CES Panels Highlight Streaming’s Growing Pains

Players see shakeout coming and cite need for better navigation, content discovery

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Streaming video’s rapid expansion — fueled by explosive growth during the COVID-19 outbreak — will continue to increase in coming years, along the way finding a new equilibrium with traditional broadcast and cable TV.

That was the consensus of three virtual sessions at CES 2021 that examined the evolving media relationships of the digital ecosystem. (For more from CES, including WiFi and smart set upgrades, see Tech, page 16).

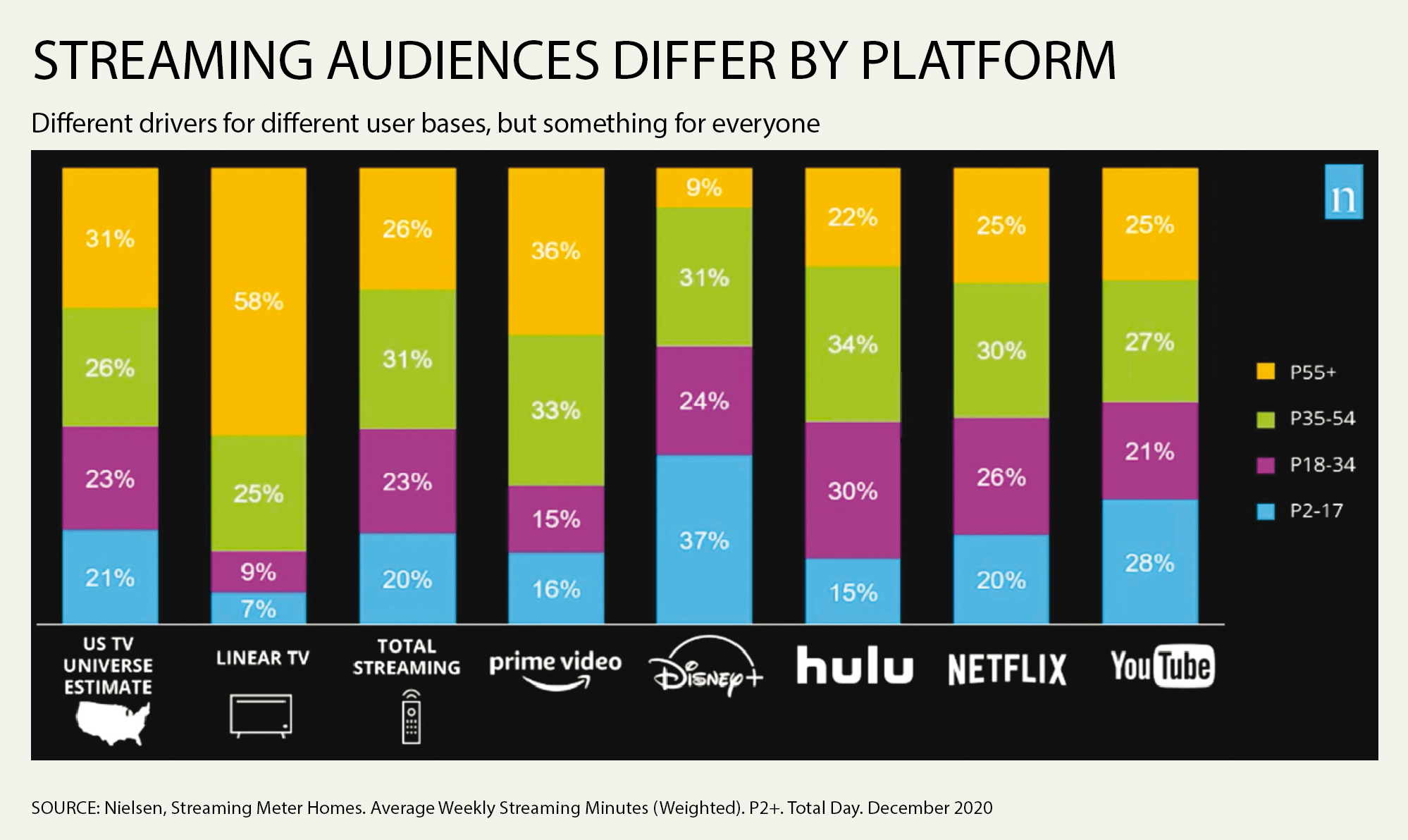

Data from Nielsen Global Media showed that the pandemic encouraged viewers, especially in older demographics, to learn how to use streaming technology, Nielsen senior VP of product strategy and thought leadership Brian Fuhrer said. As a result, the audience measurement firm’s year-end assessment showed that total streaming audiences at all age categories were very similar to the segmentation of traditional (broadcast and cable) viewing. But the assessment also showed that older viewers (age 55 and up) are now among the biggest users of linear, rather than on-demand, streaming services — reflecting their comfort level with linear, ad-supported formats, Fuhrer said.

Despite the growth of streaming viewership from December 2019 (117.7 billion minutes) to last December (132 billion minutes), the percentage segmentation of preferences, topped by YouTube and Netflix, remained relatively consistent.

Moreover, Nielsen’s findings underscored the continuing crossover between programming on traditional media and over-the-top platforms. For example, reruns of sitcom The Office attracted 10 million viewers on Netflix (before the show moved to Peacock this month). But The Office also attracted 11 million viewers for episodes airing in syndication on Comedy Central, local stations and from other sources.

“That is really important when looking at content,” Fuhrer said, emphasizing “the long-term life in multiple platforms simultaneously.”

Nielsen’s research also identified emerging release protocols, such as the value of offering all episodes of a series simultaneously (thus allowing immediate bingeing) versus regular rollouts, such as weekly release. Fuhrer noted that Disney Plus’s The Mandalorian had very high viewership during every weekend release, while series unleashed all at once showed steep viewership dropoffs after a one-time spree.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Fuhrer’s data was reflected in the discussions on two separate CES panels dealing with streaming. In particular, panelists said, the role of original content versus “acquired” programming such as off-network series is a work in progress. Speakers also looked at the role of content in consumer acquisition and retention.

At a session titled “The Great Unbundling in Video,” Philo CEO Andrew McCollum predicted cord-cutting would continue to accelerate the viewer shift toward streaming. He expects the streaming companies will “offer new options to people who cut the cord long ago and are looking for new options,” he said.

Five to 10 years from now, McCollum said, consumers won’t consider OTT options to be “cutting the cord,” but rather “a better way to get the content they care about.”

Both McCollum and fellow panelist Scott Reich, senior VP of programming at AVOD platform Pluto TV, cited the growth their services experienced during the early COVID crisis. For Philo, it was a surge of attention to kids’ content, while Pluto TV’s “massive influx” came as the 2020 political campaign heated up.

As PlutoTV, owned by ViacomCBS, had a lot of political and health information, its channels offered “an interesting combination” of political and pandemic news, plus “a whole lot of escapism” from its entertainment channels, including cross-selling of Showtime programs via streaming teases of selected shows.

Reich and McCollum agreed that streaming isn’t a winner-take-all marketplace, though both said there are lots of questions about how many entrants the SVOD market can support.

Finding Shows Still a Challenge

Predictably, data is at the heart of video navigation and search. At the “Streaming’s New Era” session, Sandeep Gupta, VP and GM of Amazon’s Fire TV, acknowledged his company — known for its algorithmic awareness of customer preferences and usage — is not sharing what it knows, even with partners such as co-panelists from Starz and WarnerMedia.

“The key thing is helping them discover content in ways that [the programmers] didn’t think of before,” Gupta said.

Viewers know what they want to watch and can find it some two-thirds of the time, said Sarah Lyons, senior VP, product experience at WarnerMedia. “We believe in a blend of human curation with underlying data to facilitate that curation,” Lyons said.

“We are all in this battle to make sure our customers can find our content as easily as possible,” said Starz senior VP of distribution Stefanie Meyers. “We’re just trying to make sure that we make it as easy as possible for our consumer on whatever platform … so they can engage.” λ

Contributor Gary Arlen is known for his insights into the convergence of media, telecom, content and technology. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the longtime “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports. He writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs. Gary has taught media-focused courses on the adjunct faculties at George Mason University and American University and has guest-lectured at MIT, Harvard, UCLA, University of Southern California and Northwestern University and at countless media, marketing and technology industry events. As President of Arlen Communications LLC, he has provided analyses about the development of applications and services for entertainment, marketing and e-commerce.