Acorn TV: Everything You Need to Know About the SVOD Service for Anglophiles

Bolstered by a strong library of British movies and shows, AMC Networks streaming service has 1 million users. But its BBC-backed competitor is coming fast

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Acorn TV debuted in 2013 as the first streaming service to serve the U.S. Anglophile market, offering a steady mix of old and new British TV shows, mini-series, movies and originals, and six years later managed to attract 1 million customers. But in that same time frame, U.K. programming powerhouses BBC and ITV launched their own streaming service -- BritBox -- for lovers of all things Old Blighty, putting pressure on the pioneering service to find new ways to attract and retain subscribers.

Where Can I Get Acorn TV?

Acorn TV can be accessed via a streaming app, on computers, tablets and phones through the www.acorn.tv and is priced at $6.99 per month. The app is available for download at most app stores, Apple TV, Roku, IPhone, IPad, Chromecast, Android mobile and tablets, Smart TVs, Amazon FireTV and the web.

How Much Does Acorn TV Cost?

Acorn TV offers a one-week free trial, and then customers are billed $6.99 monthly. Annual subscriptions are available for $69.99. Acorn TV also allows for gift subscriptions.

What Shows Are on Acorn TV?

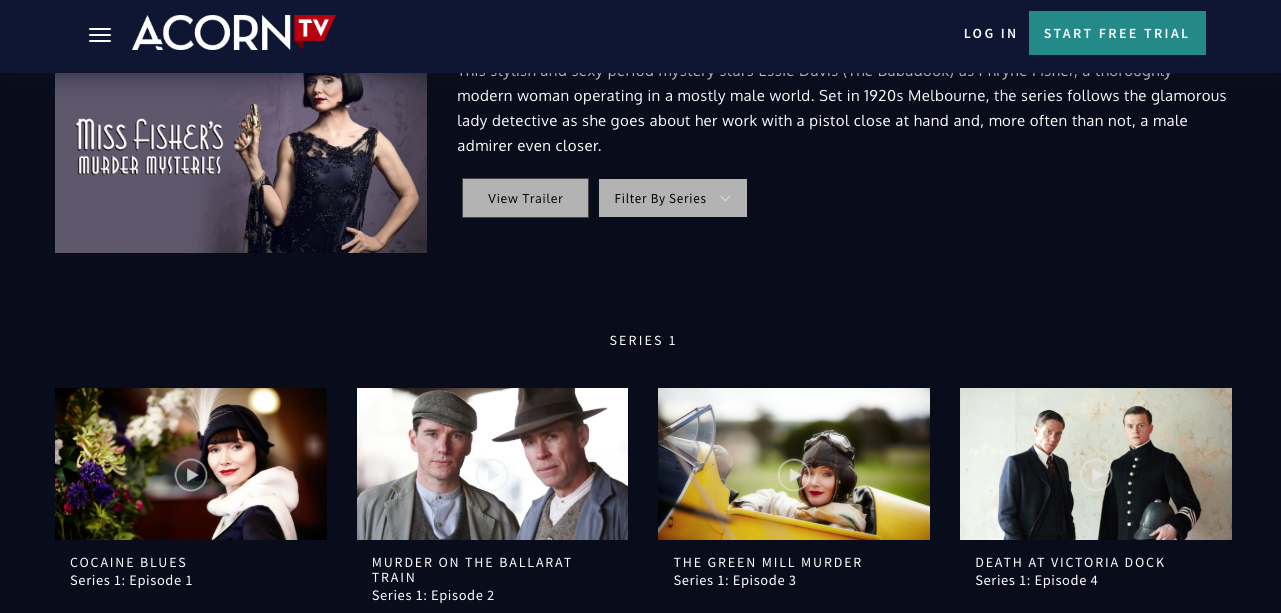

Acorn TV programming concentrates mainly on British mysteries, dramas, crime shows and “heartwarming comedies,” offering new originals and exclusive U.K. premieres. Originals including Agatha Raisin, starring Ashley Jensen (Extras, After Life,Ugly Betty) and based on the best-selling books by M.C. Beaton; The Chelsea Detective, a detective series starring Adrian Scarborough as DI Max Arnold and Sonita Henry as his partner DS Priya Shamsie have also resonated with viewers, as have shows like Aftertaste, Cuffs, and The Good Karma Hospital. U.K. comedy and drama essentials like acclaimed BBC detective drama George Gently, Acorn original Bloodlands and Miss Fisher’s Murder Mysteries join New Zealand comedy-drama Nothing Trivial, Aussie legal drama Newton’s Law, and Australian thriller The Code in the growing Acorn TV lineup.

Acorn TV also offers award-winning series and movies like BBC classic I, Claudius; family drama A Place to Call Home; Mystery Road an original drama set in the Australian Outback; and The Hour, a look into the high-stakes world of TV news. Returning favorites including mystery My Life is Murder starring Lucy Lawless; and the final season of Doc Martin, a British drama series starring Martin Clunes.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

On April 4, new episodes of Walking Through History; The Straits, starring Brian Cox (Succession) as the head of an unconventional crime family; Dead Lucky, a thriller starring Rachel Griffiths (Six Feet Under); and new series Harry Wild, starring Jane Seymour as a retired literature professor turned crime solver, will be available. April 11 is the premier of police drama Candace Renoir and on April 14, 1998 mini series Coming Home, based on the best seller by Rosamunde Pilcher and starring Peter O’Toole, Joanna Lumley, Emily Mortimer, David McCallum and Paul Bettany, makes its debut.

Will It Last?

Parent AMC Networks doesn’t break out individual subscribers anymore for its streaming services, but said its SVOD networks -- Acorn TV, Shudder, Sundance Now, AMC Plus and ALLBLK -- surpassed a combined 6 million paying customers in 2020 and ended 2021 with more than 9 million subscribers. During its Q4 earnings conference call with analysts in February, AMC Networks interim CEO Matt Blank said the goal is to reach a combined 20 million-to-25 million subscribers for the streaming services by the end of 2025.

At the same time BritBox has been gaining its own ground. Launched in March 2017, the service -- a partnership between the BBC and ITV and mainly offering TV series and films from the main British public broadcasters (BBC, ITV, Channel 4 and Channel 5) -- said it had about 2 million subscribers last year (1.5 million in the U.S. and 500,000 in the U.K.) Acorn TV launched its U.K. version in 2020.

While Acorn TV may have a much smaller customer base than broader streaming services like Disney Plus and HBO Max, Blank said on the call that scale isn’t as important for niche streamers like Acorn TV as it is for larger entities.

“Last quarter we talked about the beauty of smaller numbers and how our strategy is allowing us to build the streaming business marked by what we believe are higher levels of customer engagement and satisfaction, lower costs, higher margins and other benefits that are enabling us to achieve our goals at much lower subscriber levels than others,” Blank said.

Acorn and its AMC streaming brethren also are more likely to weather smaller subscriber bases because the cost of its programming is so low. During the Q4 conference call, AMC Networks Streaming Services president Miquel Penella said that 19 of the top 20 most popular shows on Acorn, Shudder, ALLBLK and Sundance Now cost less than $1 million per episode, and some substantially less. In contrast, according to The Hollywood Reporter, Disney Plus spends about $15 million per episode for The Mandalorian and as much as $25 million per episode for its Marvel streaming TV series like WandaVision, The Falcon and the Winter Soldier and Hawkeye.

With a highly targeted niche market, low programming costs and strong viewer engagement, it’s hoped that there will be ample room for both Brit-themed services to survive. ■

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.