Virtual MVPDs Added Over 1 Million Users in Q3, Offset Huge Linear Pay TV Losses

It was the third biggest growth quarter ever for vMVPDs, which made Q3 cord-cutting look not as bad as it really was

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

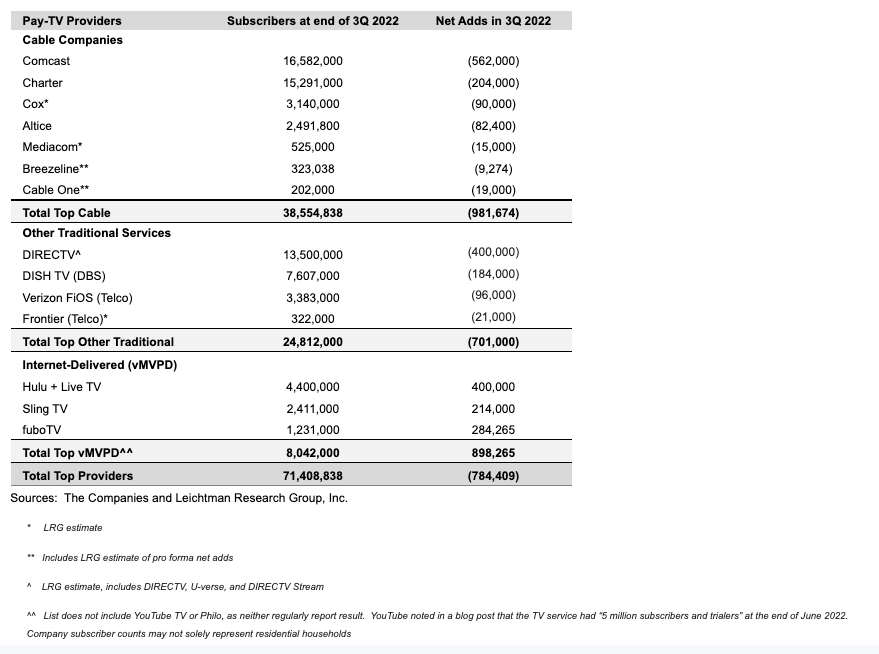

The top seven U.S. cable companies collectively lost nearly 981,674 pay TV customers in the third quarter, according to estimates and tallies collected by Leichtman Research Group (LRG).

Overall, these same seven MSOs lost nearly 8% of their combined video customer base from Oct. 1, 2021 - Sept. 30, 2022, led by Comcast, which shed Xfinity TV subs at a 10.6% clip over that span (our math, not LRG's).

However, the heavy linear pay TV losses in Q3 were offset by the biggest growth quarter for virtual MVPDs in two years, with Hulu Plus Live TV, Sling TV and fuboTV combining to add 898,265 customers from July - September.

Google doesn't often break out customer growth for market leader YouTube TV, and LRG doesn't hazard estimates for the platform in its quarterly report on the state of pay TV cord-cutting. But assuming YouTube TV grew like the rest of the market did, the vMVPD sector just had its best quarter since Q3 of the pandemic 2020 frame.

Officially, LRG said it was the third biggest growth quarter for vMVPDs ever, trailing only the third quarters of 2020 and 2019. Hulu + Live TV, Sling TV and fuboTV -- the vMVPDs that LRG does count -- have collectively grown their customer bases by around 7% over the last 12 months. Going back two years, however, the growth rate for these three companies comes in at just under 4% (again, our math).

Meanwhile, in U.S. pay TV, linear losses remained steep beyond cable.

Dish Network lost another 184,000 satellite TV customers. And LRG once again estimated that DirecTV lost 400,000 customers across DirecTV satellite, DirecTV Stream and U-verse TV. (Note that LRG has been estimating quarterly losses of 400,000 for DirecTV since it was spun off from AT&T last year and disappeared from public view.)

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Collectively, the top 13 U.S. pay TV companies -- minus Google -- represent 92% of the market and lost a combined 784,409 customers in the third quarter, vs. 653,616 in the third quarter of last year.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!