NextGen TV’s Busy Summer Sets Up Fall Events

Dozens of rollouts, innovative projects and promising predictions, amid concerns about viewer acceptance

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The numbers for NextGen TV look good right now:

- Broadcast stations in 16 more markets are lighting up their ATSC 3.0 signals this summer, bringing the total to 47 metro areas.

- About 150 stations are involved, with many of them transmitting multiple channels.

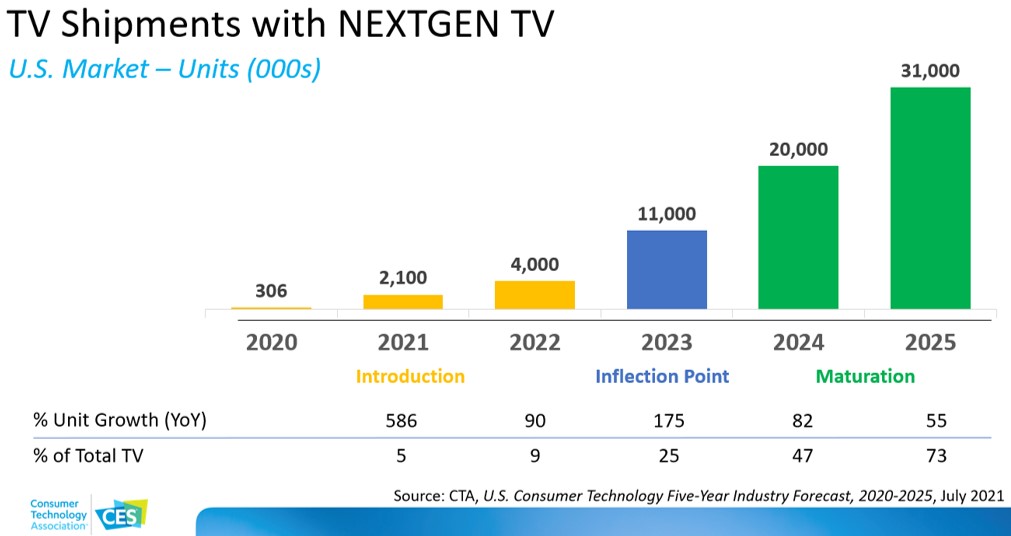

- Sales forecasts envision two million receivers this year, four million next year and 11 million in 2023 plus a new line of 3.0 set-top boxes.

With those ATSC 3.0 data points in hand – plus the looming Washington, D.C. multi-station launch, which will provide a political tech showcase -- the new platform’s cheerleaders are enthusiastic.

"NextGen TV signals now reach 22% of households in our stations' footprints,” said Mark Aitken, VP of advanced technology at Sinclair Broadcasting Group and president of its ONE Media subsidiary. Aitken said every market Sinclair launch offers "Advanced HDR (high dynamic range) by Technicolor" content and “hybrid TV” is also in the works across the company's stations.

Overall, according to FCC data, one-third of U.S. homes will be within range of a NextGen TV signal as of mid-August when Atlanta stations light up.

Sinclair’s “hybrid TV” approach includes STIRR, the ad-supported video-on-demand streaming service. “We’ll have OTA (over-the-air) and OTT (over-the-top) brought together in our hybrid environment,” Aitken said.

Separately, Pearl TV is “laying the groundwork for future opportunities.”

“We’re 100% focused on scale,” said Anne Schelle, managing director of Pearl TV, the broadcast group consortium supporting the all-internet protocol delivery platform. “This is not your grandmother’s [digital] transition. The economics are much different. … Scale will happen a lot faster.” Schelle said each market rollout has a viewer education plan in which the consortium runs a three-week promotional campaign with stations running 10-, 15- and 30-second spots inviting viewers to look at the website to learn about the new technology. Pearl TV is coordinating with local retailers who are selling the new receivers.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Patrick Butler, president of America’s Public Television Stations, proudly points out that about a dozen public TV stations have transitioned to 3.0 and that New Mexico PBS is the first to carry all five public TV programming streams in the new format.

But Butler also acknowledges that many public TV stations are “stymied by the cost of conversion.”

“We have requested that Congress provide funds to accelerate this conversion,” Butler told B+C. He’s hopeful for the support because “the new broadcast standard means not only better pictures, sound, signal strength and mobility but also a major opportunity to enhance our remote learning capabilities, public safety communications, and other ancillary and supplementary uses of our spectrum, as Congress and the Federal Communications Commission have been encouraging us to do for years.”

Analysts are maintaining a realistic attitude about the adoption of NextGen TV. Stephen Baker, VP industry analysis at the NPD Group, observed that, “We’re barely in the infancy” of NextGen TV.

“Until the costs [drop] and availability becomes more widespread, then whatever the tech and software bring doesn’t mean a lot,” said Baker, who follows consumer electronics for the market research firm.

Moreover, there are still questions about the status of the non-broadcast services that NextGen TV promoters have promised: digital capabilities that will provide new business options.

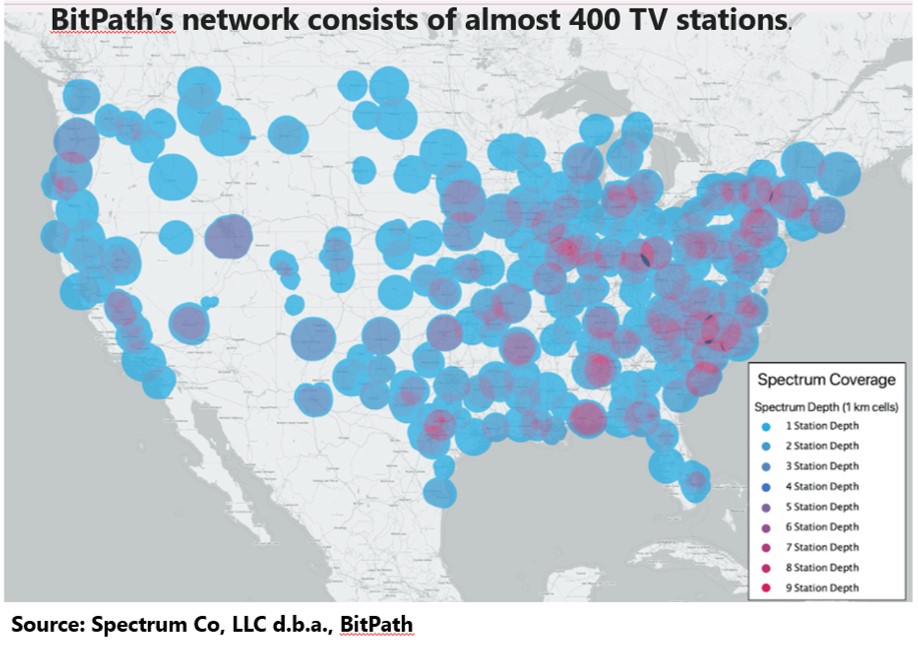

“We’ve worked hard not to look like a bunch of TV stations with a side hobby, but rather a data network that incidentally relies on TV stations for high power transmissions,” said John Hane, president of BitPath, a joint venture of Sinclair and Nexstar Media Group (both of which are Pearl TV members). Hane characterized BitPath’s main mission as “to create data broadcasting services that are profitable and serve the public interest.” To do that, he said, it’s necessary to have 3.0 capacity “on the air,” and he expected “to be on at least 25 sticks this year” and to provide service via more than 100 stations by the end of 2022.

But Hane, too, admitted that BitPath is “just at the beginning of the process.”

“We came up with a model hosting agreement and a transition process … and we created sophisticated back-end systems to support multiple ongoing transition planning,” he said.

Expanding Data Services

Since May, NextGen stations have popped up in these markets: Atlanta; Baltimore; Charlotte; Grand Rapids; Hartford and New Haven, Connecticut; Houston; Indianapolis; Kansas City; Little Rock; Orlando; Sacramento; St. Louis and West Palm Beach. In Phoenix, where the “model market” launch has been underway for more than a year, single frequency network (SFN) transmissions started in July.

Stations are already developing and testing data applications, some of which are based on “Run3TV,” the new name of the app formerly known as the A3FA Framework Application. The app is built on top of Pearl TV’s common app framework.

At Scripps-owned WXYZ-TV in Detroit, a local development team customized it to match the look and feel of the station’s branding of WXYZ and supplied the framework with VOD content that viewers can access via their NextGen TV remote control.

“The content includes categorized news video packages along with daily weather forecast from their local weather meteorologists,” said Bryan Dunbar, VP and CTO at E.W. Scripps Co. He said the “beauty of the framework is that we are now able to leverage this same software package and re-skin/brand it for all of other stations.”

New Mexico PBS transitioned its flagship digital station KNMD to ATSC 3.0 in late June, covering the Albuquerque/Santa Fe metros, which reaches about half the state’s population. Although the original station KNME (which reaches most of north and central New Mexico via translators) will continue to transmit in ATSC 1.0, the new NextGen TV transmitters will simulcast the full public TV line-up. That makes it the first public station to carry all five network streams -- PBS, PBS Kids, FNX, World and Create -- in ATSC 3.0, according to Franz Joachim, CEO and general manager of NMPBS.

Joachim said that the stations are considering a 4K broadcast test (“an idea in its infancy”) and they are looking for ways “to monetize the [3.0] spectrum to support our mission.”

“We have been pushing datacasting on both KNME and KNMD pretty hard and are interested in the possibility that the ATSC 3.0 datacasting for the bulk of New Mexico’s population can provide the bandwidth to take the load off rural areas where bandwidth is a real challenge,” he told B+C.

Catherine Badalamente, VP & chief innovation officer at the Graham Media Group, has also focused on supplementary interactive content. She credits the Pearl framework as a “solid base” for developing livestreams, video-on-demand and data-based services such as weather updates and “personalized content.”

“In the markets where we’ve launched our NextGen TV signals, we see rapid and persistent adoption,” Badalamente said. “When we compare the growth trajectory of NextGen TV adoption with the earlier Roku streaming box adoption, we see even faster audience growth for NextGen TV than we did for Roku. This suggests significant opportunities exist.”

“Additionally, we have been working with Google to experiment with addressable advertising – initially within the supplementary content, but as we find solutions, we hope to directly monetize the broadcast ad breaks with addressable advertising.” Badalamente said.

She explained that Graham Media has leveraged the Pearl framework applications. “We have been able to launch applications to run alongside our broadcasts. This means we get to distribute digital-exclusive content to our broadcast viewers with very little overhead.”

“We are delivering libraries of additional content to our viewers as well as secondary lean-back channels they can watch,” she added. “Being able to distribute these experiences seamlessly through the ATSC 3.0 signal is a fantastic opportunity.” She said the Graham team is building more capabilities as part of a broader focus “on membership and insider programs for broadcast television.”

Graham is also participating in the Detroit Automotive Test Track.

Hoping for Answers at Late August Conference, then CEDIA and NAB

Following a year of pandemic-induced virtual development, the NextGen TV community will plunge into a new round of personal meetings in coming months. Among the issues confronting them are operations and competitive digital services. Supporters hope that many of the concerns will be addressed and resolved during the Advanced Television Systems Committee’s 2021 NextGen Broadcast conference, a live annual event in Washington, D.C. Aug. 25-26.

Also read: NextGen TV Delivering Remote Learning in Washington, D.C.

Sinclair plans to show its first mock-up of a network operations center for 3.0, with an eye toward bringing stations together to operate effectively as a distribution network, said Aitken.

Also on the agenda is the Consumer Electronics Design and Installation Association’s CEDIA Expo in Indianapolis on Sept. 1-3, where NextGen TV hopes to make inroads – prior to its next pitch to the CE industry at CES in Las Vegas in January.

By the time of the NAB Show convention Las Vegas in October, Sinclair plans to show off SFN and also its mobile applications on “true consumer phones.” Aitken said that Sinclair’s chip subsidiary Saankhya Labs has made a deal with one of the handset makers (which he declined to identify) that supplies devices to Verizon.

Another landmark in the ATSC 3.0 rollout will be the launch of a special NextGen TV showcase in Washington in September. It will focus on the coordination of signals from two sticks: WHUT-TV (public TV channel) is handling several of the signals and the new WIAV-CD (a Class A station that Sinclair acquired late last year) will transmit channels. Program details and promotional (including political focus) are still being developed.

Bringing the Signals Home

CTA’s semi-annual products forecast, published in late July, foresees an “inflection point” in 2023 when 11 million new TV sets will include NextGen TV receivers (representing about one quarter of all set sales), then “maturity” in 2025 when 73% of new TV sets (31 million devices) will have NextGen capability. Meanwhile, add-on set-top 3.0 receivers will become available in the coming year, enabling viewers to pick up signals for display on their current monitors. CTA expects about 1.5 million 3.0 STBs to be sold in 2022, climbing to 7.5 million units in 2024, then dropping off as more new TV sets include the ability.

CTA’s forecast for 2021 envisions 2.1 million NextGen TV in the distribution pipeline, representing about $3.9 billion in revenue. Nearly 40 different models and sizes from a handful of TV makers are in that line-up now, and Schelle of Pearl TV expects more TV makers to enter the market by yearend. The current CTA data puts the median wholesale price for a new receiver at just under $2,000 – well above the $500 most Americans pay for a new TV set, according to NPD’s Baker. But Schelle said that the current pricing for NextGen TV receivers ranges from $599 to nearly $20,000 (based on screen size and other factors), with the costliest models skewing the median upwards. Like most technologies, the prices will drop rapidly with scale, she added.

Contributor Gary Arlen is known for his insights into the convergence of media, telecom, content and technology. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the longtime “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports. He writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs. Gary has taught media-focused courses on the adjunct faculties at George Mason University and American University and has guest-lectured at MIT, Harvard, UCLA, University of Southern California and Northwestern University and at countless media, marketing and technology industry events. As President of Arlen Communications LLC, he has provided analyses about the development of applications and services for entertainment, marketing and e-commerce.