AMC’s Josh Reader Focuses on ‘Targeted Strategy’ for D2C Streaming Experience

Growing churn expected as online video customers shift preferences, Deloitte’s Kevin Westcott explains at DEG Expo

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

“We’re adapting the expertise we have into a new customer experience” as AMC Networks plunges more deeply into streaming video projects, Joshua Reader, president, distribution and development at the company, explained in his opening remarks at the Digital Entertainment Group’s Direct-to-Consumer Expo. “We decided not to compete with subscription VOD,” he said, describing AMC’s plans to focus on some - but not all – of its program inventory.

Reader’s outlook topped a wide-ranging session on the “Maturing D2C Landscape, which also included Deloitte’s latest data on the fast-churning audience attitude toward streaming channels along with the unveiling of DEG’s new “official” terminology for the growing roster of home viewing options, including PEST and PVOD services. The avalanche of information emerged during DEG’s streaming online Expo on Thursday (Feb. 25).

Also Read: AMC Networks Touts Addressable Ad Capability Going into Upfront

Reader acknowledged that AMC’s “DNA is in B2B [business-to-business] delivery to cable operators.” But he quickly noted that its specialty networks such as Acorn and ALLBLK “give us the opportunity to offer D2C” services to specific audiences.

“We have those true consumer relationships plus the wholesale relationships,” Reader said, explaining the revised targeting strategy as AMC modifies its distribution arrangements. He said that the new AMC Plus service “lets us focus on how we’re going to market with partners.” Reader described the plans as including “more disciplined … marketing” without putting “immense funds into D2C.” He said the increased efforts help viewers “find other content on those platforms.”

“We are hyper-focused on serving those audiences,” Reader said, adding that, “We think there’s a robust future in offering fans an individual service and if they want something more, they will pay more for a bundle of programs such as AMC+.” He cited other AMC assets, such as Shudder and IFC Films, and emphasized his belief of the “good synergy” via D2C that will evolve if AMC exposes its viewers to shows they might “not have found on their own.”

Also Read: Streamers Look Outside the Lines

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Susan Agliata, director of business development and OTT partnerships at Samsung, echoed the expectation of more consolidation in the post-pandemic streaming world.

She believes that viewers will remain fixated on linear TV, but she reminded webinar attendees that, “Our work has just begun to foster maturation of this industry.”

Churn and Consolidation Will Accelerate; Ad Acceptance Increasing, Deloitte Explains

Reader’s plans for AMC’s shift toward direct-to-consumer delivery offered an appropriate prelude to the research findings from Kevin Westcott, vice chairman, national Technology, Media & Telecommunications (TMT) Industry Leader of Deloitte. Using data from Deloitte’s latest consumer research survey, Westcott described how consumers bought more video subscriptions as the COVID-19 isolation continued, but that churn has increased during the pandemic’s later stages. He also predicted that consumers will accept more online advertising on streaming channels – depending on how it’s structured.

“Consumers are telling us that they are overwhelmed by having multiple subscriptions,” Westcott said, noting that there are more than 300 streaming options. In the first six months of the pandemic, 46% of streaming video subscribers eliminated at least one streaming service. The Deloitte survey found that 28% of consumers intend to reduce the number of entertainment subscriptions they buy, which among millennials is an average of 17 services.

By October, 28% of streaming customers said they were dropping a service because the free or discounted trial period had ended.

For example, in May of 2020, only about 9% of streaming video customers were adding and cancelling streaming services, but by October 2020, about 24% of streaming viewers were churning like that – far more than the number who were merely adding or cancelling providers, according to Deloitte’s data.

Westcott predicted that there will be a “reaggregation of content” with the largest platforms adding more options. He also pointed out that the reasons for cancellation are changing. The top reason (cited by 39% of subscribers) for dropping a service had been because viewers had “finished watching a show or series” that had caused them to sign up for the service. In addition, a basic “economic aspect” kicked in when “consumers recognized they were paying $60 or more per month, which was comparable to their old cable bills,” Westcott added.

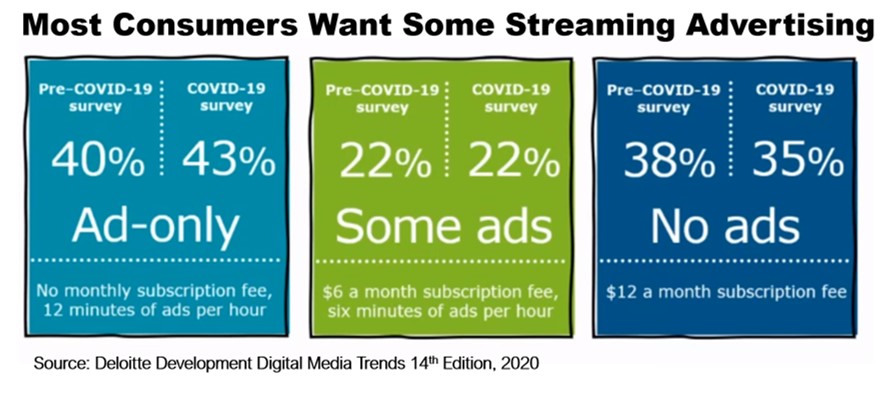

Deloitte’s research showed that streaming viewers “are very willing to accept advertising, but they are deeply annoyed by constant repetition of the same commercials. It found that 43% of viewers during the COVID-19 era say they would like an ad-only format with no monthly fee and no more than 12 minutes per hour of advertising. About 35% would pay up to $12 a month for a service with no advertising, according to the Deloitte data.

Nonetheless, Westcott’s study did not offer a specific roadmap into the D2C landscape. He said that “content is still king, but bundles [remain] the incentive to subscribe.” Citing the response to a question about “Why do you subscribe to a specific streaming service,” Westcott noted that the among the most recent responses, 55% of viewers said they want “to watch a broad range of shows and movies” (higher than in the pre-COVID-19 study) but that 43% said they signed up to see “new, original content not available anywhere else” (slightly lower than in the first months of the pandemic.)

PEST, PVOD Part of “Industry-Standard” Terms to Clarify VOD Variants

In addition to the executive perspectives and data about the move toward D2C services, DEG unveiled its new lexicon of the growing variety of on-demand services.

Declaring that consumers – as well as some media companies and analysts who follow the video industry - are confused about the expanding viewing options, DEG’s D2C Alliance Steering Committee issued a list of “industry terminology.”

In addition to defining familiar digital terms such as OTT (Over-The-Top), AVOD (Ad-supported Video-On-Demand) and new terms such as FAST (Free Ad-Supported Television, referring to Internet-delivered linear TV channels), the new lexicon seeks to specify neologisms. For example, PEST is “Premium Electronic Sell-Through,” described as a “one-time fee [for] a specific piece of digital content” available prior to its “traditional release window.” PVOD (“Premium Video-On-Demand) offers content for “limited-time access for a one-time fee.” TVOD (Transactional Video-On-Demand) services charge a one-time fee for viewing a specific piece of content for either a limited period (typically 24 or 48 hours) or an extended period.

DEG explains that some services may fall into more than one category, noting for example that Amazon Prime offers both TVOD and SVOD components and Peacock’s menu has both free AVOD to SVOD products.

“PEST and PVOD are generally offered through transactional services but may also be presented for added fees on subscription services, such as Disney+’s offering of Mulan,” according to the DEG nomenclature.

“Establishing accepted industry terminology is an important early step in both industry relations and consumer outreach,” said Amy Jo Smith, DEG President and CEO. “This is an important milestone for the D2C Alliance as it moves forward with a strong base of support across platforms and services, device makers and content owners and distributors.”

DEG said the new terminology is “a first step in proactively addressing key issues” affecting future video distribution.

Contributor Gary Arlen is known for his insights into the convergence of media, telecom, content and technology. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the longtime “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports. He writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs. Gary has taught media-focused courses on the adjunct faculties at George Mason University and American University and has guest-lectured at MIT, Harvard, UCLA, University of Southern California and Northwestern University and at countless media, marketing and technology industry events. As President of Arlen Communications LLC, he has provided analyses about the development of applications and services for entertainment, marketing and e-commerce.