a good investment. It’s nice to see the industry recognizing that as well.”

Boosted By Solid Backers

Holanda said having the support of its backers throughout the years also has been a big benefit to Patriot. Companies like Spectrum Equity, Abry and TPG have all helped finance Patriot’s moves over the past 18 years — and have allowed managers to run the business their way.

“Private equity does not make quarter-by-quarter and year-by-year decisions about the business,” Holanda said. “They want to understand how we’re going to set it up for success over the next three years, the next five years, the next seven years.”

That includes Patriot’s earlier private-equity owner, TPG, which bought into RCN and Patriot about three years ago. Initially, Holanda said, TPG wasn’t looking to sell Astound. It was investigating several different scenarios, including going public, to push the company forward.

“There wasn’t a rush to exit, but it was hard to ignore the fact that cable multiples were hitting record highs in the back half of 2019 and the early part of 2020,” Holanda said. “Being prudent equity investors, if there was an opportunity to take advantage of that in the public markets or the private markets, we wanted to be able to set ourselves up to do that.”

Then, the pandemic hit and everything was put on hold, switching the company’s focus to day-to-day operations and keeping employees and customers safe. While there was initially some doubt as to how COVID-19 would affect the economy, early signs were encouraging: federal stimulus packages were strong, the Federal Reserve kept loan flows humming and the bond market was performing well.

Patriot first created a new debt structure for Astound, allowing its investors to take a dividend. More importantly, that new structure included a portability feature that would eliminate the financing risk if they ultimately decided to sell the company or go public.

That helped spur interest from potential suitors, and Holanda said he was surprised at the number of players (more than a dozen) that expressed interest in buying Astound.

But the combination of a robust broadband market, available capital and favorable financing made Astound an attractive target. And even in the pandemic, there is a lot of idle cash looking for a home.

“It hasn’t been front-page news, but the residential broadband market, broadly speaking, is stronger now than it’s ever been in my career,” Baker said. Fueling that strength are deep-pocketed infrastructure funds once focused on energy, airports and toll roads, he added. “The infrastructure funds, of which Stonepeak is one, are entering the industry incredibly aggressively,” Baker said.

ALSO READ: Holanda: Astound Will Continue to Grow

Stonepeak partner and senior managing director Brian McMullen said the private-equity company isn’t a total stranger to residential broadband — it has an interest in Canadian residential provider Xplornet Communications — but Astound was a unique opportunity.

“We've looked at dozens and dozens of opportunities in North America and Asia-Pacific,” McMullen said. “We’ve looked at incumbent telcos, fiber-to-the-home overbuilders and we’ve looked at cable. There’s puts and takes across all the above, but we thought that Astound, and its network footprint, aligned really well with what we were looking for.”

The sale of Astound to Stonepeak — the deal is expected to close in Q2 of next year — gave a needed lift to cable valuations overall. With a price that some analysts estimated to represent a multiple of 14.1 times 2020 forward-looking cash flow, the purchase further solidified the importance of broadband service and could help raise valuations for public cable companies.

In a research report last month, Bernstein media analyst Peter Supino pointed to the Astound deal as a benchmark for future valuations, adding that it was able to attract a hefty multiple even without the operating synergies usually inherent in such transactions.

Owners: Stonepeak Infrastructure Partners; Patriot Media

Brands: RCN, Grande Communications, Wave Broadband, enTouch Communications

Service Territory: Chicago, Eastern Pennsylvania, Massachusetts, New York City, Northern California, Oregon, Texas, Washington, D.C., and Washington State

Subscribers: More than 1 million

Purchase Price: $8.1 billion ($3.6 billion in cash, $4.5 billion in assumed debt)

SOURCE: Company and published reports

“Astound’s sale price appears to be highly relevant” to public cable operators like Altice USA, Charter Communications and Comcast, Supino wrote in a November note to clients, adding that applying the same multiples to the publicly traded stocks would result in increases to their share prices ranging from 32% to 91%.

Stonepeak manages more than $29 billion of capital for investors, but its portfolio consists mainly of data centers and fiber companies, not cable or broadband service providers. Add to the fact that Astound was managed well, meaning there is little fat to cut from operations, and the sale price is even more impressive.

Holanda said the business isn’t a one-trick pony. Astound has a three-pronged growth opportunity: residential broadband; commercial services, growing at a double-digit percentage rate annually; and edging out the network to adjacent communities within its footprint.

“Those three combined growth strategies allow us to grow our cash flow faster than most traditional cable companies,” Holanda said. “And if you add back the ability to continue to do add-on acquisitions, which we’ve had a long history of success with, we have the ability to grow this business from a whole lot of different angles. I think Stonepeak appreciated that early on.”

Kept Executive Team Together

Another key to Patriot’s success has been its ability to retain key executives. Most of the company’s senior management and six of its eight local market leaders have been with the company for a decade or more. Having that kind of experience and expertise allows everyone to have a voice at the table, Holanda said, whether that means finance executives can talk about marketing or marketing people about network issues.

“To have that kind of group thinking leaves everyone hyper-focused on the business all the time,” Holanda said. “I think that is a tremendous key to our success. … To have that kind of leadership stability at the local level as well just gives the organization a tremendous ability to focus on what

the right long-term decisions are on behalf

of customers.”

That continuity also was a factor for Stonepeak in its decision to pull the trigger on the Astound deal and to work with Patriot.

“If you look at the people around Jim, it’s an absolutely fantastic team,” McMullen said. “It’s a team that has been together a long time. There’s a lot of continuity, which I think speaks to Jim’s leadership, it speaks to the culture of the business and the organization.”