How WarnerMedia-Discovery Talks Temporarily Broke Down in April

Discovery's nearly 700-page S-4 filing to the SEC reveals how CEOs John Stankey and David Zaslav made the $43 billion deal that will result in Nasdaq ticker symbol 'WBD'

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Like all big TMT deals, the $43 billion agreement that will, regulators permitting, render the new Nasdaq trading symbol "WBD" endured its moments of doubt and pain.

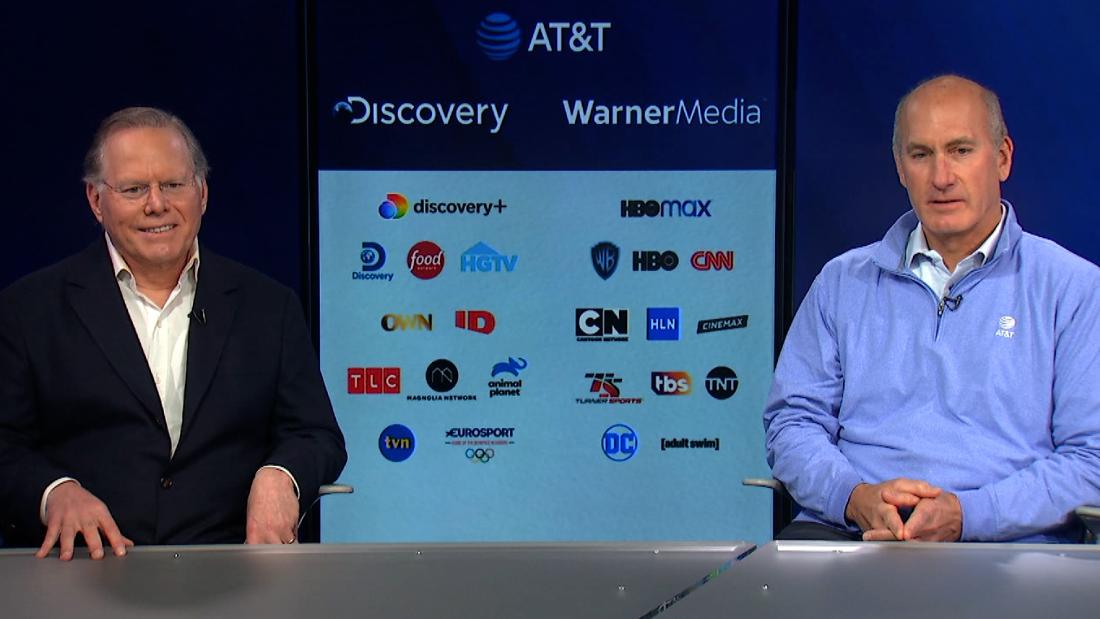

As detailed in Discovery's lengthy S-4 filing to the Securities Exchange Commission Thursday, the talks initiated on Feb. 13 by AT&T CEO John Stankey and Discovery CEO David Zaslav to spin off WarnerMedia from AT&T and merge it with Discovery temporarily broke down in April.

Also read: AT&T Accused of WarnerMedia 'Malpractice’ By Ex-CEO Jeff Bewkes

"During these discussions, Mr. Zaslav initially proposed that AT&T’s stockholders would receive 65% of the outstanding shares of the combined company post-closing on a fully diluted basis, with Discovery stockholders holding the remaining 35%, and that the WarnerMedia Business would be transferred to Discovery with debt in the amount of $40 to $42 billion," the filing reads.

"Mr. Stankey noted that AT&T’s position was that AT&T’s stockholders should receive 75% of the outstanding shares of the combined company post-closing on a fully diluted basis," the document added. "Mr. Zaslav indicated that Discovery would not be willing to accept AT&T’s proposal. Messrs. Zaslav and Stankey agreed to work with their respective advisors to refine each company’s analysis with respect to relative valuations and continue discussions."

With talks stalled on April 18, AT&T yanked Discovery's access to a virtual "data room" it had set up in order to share internal documents related to the deal.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

The deal, however, still had the support of Discovery's largest investors, TMT mogul John Malone and the Newhouse family. And Stankey and his team were still interested, as well. According to the 700-page SEC filing, it was also on April 18 that Zaslav was approached by a representative from LionTree--a consulting firm brought in by AT&T--to see if there "was a path for continued engagement between the parties.”

Zaslav re-approached Discovery's board. And ultimately, the two sides came to an agreement in which AT&T shareholders would receive 71% of the outstanding shares of the combined company called Warner Bros. Discovery.

While it details the timeline that led up to the agreement, much of the rest of the document outlines what the two companies see as the primary focus of the merger: it will help HBO Max and Discovery Plus better compete in a heated streaming market in which they vie "with other programming networks for distribution, viewers and advertising, and face increased competitive pressure from subscription-based streaming services, DTC products and expansion by other companies—in particular, technology companies—into the content production and distribution space."

Discovery said that in 2020, total subscribers for its U.S. linear and digital networks declined 5%, leading to the aggressive launch in January of direct-to-consumer platform Discovery Plus ... and ultimately, seek out a deal with WarnerMedia to achieve even greater scale in the global DTC market. ■

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!