Why Netflix Is Ready To ‘Fly Like an Eagle’

In our latest Next Text, we also celebrate more Steve Miller hits, laud Alex Garland’s trippy ‘Civil War,’ eulogize Participant Media, and wonder what the heck Sony and Uri Berliner are thinking

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Every Sunday, Next TV writers Daniel Frankel and David Bloom share their reckless, poorly thought out, badly articulated grievances and impulses in a kind of text-based podcast. It's an experiential journey into a small, dark, vindictive, petty place … But joyfully chased with charts, photos, music, movie trailers and more. Enjoy!

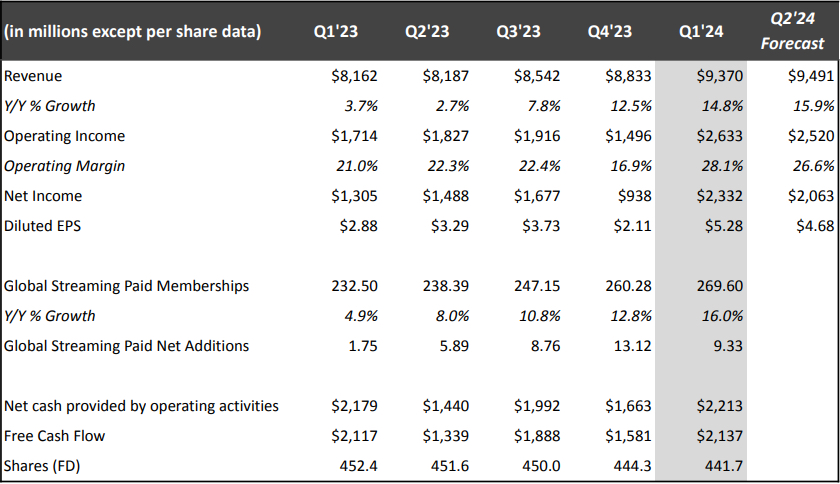

DANIEL FRANKEL: Hello again, D Money. Active TMT week, any time you have NAB and Netflix earnings going on at the same time. As we, er, spin The Clash’s Sandinista! LP classic “Police on My Back” (heck, it goes with anything), let’s start with the latter — only in American capitalism can Netflix put on a show like it did on Thursday, growing revenue by 15% and adding nearly 10 million new customers … and the stock market rewards you by cratering your shares nearly 10%?

I can only guess that the Street was reacting to Netflix’s disclosure that it’s going to stop reporting quarterly subscriber numbers. But Netflix is still projecting revenue-growth expansion. Of course, North America is becoming saturated. Of course, the bump from the account-sharing crackdown has to slow down eventually. But Netflix, which is just scratching the surface with what it can generate with ads, expanding its addressable customer base by 65% Q1 to Q1, is telling a nice revenue-expansion story. What do these feckless, fickle, fart-faces not get?

DAVID BLOOM: The fall in Netflix share prices was mostly part of a brutal, far-broader market pullback after an overheated, record-setting Q1. Netflix was overheated, too, within hailing distance of the $690 peak it set in just-past-lockdown 2021, before the Great Correction two years ago. The changes set in motion after prices plunged to $175 are paying off now but, as analysts kept noting, have “room to run.”

Paid sharing can capture more of the 70 million jettisoned freeloaders who haven’t signed up for their own account. The ad-supported tier keeps growing, to 23 million, and attracting 40% of new signups. Other post-2022 changes are promising. Netflix can extract more from ad-supported subscribers. Programming spend remains flat at $17 billion a year, with a more efficient mix. Now, $1 billion a year goes to WWE Raw, less to open-checkbook awards hunters. Other money will go to sports and live events, and far more licensed content. Licensed content means known properties that the Netflix global machine can easily turn into hits for new audiences and generations.

The growth from 2022’s changes won't be there forever, though. As your analyst pal Michael Nathanson wrote (while raising target prices again): “We continue to remain cautious of pie-in-the-sky forecasts that see this hockey stick continuing indefinitely — the password-sharing crackdown was likely a pull-forward of growth and does not change the underlying fact that there are increasingly fewer and fewer households in (U.S.-Canada) yet to subscribe to the streamer.“ The market isn’t “not getting” Netflix so much as freaking out more broadly. When the dust settles after the latest price stampede, Netflix should again be just fine. At this weekend’s $550 price, it's still up 14% for 2024. As the sage Steve Miller might say, it’s ready to fly like an eagle.

FRANKEL: If we’re going to veer into Southern rock and Steve Miller, I'm going to humbly request the inclusion of “Wild Mountain Honey.” As an engineering major at Cal State Northridge in the 1980s, playing that jam on the Pioneer Super Tuner inside my 1970 Cougar XR7 (yes, it had the Cleveland block, duh!) was part of my pre-exam ritual. Sadly, it didn’t seem to help my test performances, and I ended up in the explosive growth field of media business trade journalism. (As Joe Strummer might say, “What have I done?”)

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

But while we’re rocking out to the SMB, I am going to ask you about Sony getting involved in the Paramount bonanza.

BLOOM: Speaking of curious share-price peregrinations, Paramount jumped 12% amid the general market swoon, after reports that Sony is joining Apollo's $26 billion Par bid that seems to be a.) straightforward, b.) the biggest bid by far and c.) therefore not of interest to controlling shareholder Shari Redstone and the ostensibly “independent” board committee vetting deal proposals. A 30-day clock is ticking on David Ellison”s inside-out takeover plan, which still looks like a fertile source of shareholder lawsuits.

Also read: Paramount Enters Exclusive M&A Talks With Skydance Media

Sony is the only major studio without an SVOD service, so maybe they’d even retain quivering loss pit Paramount Plus, further beefed up by their Columbia/Tristar library. I read the share-price revival as non-Redstone owners hoping desperately that they'll get a better deal than Ellison's proposal. Think it’ll make any difference for Redstone or that incredible, shrinking “independent” board committee?

FRANKEL: You know better than I, but taking on Paramount and its burdens feels like a mistake for Sony, arms dealer to the stars. I still like David Ellison … who, you pointed out in a separate email conversation earlier this week, just donated $926,600 to President Joe Biden. As you also said, “It’s entirely possible the massive donation, midwifed by Democrats’ Hollywood rainmaker Jeffrey Katzenberg, is a strategic donation as the Ellisons try to play both sides of the aisle in any upcoming regulatory overview of an eventual deal.” Speaking of political donations, I want to not talk business for a second and steer into that separate email conversation again. I saw Civil War last week.

Now, I recall shitting on studio A24 during one of our pre-Oscar conversations over the winter. You informed me that the place is sort of a creative wellspring right now, and that —as Aaron Rodgers might advise — I should “read up on it.” You weren’t wrong. Alex Garland's Civil War is a trippy, experiential adventure into a believable near-term future, stripped of lurid details that might bog the whole enterprise down into some controversial social commentary it’s not trying to be. It’s just: “You wonder what this worst-case outcome to our societal differences might be like? Here it is.” Fantastic performances from Kirsten Dunst, Wagner Moura, Nick Offerman and Stephen McKinley Henderson. And the most eclectic, out-there score you’ll hear all year. (Garland uses “Lovefingers,” from this obscure 1960s electronic band called Silver Apples, for an opening montage describing the dystopic chaos.) I bring this up because when a filmmaker manages to score a large theatrical audience with an entirely original concept, it should be mentioned.

BLOOM: I’ve resisted the impulse to see Civil War (or anything else in theaters) since the pandemic, but look forward to the film's eventual streaming debut … somewhere. I’m already haunted enough by actual election and trial news without mainlining an all-too-possible alternative future for journalism and politics while sitting alone in a dark room with strangers. That said, Civil War is A24’s biggest debut ever, opening to $25.7 million domestically on a $50 million production budget, just a year after the indie grabbed the Best Picture Oscar for Everything, Everywhere, All at Once. Bigger picture, ahem, A24 has done something other studios haven't managed since Miramax’s preindictment heyday.

It’s a reliable brand, routinely serving up original films in many genres for an ardent fan base happy to go wherever A24 takes them. Best of all, it comes with no Weinsteins attached. The same week Civil War rocked it, though, another well-regarded indie, Participant Media, shut its doors, despite repeatedly serving up smart, left-ish Oscar winners such as An Inconvenient Truth and The Green Book over the past two decades. All this makes me wonder whether the older studios will ever figure out how to do what A24 has done. They repeatedly build brands for every project or franchise, but can't make their own studio a brand that means something? Maybe they're too busy at places such as Warner Bros. Discovery with crazy executive compensation plans. As we predicted, David Zaslav earned a 27% raise, after his strike-year cuts and manipulations freed up $6 billion in cash flow.

Also read: Warner Bros. Discovery CEO David Zaslav Got 27% Raise to $49.7 Million in 2023

That $49.7 million payday is triple the average for public company CEOs. This for a studio whose share price is down two-thirds since it debuted two years ago, with $3 billion in losses in 2023. We should call Zaz Mr. (Self-)Value Creation. Back to my previous point, no one knows what the WBD brand stands for, beyond lining Zaslav's pockets. At least he won't be doing any more deals for a while, given the company's brutal debt load.

FRANKEL: What are your thoughts on the demise of Participant Media? Good riddance? (Joke!) Speaking of good riddances, how about 25-year NPR news veteran Uri Berliner, who threw his employer under the bus with this essay, got suspended, then quit this week? Let me see if I can follow his logic — for more than 30 years, conservative lawmakers and presidents have been trying to defund National Public Radio, alleging liberal bias. But Berliner claims that NPR “lost America’s trust” just within the last several years, trying to report on the abuses and excesses of Donald Trump. To me, it all feels like another strategic, political attack on NPR CEO Katherine Maher, and once again, Republican lawmakers are on the defund march. I’ll close my remarks with the end-credit tune from Civil War, the Lou Reed-ish “Dream Baby Dream” from Suicide.

BLOOM: Not sure what Berliner wanted from his public rant about public radio. Perhaps, after three decades, it was just time to move on and burn some bridges as he went. Perhaps he’d heard one too many comments about his status as an older white heteronormative cis-male, or whatever his particular grievous blessings of privilege. Perhaps, given the Gaza-Palestine-Israel-Hamas rifts sundering institutions ranging from Harvard to The New York Times to Google, he felt under siege. Whatever. I hope his next step is good for him, though it did his longtime employer no favors.

It’s always useful amid such political potshots to note how little of the budgets of public TV and radio actually come from those loud-mouthed legislators. Most of it is raised retail, through endless listener fundraising campaigns, foundation support and corporate “sponsorships.” Presumably, these supporters have few problems with what they’re hearing/seeing/paying for directly. That said, I’d prefer a broader array of journalists at NPR or any major news outlet. Just as having a staff with women, people of color, a range of ethnicities and religious experiences, wider educational backgrounds, and differing gender preferences and identities creates broader perspectives, so can a broader spectrum of political belief. Puck’s Tina Nguyen, for instance, started her career in the belly of the right-wing media beast, and thus has insider relationships and a deep understanding of MAGA dog-whistle conversations in a way the typical NPR or New York Times reporter never will. Last week’s Atlantic profile of California Gov. Gavin Newsom says the likely 2028 Democratic presidential candidate watches a lot of Fox News, to understand the points of view, grievances and performative bull-hockey that informs both his political opponents and a share of his own vast electorate. But as the populace becomes ever more partisan, audience-chasing news publications have to identify as something too, to survive. The unfortunate result is echo chambers, not understanding, and usually less-impactful journalism.

Participant Media sat at the edge of this increasingly rigid alignment. It always self-identified as lefty, but also made good films that found wide audiences, such as The Green Book, Spotlight and Roma. But the man who bankrolled Participant, an ailing, socially awkward eBay billionaire named Jeff Skoll, decided to exit amid what his shutdown memo termed “extraordinary changes in how media is created, distributed and consumed.” He tried to sell to billionaires with similar-minded media holdings such as Laurene Powell Jobs and Pierre Omidyar, couldn’t get a price, and now is keeping the Participant name and library, minus a few hundred staff members. With all their new free time, perhaps Skoll and Berliner can start a company called Non-Participant Media.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!