‘Cord-Kindas’: Cable Subs Without the Cable

Rise of streaming video has created a new class of content consumer

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

As the recent NewFront presentations emphasized, Streaming Video will continue to shape the media economy and culture at large — making now a good time to evaluate its impact on both.

First came the cord-cutters. General dissatisfaction and belt-tightening drove their defection from traditional cable, and Roku and AppleTV devices made it feasible. Cutters begat shavers, stackers, and nevers; millions of lost Cable and Satellite subscribers have permanently altered the industry.

Within cord-cutters, however, there are substrata that don’t yet have a cool “cord” name. Viewers who want to drop their cable companies, but not the cable experience. Let’s call them cord-kindas.

They can subscribe to all of the “Plus” services that keep emerging, but the individual monthly fees would quickly add up and having to switch between apps to go from Chopped to SportsCenter is inconvenient, especially for habitual channel-surfers.

A solution: vMVPDs, or virtual multichannel video programming distributors. They don’t get the attention that Peacock, Discovery Plus, et. al. do, but vMVPDs offer cable without the cable. In a recent eMarketer survey of vMVPD subscribers, 49% of respondents cited “Access to live content through a guide” as a benefit — edging out cost and leaving “No contracts” and ease of cancellation in the dust. Ultimately, kindas don’t want the end product to change.

Per Antenna Analytics, vMVPDs have grown 24% between Q4 2019 and Q4 2020 — driven largely by live sports, an offering of the more comprehensive (and pricier) providers. Costs range from free to $65 per month, with the more expensive options more closely recreating “real” cable. As you move toward free, things get less and less cable-like. Here’s how they all shake out:

Cable Without the Cable

Recreating the cable experience

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Hulu Plus Live TV ($65/month); YouTube TV ($65/month); FuboTV ($65/month); AT&T TV ($65-$95/month)

Hulu Plus Live TV offers 65-plus live channels, in addition to Hulu’s ad-supported streaming tier. YouTube TV has 85-plus channels, plus unlimited DVR (an upcharge on H+LTV). FuboTV began its life as a soccer-centric outlet (the name is short for “futbol”) but has evolved into a broader-based vMPVD with a strong sports offering amongst its 100+ live channels.

AT&T TV offers three different tiers: Entertainment ($65 for 65-plus channels) Choice ($85 for 90-plus channels) and Ultimate ($95 for 130-plus channels), with corporate sibling HBO/HBO Max included free for one year at the two highest tiers. As with traditional Cable and Satellite, premium channels are available for an additional fee on each of the services.

Still Pretty Cable-y

Live TV with Scalable Offerings

SlingTV (Starts at $35/month); Philo (Starts at $20/month)

A service of Dish Network, SlingTV has two available packages: Blue, which focuses on news and entertainment programming, and Orange, with an emphasis on sports and family. Additional channel clusters (add sports to Blue, add news to Orange, etc.) will run $6/month. Premium selections and DVR services can also be added.

Philo is a joint venture among ViacomCBS, A&E Networks, AMC Networks and Discovery Inc. For its relatively low price tag, Philo has a nice basic network roster (with upcharges for premium channels). It doesn’t hurt that Philo is owned by a consortium of four media giants, however as each establishes its own streaming brand they may start selling off their stakes in the company. How that would affect programming is yet to be seen.

It’s Good, But It Ain’t Cable

No-Cost Options

Each of these services offers a lot of content. It’s just that most of it isn’t live Cable. Pluto has taken a lot from its owner, ViacomCBS, but it’s all on specialty—“BET Pluto,” “Smithsonian Channel Selects,” etc. The rest are channels devoted to one show (i.e. Family Ties) or genre (i.e. “Black Cinema”).

Tubi is even less like linear Cable and almost entirely VOD. A wide array of movies and television episodes is available, with some top networks (Tubi has been owned by Fox since 2020) and most movie studios represented. It’s not a reasonable facsimile of Cable in its offerings or interface.

Cord Kindas Are High-Value Impressions

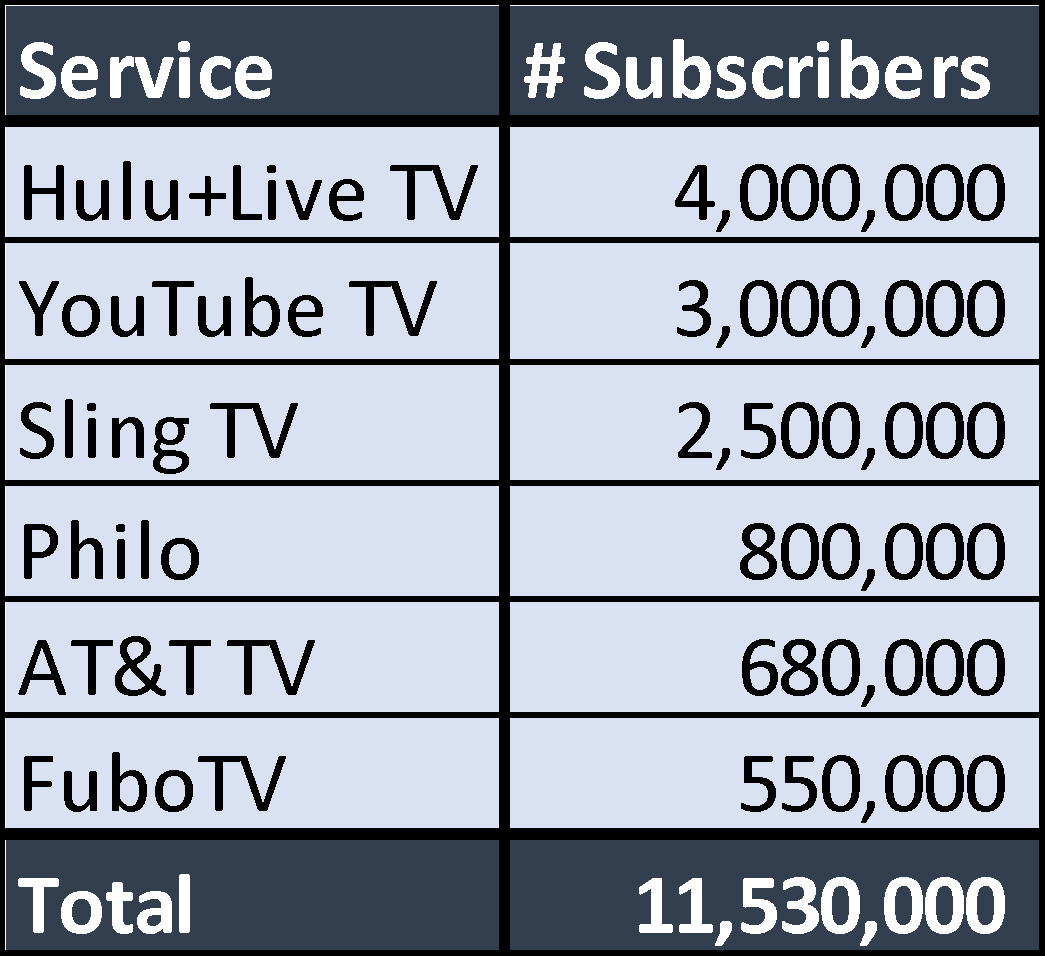

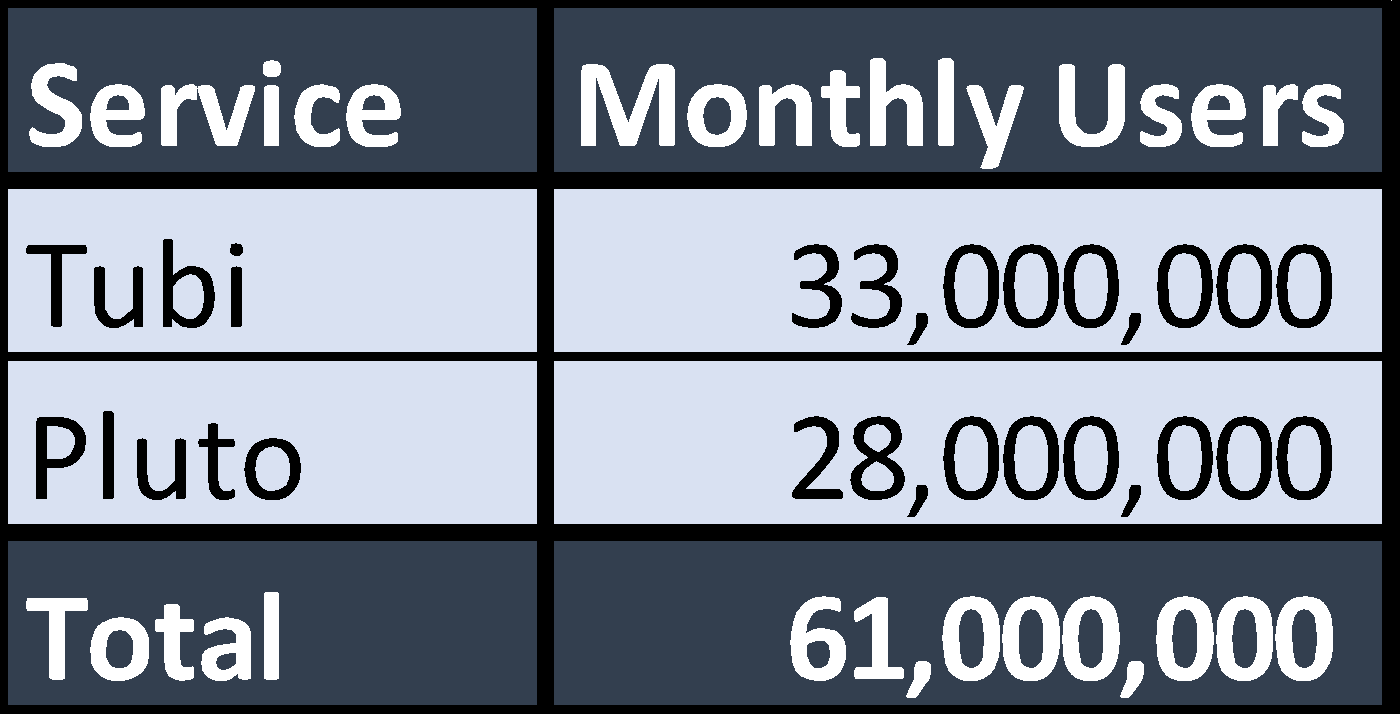

Together, these vMVPDs reach 11.5 million subscribers (paid providers) and 61 million monthly users (free services).

Hulu notwithstanding, they may not benefit from the attention or marketing budgets of shiny new AVODs, but advertisers should not ignore these providers. True, they may already see the national spots that each network airs, but they can additionally be reached through addressable advertising.

Bottom Line

With strong numbers and the potential for granular targeting, cord-kindas are an audience that won’t get lost in the shuffle by attentive marketers.

Carl Mayer is director, integrated media/Active Entertainment at Active International.

Carl Mayer is director, integrated media/Active Entertainment at Active International.