Streaming’s Youth Appeal Outweighs Cord-Cutting Impact, PQ Media Study Finds

Viewers say they're ‘overwhelmed by choices,’ prefer characters and plots they know

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Viewing time in 2020, fueled by COVID-19's distraction demand, surged at the fastest growth rate since 2015, which isn’t a surprise. But longer-term effects on viewing behaviors — and the shifting balance of ad vs. consumer payments — augur a major shift in video distribution, according to findings from the eighth annual PQ Media Global Consumer Media Usage Forecast 2020-2024.

The report, published last week, shows that viewing in 2020 reversed a five-year trend of decelerating growth in media usage. Consumer time spent with media, including all digital and traditional media, grew at an accelerated 2.8% to an average of 53.1 hours per week (HPW) with particularly strong usage increases in various age categories. PQ Media’s finding pose perceptive challenges about the growing acceptance of user-paid media compared to ad-supported platforms.

“There’s no doubt that streaming media … were the hands-down winners in an otherwise loser of a year for many media stakeholders, particularly those dependent on advertising-driven media,” PQ Media president and CEO Patrick Quinn said. “Consumer-driven media usage continued a nearly 20-year pattern of snatching away market share from advertising and marketing-supported media.”

The study showed that consumer-driven media accounted for more than 55% of all U.S. media usage while its share grew to nearly 35% globally in 2020.

“Not since the Great Recession has there been a 10-point differential between the growth of overall consumer media usage and that of total advertising and marketing spending,” Quinn explained. “But in the upside-down media economy of 2020 the pandemic drove down advertising and marketing spending 6.8%, while consumer time spent with media grew 2.8%, which was the fastest annual growth rate in five years.”

Also Read: CES Panels Highlight Streaming’s Growing Pains

Yet viewers at almost all age levels “have become overwhelmed by the choices,” Quinn told Multichannel News. He said many critically acclaimed streaming series have a short shelf life because consumers don’t have time to watch all the new programs and become immersed in the characters and plots “like we saw in the past with shows like The Sopranos and Seinfeld.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Shifting Youth Movement

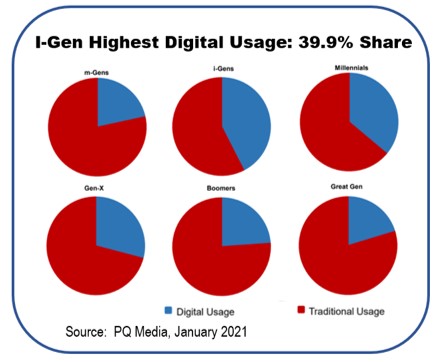

Mobile media usage was a primary driver of video usage, especially in younger age levels. Notably, so-called iGens (born 1997- 2012) use media much less than older generations (29 HPW in 2020), but nearly 40% of their media consumption is done via digital devices, Quinn said. In comparison, the Greatest Generation (born pre-1945) use media the most (89 HPW in 2020), but only 22% of their media consumption occurs on digital devices.

Only pre-teen “m-Gens” (born since 2013) have as low a digital viewing presence as the over-75 year olds. The coveted Millennials and Gen-X categories tune into digital media for about 25% to 35% of their total consumption, according to PQ Media’s evaluation.

As for cord-cutting, it “softened during the pandemic,” Quinn told Multichannel News but will likely grow again in coming years “as more households shift to a streaming-only video experience.”

And the availability of new technology, such as ATSC 3.0 and 5G, “will have minimal effect on television usage other than enhancing the experience,” he said.

“Shifts in media usage are often about price points and content,” Quinn told me. “Pay TV fee increases forced some demographics to shift to the streaming-only households, while other demos shifted to streaming to binge watch cutting edge programming not found on broadcast and cable TV.”

The PQ Media study, which examines data from 20 global markets, concludes that the key growth drivers are “a slew of mobile media … as well as social media channels, podcasting and over-the-top streaming video services, all of which posted consumer usage growth rates exceeding 15%” in 2020, a pace likely to slow this year.

For example, despite the Tokyo Summer Olympics (assuming they actually take place) and other stunts, PQ Media expects global consumer media usage to rise only 1.4% this year. PQ Media’s research look at media in four major global regions; three digital media platforms (online, mobile & other digital media); 22 digital media channels; eight traditional media platforms; and 11 hybrid (digital + traditional) media silos.

He acknowledged that technology has impacted video viewing, citing broadband access as very significant.

“But in other instances, improvements to the quality of signals, such as ASTC 3.0 and 5G offer, hasn’t had a similar impact, most recently exhibited during the 2012-13 period when all households had to switch from analog to HDTV signals,” he said. In a similar vein, the move toward broadband video platforms will be an extended process.

“I think it will be a long process for households to switch from HDTV to ASTC 3.0 TV sets,” he said. “SmartTVs, for example, are not yet in 50% homes as most lower- to-middle income households are not ready to upgrade if they paid $500+ for an HDTV set before the SmartTVs came out.”

PQ Media’s analysis presents a mixed view of the comparative outlook for traditional and digital media.

“We projected last year that consumer media usage would likely reach a tipping point at which media consumption flattens by the end of 2023. And while the pandemic reversed some secular trends in 2020, we believe this was simply a short-term disruption of key long-term trends that will resume in 2021,” Quinn said.

Contributor Gary Arlen is known for his insights into the convergence of media, telecom, content and technology. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the longtime “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports. He writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs. Gary has taught media-focused courses on the adjunct faculties at George Mason University and American University and has guest-lectured at MIT, Harvard, UCLA, University of Southern California and Northwestern University and at countless media, marketing and technology industry events. As President of Arlen Communications LLC, he has provided analyses about the development of applications and services for entertainment, marketing and e-commerce.