Next-Gen, Right Now

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

In 1970, cable MSOs served about 4 million homes, a small percentage of the U.S. residences they would ultimately reach in the decades to follow; The Brady Bunch was airing its second season, Abbey Road topped the charts; and three Corning scientists had just invented the first low-loss optical fiber, transforming the way the world connects.

Since then, enough fiber has been deployed to circle the globe 25,000 times and, according to the Cisco Virtual Networking Index, by 2021 the number of devices connected to an internet protocol network will be three times as high as the global population. Connectivity matters. From the life-enhancing power of information moving at the speed of light, to freeing the fundamental human need for connection from the boundaries of distance, we’ve only just begun to realize the rich potential of optical connectivity.

MSOs have long been at the forefront of network migration to deliver cutting-edge services and applications. They were among the earliest adopters of fiber in their networks, with TelePrompTer having first trialed optical fiber in 1976 for its “super-trunk” distribution in Manhattan. Less than two decades later in 1992, the first fiber-to-the-node designs were tested and trialed and hybrid fiber-coaxial (HFC) networks were born.

Shortly thereafter, in the early 2000s, telecommunications service providers began significant optical network investment, passing 35 million homes with fiber in the United States and connecting about 15 million fiber to the home (FTTH) subscribers. Fiber deployment to the network’s edge continues today at a feverish pace. Many of these operators are now further investing in fiber plant for 4G densification and 5G, driving substantial fiber density in urban environments to support new millimeter wave spectrum and lower-powered small cells.

Throughout these periods of fiber penetration into the access network, MSOs continued to expand their HFC network, now passing approximately tens of millions of U.S. homes. Services also expanded as video delivery on coax evolved into a primary broadband access medium, and HFC demonstrated continued ability to deliver a competitive advantage against legacy wireline alternatives. It is a tale of two cities in one rapidly changing market: legacy copper — sometimes over 100 years old and built at a time when telephony was its singular purpose — facing focused, necessary leaps to all-fiber; and the younger, robust HFC plant built for video broadcast and revolutionized by DOCSIS, facing more rapidly decrementing coax lengths to make use of higher frequencies and deliver faster downstream and upstream speeds.

Regardless of architecture, all operators in the industry are at an inflection point.

The combination of evolving consumer connectivity expectations, competitive landscapes in key markets, and the underlying macrotrend of fiber penetration deep into the network, suggest it is now more critical than ever to architect a quantified, detailed, and tactically-relevant transformation plan.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Decision-makers with vision and an eye on operating expenses are pursuing sustainable network transformation that grows their leadership position for the next decade in a rapidly evolving market. Given the wide range of options and the scale of investment at stake in this upgrade cycle, the network architects at Corning believe that now is the opportunity for leaders in the industry to challenge their teams, stakeholders, and advisors on topics such as:

• “Where, when, and how can the enterprise leverage gains in fiber access network efficiencies as a complementary investment to HFC upgrades such that we maximize competitive advantage and minimize regrettable spend?”

• “What factors in the plan ensure maximum return on investment (ROI) across business units for every capex dollar spent?”

• “Are the transformation plans(s) implementable at the necessary scale, and with what resources?”

• “What is the magnitude of operational savings made possible with optical plant that can be applied toward revenue-growing expansions of services, subscribers, and service areas?”

As industry leaders explore responses within the context of their individual business models, here are three considerations to bear in mind.

1. The Evolution of the Connected Experience Creates Opportunity for a Converged Business Case

Connectivity is increasingly transforming from static wireline to mobile or wireless delivery. As reported by Cisco, smartphone traffic will exceed PC traffic by 2020 and account for 30 percent of the total global IP traffic. While the 5G business case remains nascent, it is clear the competitive landscape is changing along with customer expectations.

Today, most operators structure their businesses around functional service silos: content, residential, business and wireless. Given wireless densification, upcoming opportunities in Citizens Broadband Radio Service (CBRS) spectrum, continued proliferation of Wi-Fi access points, mobile virtual network operator structures (MVNOs), and the revenue opportunities in business and residential services, a combined approach to building target services areas is too worthwhile to ignore. The savvy operator is considering the competitive power of a converged investment in the outside plant.

Our experience in the deployment of fiber access networks over the past 15-plus years shows that 50% to 75% of the cost associated with building new plant is attributed to labor — a nonfixed asset. Corning’s forward-analyzed converged architectures based on the same true costs indicate savings potential between 15 and 50 percent when service providers build a single optical network for multiple uses. Capital invested in scalable infrastructure can more advantageously serve the MSO when applied to a single, multiuse network rather than to multiple, purpose-built networks within a common service area. Consistent with these trends, modern connectivity solutions enable isolation between service types within the same optical layer while reducing total cost and easing service provider access to the converged access business case.

2. Millions of Homes Passed is a Long-Term Transformation and a Heavy Lift Worthy of Actionable Consideration

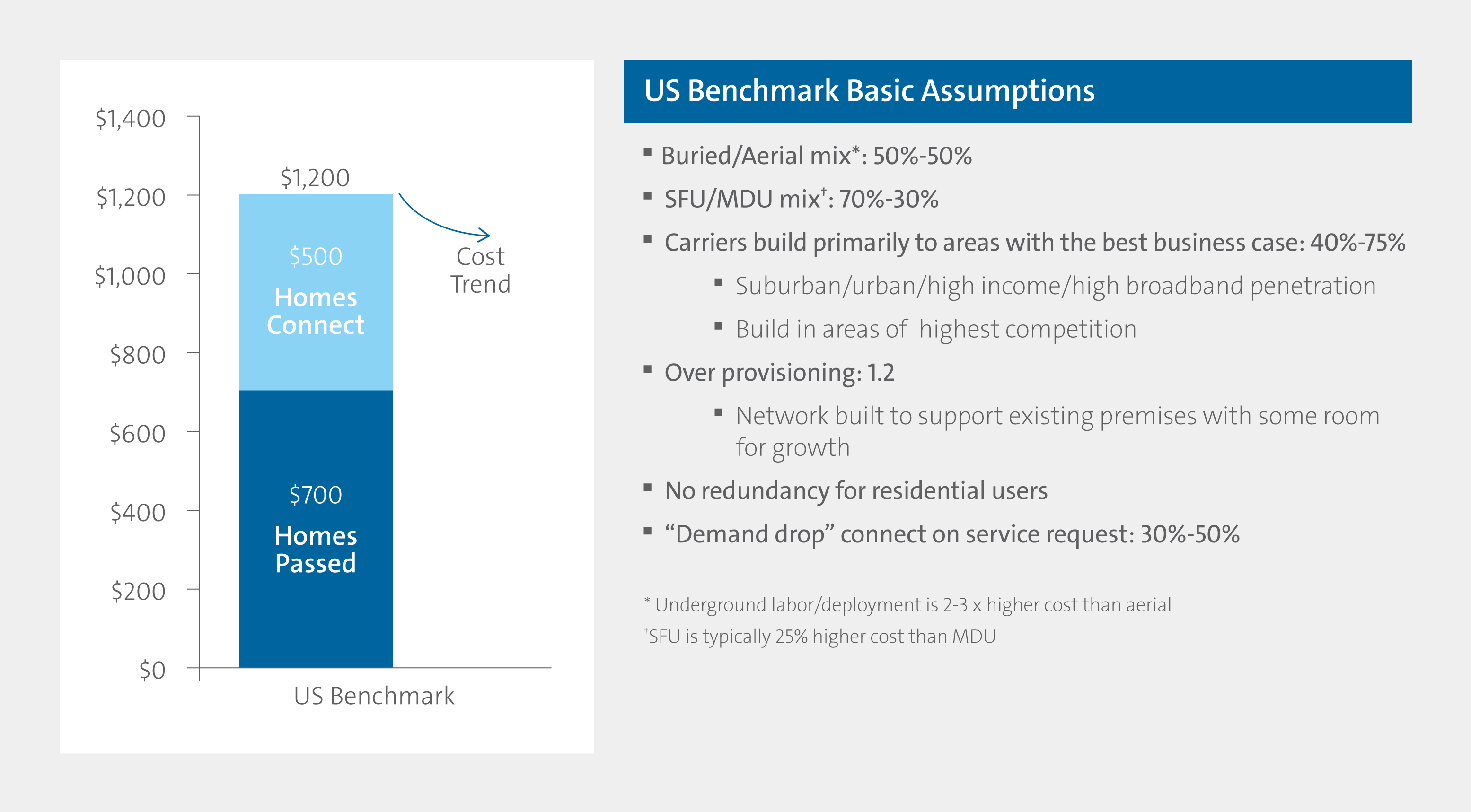

Coax gets short to go long: Many architectures supporting node+0, remote PHY and full-duplex DOCSIS place the node within a few thousand feet of residences. Service areas are shrinking from what was 500 or 1,000-plus homes per parent node to an average of fewer than 100 homes per child node. Depending on the service area density, this node split may result in as many as five to 20 child nodes. Some operators estimate all-in capex at $20,000 to $50,000 per fiber deep node. Quick division easily places anticipated capex as high as $500 per home passed, not including the additional plant conditioning necessary to support mid and high splits. In addition to upfront costs, the plant requires further investment in power supplies and batteries as the reduction of centralized powering at the headend, hub, or parent node is exchanged for less efficient distributed powering in the field.

With child nodes within 1,000 feet of the home, and costs between a few to several hundred dollars per home in child node service areas, a cost comparison to FTTH is both relevant and timely. Major communications providers have consistently averaged at scale all-in FTTH deployment costs at or below $700 per home passed across their service area footprints, and the figures continue to drop. The upfront cost similarity is striking; however a notable difference could involve the cost to connect a fiber subscriber, which is an additional expense not incurred in brownfield HFC when a coax drop is present.

The costs to pass and connect homes with fiber continue to decrease due to economies of scale and the labor-reducing efficiencies created by integrated optical solutions. With comparable first-installed costs, the advantaged opex for fiber networks, and with the maturation of linear IPTV offerings, MSOs now have line of sight to a compelling FTTH business case even in overbuild environments.

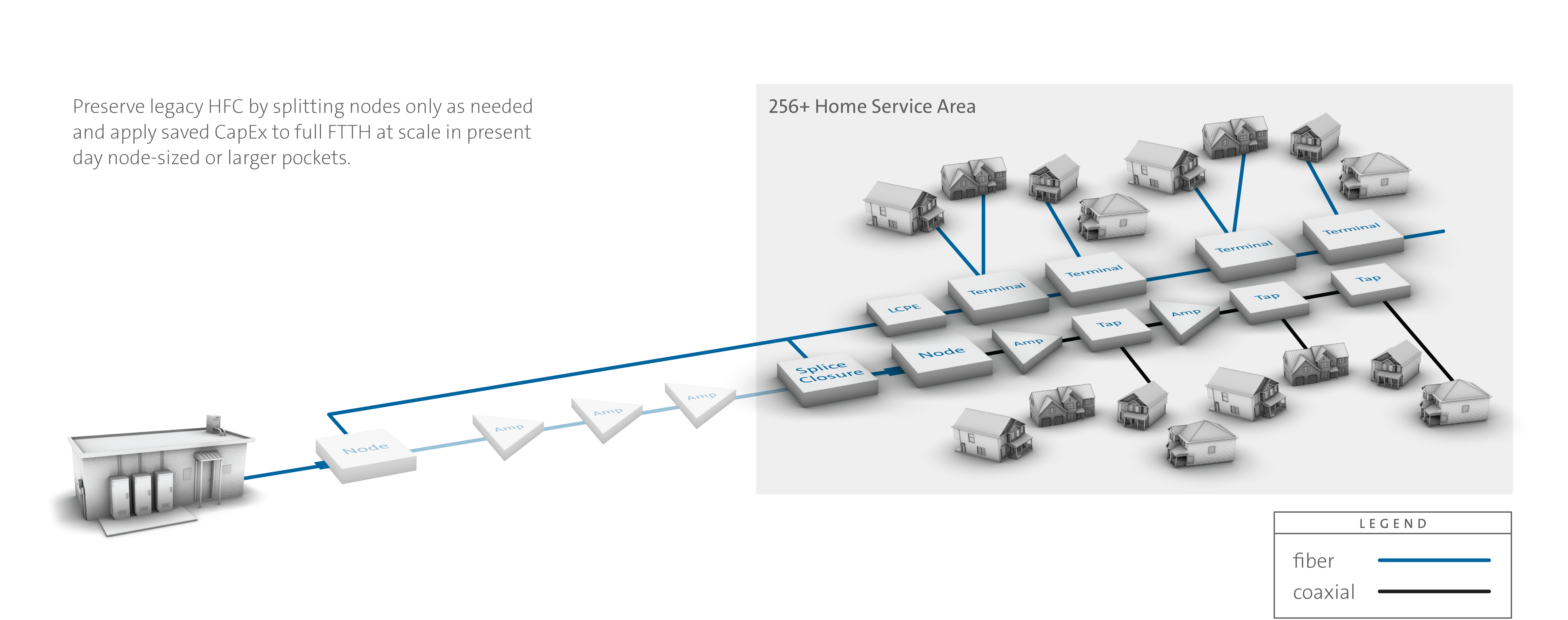

Preserve and leap with HFC-enabled passing gear: While traditional FTTH architectures were built to connect wide service areas in large-scale, fast-paced overbuilds, CATV operators face that constraint only by exception. The luxury of robust plant in traditional node+x architectures enables MSOs to much more strategically invest in scalable infrastructure. Two such examples are converged optical plant investment in select markets and residential FTTH designed around small node service areas that ease the operational lift and offer greater total cost-efficiencies as compared to historical mass-overbuild architectures.

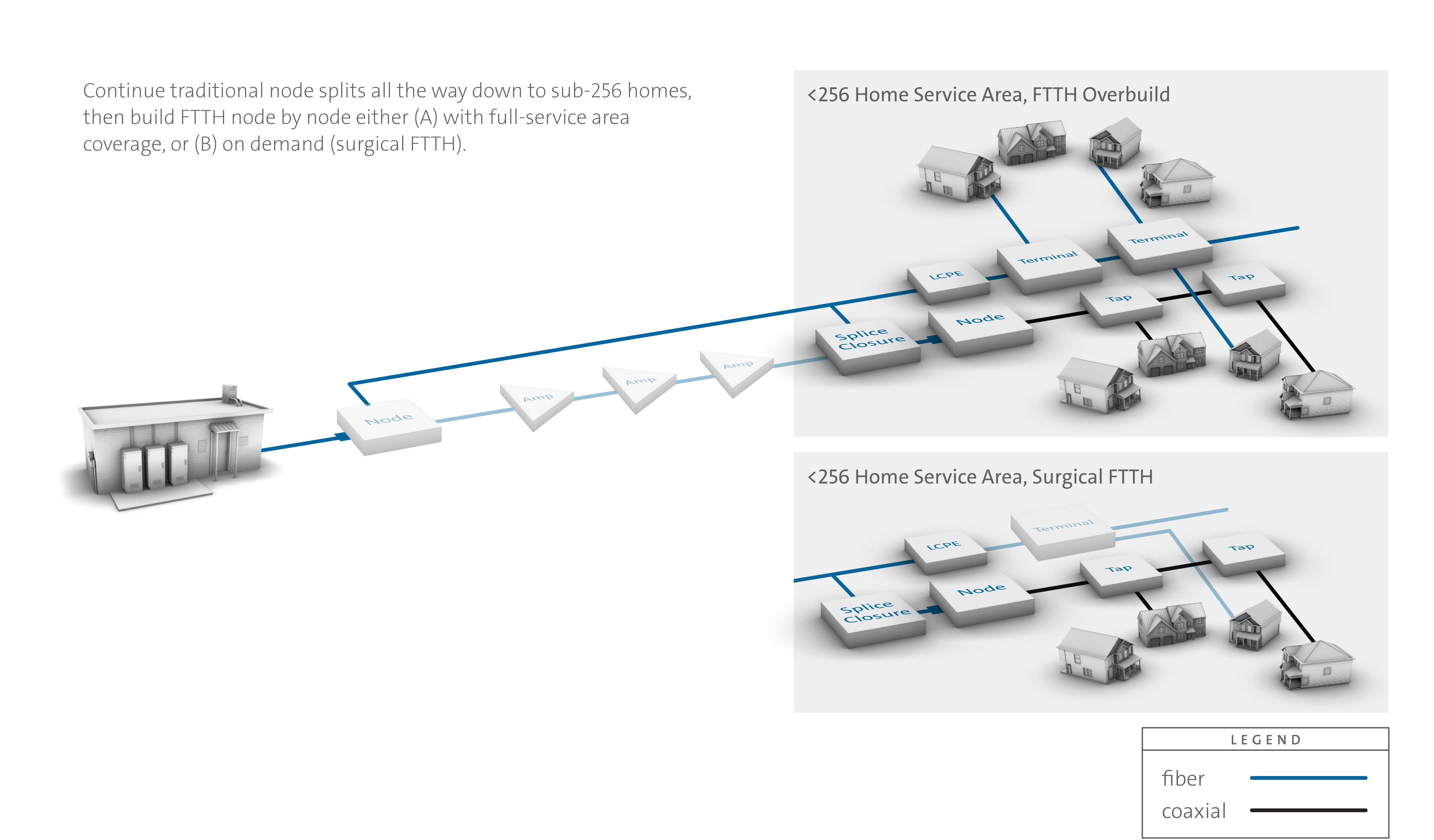

Integrated connectivity solutions designed to service sub-256 home pockets allow for easy and phased use of transformation concepts:

(1) Preserve legacy HFC by splitting nodes only as needed and apply saved CapEx to full FTTH at scale in present day node-sized or larger pockets.

(2) Continue traditional node splits all the way down to sub-256 homes, then build FTTH node-by-node either (A) on-demand (surgical FTTH), or (B) with full-service area coverage.

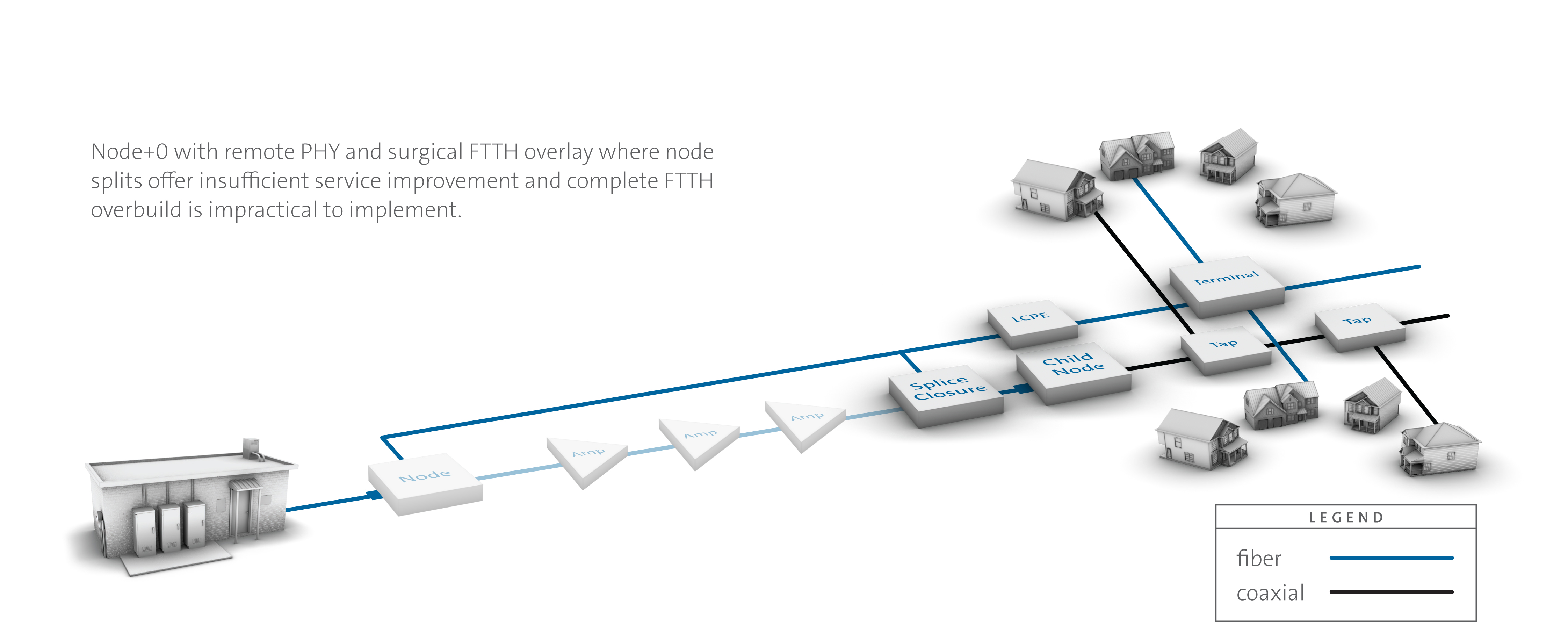

(3) Node+0 with Remote PHY where node splits offer insufficient service improvement and FTTH is impractical to implement

3. Choices Made Today Impact Tomorrow’s Growth Potential – and Costs

When Hurricane Sandy tore through the Northeast, service areas around entire central offices had to be rebuilt. Rather than spend regrettably and brace themselves to repeat the cycle with the next big storm, operators replaced legacy copper with a fully passive, optical plant. The results have been a proof point for the industry, with the new networks being 70% to 90% more reliable, consuming 40% to 60% less energy, and ultimately delivering annual operational savings of nearly 60% since that transformation. More recently, Hurricane Harvey flooded huge areas of Houston in 2017, and in many instances, full optical communications infrastructure remained largely unaffected due to the inherent advantages that fiber has over copper in wet conditions. Once power was restored to homes and businesses — either over the power grid or through subscriber use of generators — connectivity immediately resumed.

To that end, industry contacts estimate that a powered HFC plant costs cable operators between $1,000 and $3,000 per route mile per year to power and maintain. With representative figures between 100 and 150 homes per route mile, the cost to maintain residential broadband service over coax can be between $15 and $50 per residence per year. While powered plant is an enormous strategic asset, it may most powerfully serve the MSO when optimized for applications that maximize competitive advantage and increase or diversify revenue. These opex considerations are significant contributors to the long-term value of optical transformation. Perhaps the FTTH ROI — better still, a converged optical access ROI — is shorter than once believed and within this upgrade cycle for specific service area demographics. Quantified and tactically relevant transformation plans will identify those demographics and phase their transformation.

Forty eight years after the first low-loss optical fiber was invented, the connected experience continues to amaze people and enrich lives, making it increasingly necessary to expand the reach of fiber in our always-on world. As we enter the Gigabit era, CATV operators face the opportunity to apply scalable infrastructure spend in a powerfully impactful and competitive manner. Collaboration that both challenges conventional perspective and delivers scale may be of far greater value than in years past, and can offer alternatives that may just bring a far greater return.

Cate McNaught is emerging applications market development manager at Corning Optical Communications.