Verizon Posts More Strong Fixed Wireless Growth, Telco Adds 384K Customers in Q3

Conversely, analyst Craig Moffett wonders if Verizon shot itself in the foot 12 years ago with those Comcast and Charter MVNO deals

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Proliferation of low-priced fixed wireless access home internet isn't slowing down. In fact, it's speeding up a little.

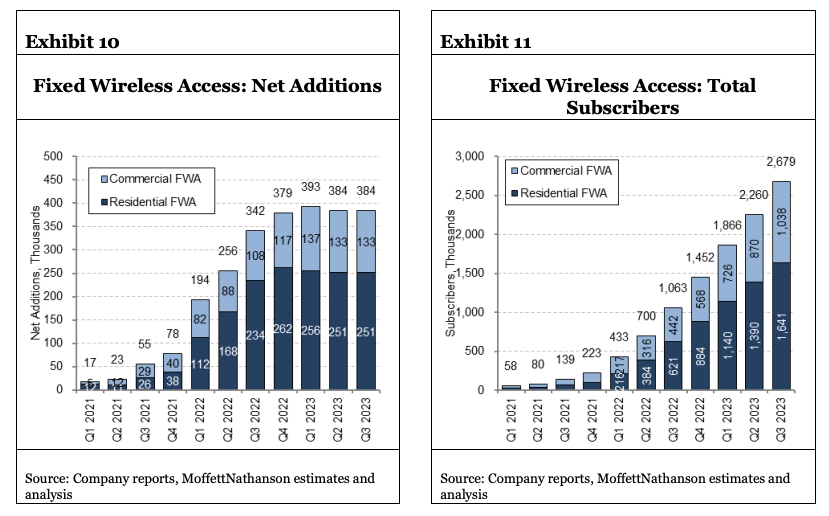

Verizon reported the addition of 384,000 FWA customers in the third quarter, precisely flat with the telco's Q2 FWA additions, but a slight uptick over the 342,000 subscribers that were added in the third quarter of 2022.

Verizon said that 251,000 of its Q3 FWA additions came from residential customers, while 133,000 were on the commercial side. The wireless company has added 2.68 million fixed wireless home internet customers since launching the service in 2018.

Verizon offers its "5G Home" FWA service for as little as $35 a month, delivering a wireless router, a two-year price guarantee and enough speed, the company says, to stream full 1080p HD video (you can see Verizon's landing page here).

Especially intriguing is the $45-a-month "5G Home Plus" package, which tacks on faster speed (enough for 4K video streaming, Verizon says), a three-year price lock, unlimited cloud storage, and a $200 gift card.

Cable operators, who have collectively seen their customer growth slow to a trickle in the last few years, condemn FWA offerings from Verizon, as well as market leader T-Mobile, as lacking the network capacity needed to compete with them longterm for home internet market share.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

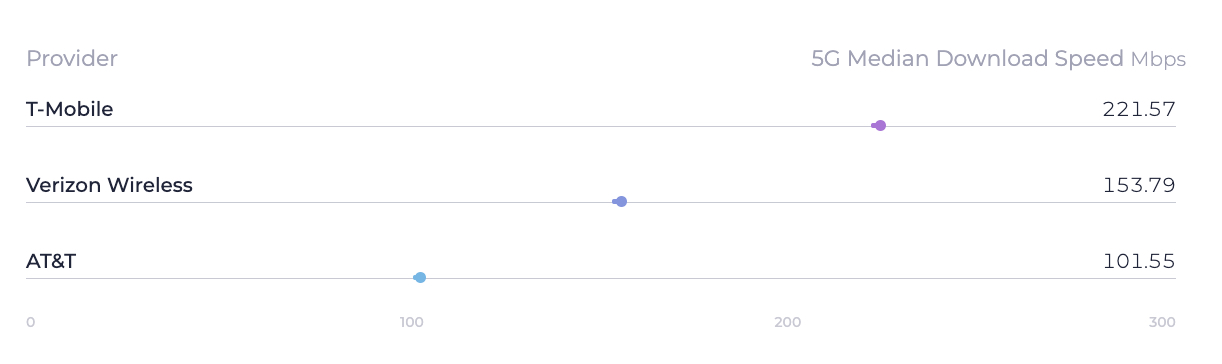

Last week, research company Ookla published data from its Speedtest app in September revealing that median download speeds for T-Mobile's 5G network had reached 221.54 megabits per second, spitting distance from the Q3 wireline broadband champ, Cox Communications (260.09 Mbps).

Verizon 5G median speeds came in a bit slower, but the company is still delivering enough speed to stream 4K at roughly half the price of wireline broadband.

Verizon's FWA growth comes as the company's Fios Internet wireline product also showed vigor, adding 69,000 customers in Q3 vs. 57,000 in the same period last year.

The company lost another 78,000 Fios linear video customers vs. 96,000 in Q3 2022. Verizon has just under 3.1 million remaining traditional video subscribers.

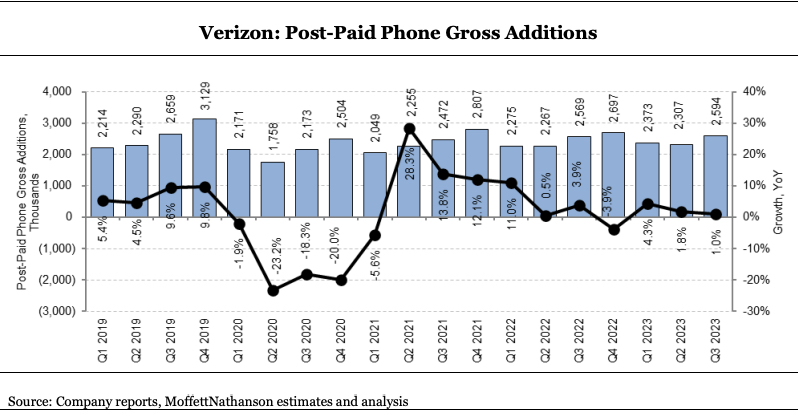

With Verizon also beating consensus forecast on post-paid mobile phone adds (100,000 in the quarter, the company's first meaningful positive growth in two years), its stock surged nearly 9% as of early-afternoon trading on the Nasdaq.

For his part, equity analyst Craig Moffett wonders if the customer growth should have been bigger.

As FWA encroaches on cable's long-held wireline dominance, Moffett pondered Tuesday if, conversely, Verizon didn't make a huge mistake 12 years ago, when it opened the door to the wireless business for Comcast and Charter Communications by carving out an everlasting "MVNO" deal to let the cable companies piggyback on its wireless network.

"When Verizon first signed their MVNO agreement in December 2011 with Comcast, Time Warner Cable, and Bright House, it looked to many to be a masterstroke" Moffett wrote in a note to investors. "They gained valuable spectrum -- don’t forget that the deal started with a purchase of cable’s AWS-1 spectrum -- and in the process took a potential facilities-based competitor out of the market. Better still, their agreement to resell cable broadband and for cable to resell Verizon wireless service (the MVNO) portended a future symbiosis between Verizon and the cable industry that would strengthen both in their competition with AT&T and T-Mobile. Twelve years on, things haven’t quite worked out as planned.

Twelve years later, the analyst noted, things have turned out different than as planned.

"On the surface, the deal is a good one for Verizon," Moffett wrote. "For every three customers the MVNO acquires, only one is likely to have come from Verizon itself; even accounting for the higher contribution of retail, the wholesale gain is likely greater than the retail loss."

Below the surface, however, the math is hazy. Has the decline average revenue per wireless customer wrought by Comcast and Charter undercutting the market more offset the benefits of the MVNO deal?

"The answer hinges on one’s view of a single question: does the MVNO deflate industry ARPU? If it does, then whatever benefit the MVNO might unilaterally bring to Verizon will be more than offset by the general deflation caused by the mere presence in the market of cable’s low price point."

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!