Streamers Look Outside the Lines

Direct-to-consumer offerings increasingly turn to international markets for future growth

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Direct-to-consumer offerings are all the rage for U.S. cable networks that have watched cord-cutting and cord-shaving slowly erode affiliate fees from traditional pay TV distributors over the years. But for many — especially smaller, niche networks — the real money is to be made internationally.

Over the past 18 months, the TV industry has seen the launches of Disney Plus (November 2019), Peacock (April 2020), HBO Max (May 2020) and Discovery Plus (January 2021). On March 4 the latest entrant, Paramount Plus, will debut (see Cover Story, page 10).

So far, The Walt Disney Co. has set the tone, with 94.9 million paid global subscribers to Disney Plus as of Jan. 2. But according to Disney, about 30% of those customers are through its Disney Plus Hotstar service in India — roughly 28.5 million. The entertainment giant continues to expand its streaming reach internationally, launching Disney Plus in Latin America in November. The company plans to expand Disney Plus into Singapore this month, followed by Eastern Europe, Hong Kong, South Korea and Japan later in the year.

ALSO READ: Cover Story: Parsing Paramount Plus

Although Hotstar’s growth has been encouraging, it also seems to have driven down average revenue per unit (ARPU) for the Disney Plus service substantially. Disney said ARPU for the direct-to-consumer service was about $4.03 in fiscal Q1, about 28% below the prior year figure of $5.56. Hotstar wasn’t the only culprit for the decline. In a research note, Barclays media analyst Kannan Venkateshwar noted that differences in averaging methods, lower sports volume and Hotstar promo pricing could have been the reason. But he added that not including Hotstar’s subscriber gains, Disney Plus subscriber additions in the period (between 10 million and 11 million) were about the same as Netflix (8.5 million), despite it being the SVOD pioneer’s 14th year streaming, versus Disney Plus’s 14 months.

“This is, of course, due to the footprint differences and the COVID-impaired content release calendar at Disney, in contrast to Netflix, but still speaks to the strength of Netflix’s business model, especially given ARPU differences,” Venkateshwar wrote.

Disney Plus a Growth Engine

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Still, the analyst estimated Disney Plus will continue to grow revenue substantially, even as it is expected to lose money for the next two years. Venkateshwar predicted direct-to-consumer revenue — including Disney Plus, Hulu and ESPN Plus — will grow to $42.8 billion by 2025 from $22.6 billion in 2021. Operating income will stay negative until 2023, when it reaches $733 million, rising to $3.45 billion in 2025, he predicted.

MoffettNathanson media analyst Michael Nathanson believes that Disney’s DTC business is on pretty much the same path. He predicts revenue in the segment will grow to $41.6 billion in 2025 from about $17 billion in 2021, but profitability will take a little longer. In a research report, Nathanson estimated that earnings before interest and taxes (EBIT) would be negative through 2023, with the segment making a first profit in 2024 — $334 milion — rising to $1.6 billion in 2025.

Peacock’s International Flight

Peacock, which NBCUniversal launched in April, has about 33 million subscribers, most of them in the U.S. NBCUniversal CEO Jeff Shell has said publicly that Peacock will launch internationally in select markets, avoiding traditional TV hotspots like the U.K., Germany and Italy, as much of Peacock’s programming is also available through sister satellite service Sky.

HBO Max launched on May 27 amid much hoopla. And after some changes — in November it said it would release its entire 2021 theatrical slate on the streaming service — it has managed to grow subscribers to about 38 million. HBO Max plans to expand into 39 Latin American and Caribbean territories in late June, transitioning subscribers who now get HBO Go, the existing streaming product (which will be phased out), to HBO Max. Following the Latin American rollout, HBO said HBO-branded streaming services in Europe — the Nordics, Spain, Central Europe, and Portugal — are scheduled to be upgraded to HBO Max later this year. HBO International head Johannes Larcher said in a statement the Latin American offering would include parent WarnerMedia’s film and series catalogue as well as locally produced content.

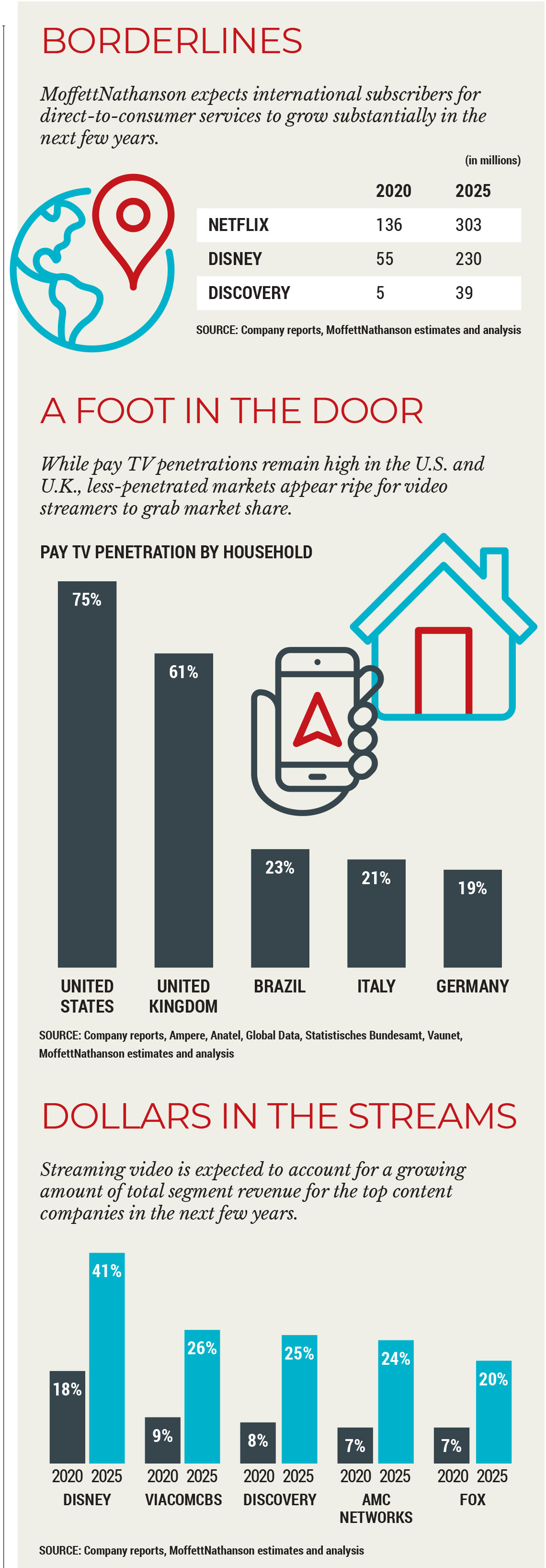

While most of the emphasis has been on the domestic market, large and small DTC services could see their biggest windfalls internationally. According to Nathanson, Disney Plus is expected to have as many as 230 million international subs by 2025, up from about 55 million in 2020. Even Discovery Plus, launched domestically on Jan. 4 and internationally in late 2020, is expected to hit nearly 40 million international customers by 2025.

At a Discovery Plus Investor Day presentation in December, the programmer estimated that the international opportunity dwarfs that of the U.S., particularly in nontraditional TV markets. Discovery identified about 1.4 billion households (not including China), of which about 400 million were in serviceable addressable markets, meaning they were avid TV watchers, they subscribed to OTT services and they had an affinity for Discovery brands. In the U.S., Discovery said of the 30 million broadband-only households and 80 million TV homes in the country, about 70 million would be serviceable to Discovery Plus.

Discovery stock has risen by about 60% since that Investor Day presentation, to $45.55 on Feb. 11 from $28.37 each on Dec. 2. Along the way, Nathanson upgraded his rating on the stock from “neutral” to “buy” on Jan. 15, emphasizing the international business. Since then, Discovery has already surpassed his 12-month price target of $45 per share.

In his note, Nathanson wrote that he expects Discovery Plus to be a “true differentiator” given the company’s linear TV experience.

Discovery Leverages Scale

“We expect Discovery to leverage its scale outside of the U.S. to lead to nearly 40 million international subscribers and improve its ARPU, especially in markets that have been structurally more difficult to grow through the traditional pay TV ecosystem,” Nathanson wrote.

According to Nathanson, Discovery sees its biggest opportunities in a mixture of traditional fTV markets like the U.K. and Italy and non-traditional locations like Poland, Brazil, Mexico, Argentina and Asia Pacific countries.

Nathanson views Discovery Plus’s international expansion as more incremental. That’s because it is in a unique position with more than 1,000 hours of differentiated programming, can expand its reach beyond pay TV penetration and it sees a window to grow ARPU for its linear channels in markets where affiliate fees are less than $1 per subscriber per month.

Nathanson sees Discovery targeting the streaming service internationally to consumers outside of the pay TV bundle who haven’t had the opportunity to watch its shows, especially mobile customers. He noted that although some large European mobile companies like Vodafone also have a hand in landline pay TV service — it has about 6 million pay TV subscribers — it has more than 100 million mobile customers, about half of whom Nathanson estimated are postpaid, non-business customers eligible for the Discovery Plus service. Venkateshwar of Barclays noted the allure of mobile-streaming partnerships, and pointed to Discovery’s deal to bundle Discovery Plus with Verizon, where the streamer is free to Verizon Unlimited Data customers for six months, as a prime example. Though mobile partnerships helped drive Disney Plus in the early days, he warned, there is a difference between video bundled with data and data bundled with video.

“For wireline and wireless ISPs, bundling a service like Disney Plus or Discovery Plus is about the ability to extract more price for a relatively commoditized data service,” Venkateshwar wrote. “In this context, for a company like Verizon, the key over time is likely to be the upgrade rate to higher priced tiers and retention benefits of various services bundled with wireless. Bundled services that don’t move the needle on these metrics over time are likely to receive different terms vs. those that drive more material differences.”

Disney Plus apparently moved the needle for Verizon. Most customers who signed on for the Disney Plus promotion stayed with the service after the promo ended, the telco said. Verizon extended that deal, adding Disney streaming services ESPN Plus and Hulu to the mix. Verizon also has similar promotions with music services (Apple Music), and PlayStation subscriptions. In this sense, services like Discovery Plus may have to justify themselves relative to totally different services like music and gaming.

“Therefore, while tie-ups with wholesale distributors during the launch phase is likely to be a positive, the cadence of this impact may vary over time as bundle structures evolve,” Venkateshwar wrote.

At CuriosityStream, a fact-based streaming service that went public earlier last year, international markets are seen as the biggest growth opportunity. CuriosityStream currently has about 13 million subscribers, 70% of them in the U.S. That mix is expected to shift dramatically in the next few years.

CuriosityStream’s managing director and head of international distribution Bakori Davis said for streaming services looking to break into foreign markets, targeting traditional areas and partners isn’t always the best idea. For CuriosityStream, created by Discovery founder John Hendricks, broadening the scope and reach of the service is the right path to growth.

Davis said CuriosityStream has traditional partners in Western Europe, the U.K., Germany and Latin America, but that there are also huge opportunities in Africa and Southeast Asia. The company has deals with distributors like MultiChoice in Africa, Tata Sky in India, Total Play in Mexico and StarHub in Singapore, but also is looking to expand into countries that have less of a pay TV legacy.

CuriosityStream Looks Abroad

“Probably the biggest opportunity for us is these emerging markets who are now deploying 5G and are learning how to package up apps and OTT sites and don’t have as much of a traditional pay TV legacy,” Davis said. “Things are really moving fast and they are looking for new partners.”

Mobile companies looking to differentiate their phone and data services with content also present an opportunity, ranging from mega-carriers like Vodafone to smaller, regional players.

Davis said that while larger mobile companies understand the content business and present the opportunity for more multi-layered partnerships that could include linear as well as streaming content, smaller players looking to differentiate themselves with streaming content also could mean big business.

ALSO READ: Roku’s Tedd Cittadine: Gatekeeper to Streaming Success

“What we represent to them [smaller players] is an easy way to capture the entire category,” Davis said.

And those smaller players aren’t that small. For example, MTN, the largest mobile carrier in Africa, has 232 million subscribers in 20 countries. India’s Airtel is the second largest mobile carrier in the world — behind China Mobile Communications with 946 million — and operates in 18 countries in South Asia and Africa with more than 457 million subscribers.

With markets that large and diverse, there appears to be ample room for large and small streamers alike to compete effectively.

“We certainly feel like the opportunity for us is as big as the other players you see now that have successfully grown globally,” Davis said, adding that the opportunity is most apparent in markets where 5G infrastructure is just being deployed. “Other players like Netflix and Amazon, they really are making the market for us. They are creating demand.”

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.