T-Mobile FWA Limitations Exposed in New Report

The cable guys have insisted all along that network capacity and performance limitations make FWA a non-threat. The latest MoffettNathanson report on T-Mobile Home Internet lends support to that notion

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

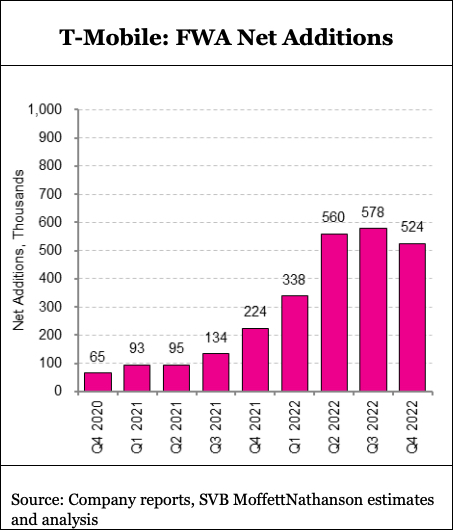

Fixed wireless access home internet services from Verizon and T-Mobile collectively amassed over 4 million customers almost overnight, explosive growth coming as wireline broadband for cable operators came to a screeching stop.

The puzzlingly consistent response from the leading U.S. MSOs has been dismissive — FWA simply doesn't have the performance or network capacity to register a competitive threat to the “10G” future, top Comcast and Charter Communications executives have said over and over again.

Also read: Cable Broadband Customer Growth Was Down by Around 500K in Q1 ... but Fixed Wireless Added 500K

A new report on T-Mobile Home Internet, published Monday by equity research firm MoffettNathanson using data provided by Opensignal, seems to support their logic.

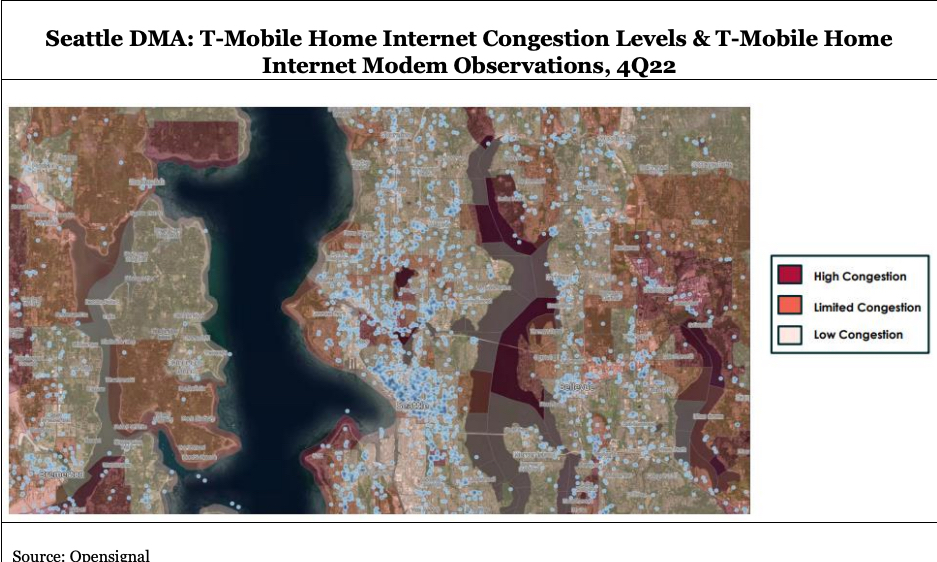

As the Opensignal coverage map of the Seattle area below reveals, T-Mobile has effectively steered FWA signups away from areas with high network congestion. (Notice the lack of white dots in red areas.)

“T-Mobile routinely informs prospective customers that their FWA service is unavailable in certain areas, directing aspiring customers instead to their tightly-managed 'Lite' service that offers very limited aggregate bandwidth,” wrote analyst Craig Moffett.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

On one hand, he noted, T-Mobile is doing a “sensible” job of network management, turning away customers who live in places where its network can’t handle them.

“At another level, however, it speaks to the capacity question that is everywhere in a discussion of FWA; T-Mobile is clearly aware of the issue and is managing appropriately around it.”

It is perhaps because of this limiting factor that T-Mobile’s $50-a-month Home Internet service over-indexes with rural customers, growing more freely in places where it’s uninhibited by capacity constraints.

Of the service’s 2.646 million subscribers as of the end of 2022, 54.7% are in urban areas vs. 70.3% of passings, and 21.3% of customers are in rural regions vs. 6.8% of passings.

Performance has improved marginally since T-Mobile Home Internet launched. T-Mobile’s FAQ has updated the service’s typical download speeds from 35-115 Mbps, when MoffettNathanson first reported on the service a year ago, to 33-182 Mbps. Expected upload speeds remain at 6-23 Mbps.

This comes at a time when cable wireline has reached a baseline of 200 Mbps.

As the report notes, T-Mobile’s quick FWA growth is marked by limitations, the service expanding rapidly in regions where competition and capacity allow.

“Our updated Opensignal analysis reveals that the broad patterns of T-Mobile’s FWA service remain remarkably similar to those of a year ago,” Moffett wrote. “Subscribership continues to heavily skew towards rural even as the preponderance of subscribers is sourced from urban and rural areas. Predictably, uptake is much higher in areas with limited fixed-line competition and is especially in areas with only DSL. And subscribership remains almost entirely confined to zip codes where T-Mobile’s network has sufficient capacity to handle the traffic, precisely as one would expect for a capably managed network.”

Are those limitations starting to reveal themselves in slowing subscriber growth?

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!