Upward Mobility

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

April 1 will be no joke for the telecom industry. That’s the day T-Mobile-Sprint is scheduled to complete a two-year odyssey to get its $26 billion merger across the finish line, creating a more competitive and deeper-pocketed No. 3 wireless carrier. But just as the New T-Mobile, as the combined company is tentatively called, bulks up to an estimated 100 million wireless customers, other players are beginning to emerge.

Dish Network is poised to become the fourth-largest U.S. wireless carrier, based on the asset it has agreed to buy from T-Mobile-Sprint as a condition of federal regulatory approval of the latter’s merger. Shortly after T-Mobile-Sprint closes its deal, Dish will buy 9.3 million former Boost Mobile and Virgin Mobile prepaid wireless subscribers. Dish will also gain access to the new T-Mobile network via a seven-year mobile virtual network operator (MVNO) deal, and will spend another $3.4 billion to purchase spectrum from the new entity over three years.

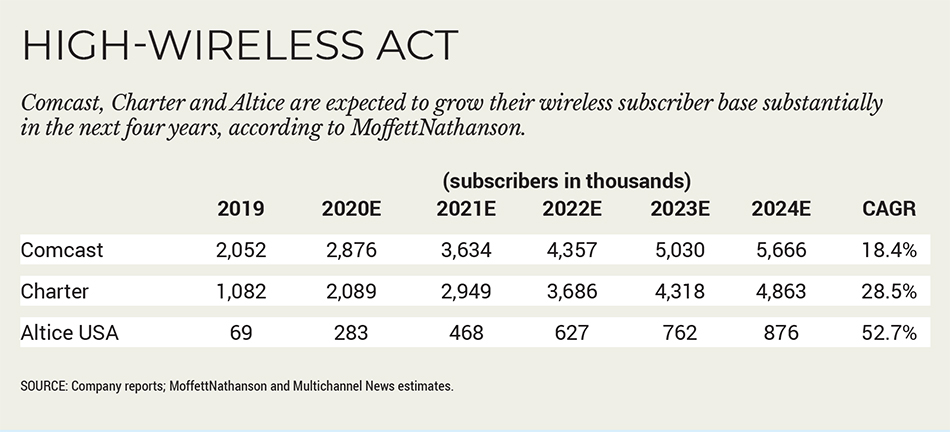

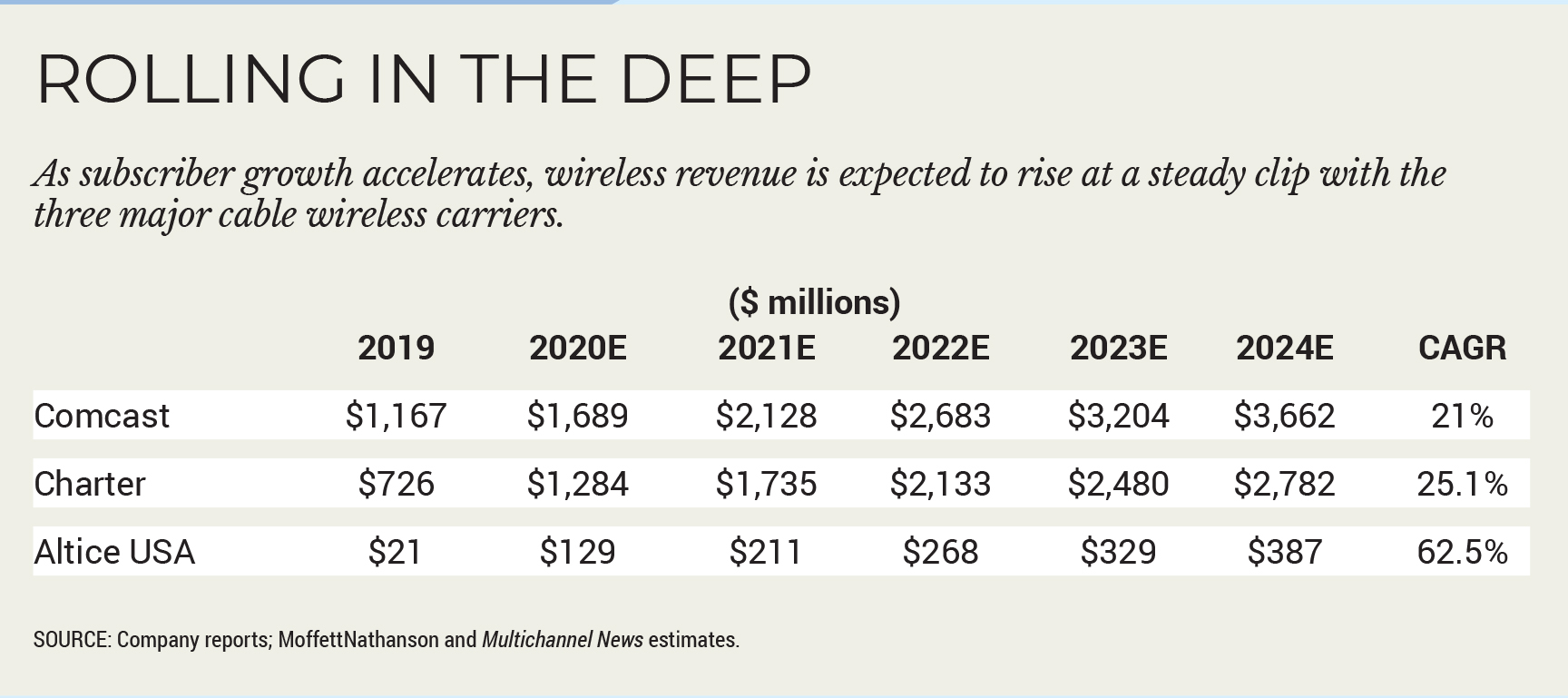

On the sidelines sits cable, which after three failed attempts to break into the wireless business over the past two decades seems to have found the right elements within the past two years. Comcast’s Xfinity Mobile, launched in 2017, crossed 2.05 million subscribers in 2019 and, according to some analysts, is on a path to more than double that base in the next four years. Typically conservative Comcast said it expects wireless to become cash-flow positive by the end of 2021.

Charter Communications, which launched Spectrum Mobile in September 2018, added more than 1 million customers in the past 18 months and expects to be cash-flow positive in 2021.

Those new and stronger players will all have to compete with wireless industry behemoths AT&T (166 million wireless subscribers) and Verizon Communications (120 million wireless customers). Here’s a closer look at how they are expected to stack up.

New T-Mobile

T-Mobile proposed its merger with Sprint in April 2018, a deal it said would allow it to better compete with AT&T and Verizon and introduce new products and services to underserved markets. Along the way, the companies had to clear hurdles set up by a group of state attorneys general, which claimed the merger would result in higher prices for consumers. T-Mobile-Sprint was cleared for takeoff in February, after a federal judge ruled the combination was in the public interest. While other states have said they won’t appeal, including New York state, California Attorney General Xavier Becerra has said he would keep his options open. Most observers believe T-Mobile-Sprint can go through with the closing no matter what Becerra decides.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Just what the new T-Mobile will do after the close is anyone’s guess. But the company has made at least one thing clear: It’s going after cable.

“We’ve said it all along: the New T-Mobile will be a supercharged Un-carrier that is great for consumers and great for competition,” T-Mobile CEO John Legere said in a press release shortly after the federal court decision was announced. “The broad and deep 5G network that only our combined companies will be able to bring to life is going to change wireless … and beyond. Look out Dumb and Dumber [AT&T and Verizon] and Big Cable — we are coming for you … and you haven’t seen anything yet!”

Whatever T-Mobile does in the video space will likely involve its 2018 purchase of Layer3 TV. T-Mobile spent about $325 million for over-the-top multichannel video programming distributor (MVPD) Layer3 TV and launched TVision Home in eight markets in April of 2019. Layer3 has high programming costs (20% to 30% higher than its peers, T-Mobile has said in federal filings) which has made launching the video service difficult.

Legere has said he will step down as CEO in May, after the deal closes, replaced by T-Mobile chief operating officer Mike Sievert. With the merger behind it, Sievert said the new T-Mobile will be able to focus on providing stronger service and expanding its 5G footprint.

T-Mobile-Sprint has pledged to spend about $40 billion over three years on 5G deployment and to expand its rural wireless service to reach 59.4 million homes. It has also promised to deploy a new in-home broadband option to more than 52% of U.S. ZIP codes, with a plan to obtain 9.5 million U.S. households by 2024, with 20% of those homes in underserved areas. The new T-Mobile also expects to build 600 additional retail outlets.

Dish Network

Dish has agreed to purchase T-Mobile-Sprint’s prepaid wireless businesses (Boost Mobile and Virgin Mobile) for $1.4 billion, adding about 9.3 million subscribers shortly after the larger merger closes. Dish will also spend another $3.6 billion on T-Mobile-owned 800 MHz wireless spectrum over the next three years, and will have its own MVNO agreement with the combined company for seven years.

Dish has been relatively quiet about its plans for the wireless service — it needs to build a 5G-capable network available to 20% of the country by 2022, expanding to 70% of the U.S. by June 2023, as per federal mandate. In the past, Dish has spoken of using its wireless capability to accelerate the Internet of Things, but lately the focus has been more on 5G, especially the ability to bring that technology to rural America. Dish has said it expects to spend about $10 billion to build out the 5G network, a figure some analysts have said is too low.

The biggest short-term benefit of the deal for Dish is that it gives it more time to build out its wireless network with its existing spectrum. It had been facing a March 2020 deadline for its network to reach 20% of the country. Now, it has two more years to reach that milestone. The addition of the Boost Mobile and Virgin Mobile subscribers also provides a pool of potential customers for its postpaid business. While prepaid customers churn at a 5% rate, Dish has said migrating those customers over to a more reliable Dish-operated network — both via the T-Mobile MVNO and whatever it builds out — should reduce that churn substantially.

On Dish’s Q4 earnings conference call, founder and chairman Charlie Ergen was reluctant to reveal too much of the company’s wireless strategy, but said the build for 5G service will be on a city-by-city basis.

“There’s obviously going to be some cities that are more interested in getting 5G quickly,” Ergen said. “And those cities that want to work with us will probably get first priority. And then, obviously, when we build out a city, we can have owner economics there. So we don’t have to build — we’re probably not going to build two towers in every city. We’ll build that city by city, and complete a city before we move to the next city.”

Xfinity Mobile

Comcast launched Xfinity Mobile in 2017. Two years later, the mobile service has 2.05 million customers and is evolving from its initial purpose as a retention tool for broadband to becoming a profit center. Comcast chief financial officer Michael Cavanagh has said wireless is expected to be profitable by 2021.

The success of the wireless product can be traced to one tenet: Keep it simple, Comcast senior VP of innovation and customer value proposition Rui Costa said.

“The starting point has always been our connectivity business,” Costa said. “The success attributed to wireless is how well we position it as an additional benefit of our connectivity value proposition. The way we’ve introduced this, as the missing piece of our broadband, has been paramount to the success of this.”

The way Comcast has introduced wireless this time around also is different, Costa said, in that the focus is on the overall customer experience.

“Our product is the experience and the experience is our product,” he said, adding that Comcast has purposefully kept the mobile product as simple as possible, whether it be flexible pricing plans, different data options and even a pay-as-you-go option. The idea is to offer consumers choice without bombarding them with options that are difficult to understand.

Wireless has also proven to be an incentive for customers to keep their broadband service. Like its cable peer Charter Communications, Comcast wireless customers are required to subscribe to broadband.

In 2019, Comcast Cable added 1.4 million broadband customers, its best performance in 12 years. While there are other factors associated with that growth, including the speedy demise of telco digital subscriber line service, at least some of it can be traced to wireless stickiness.

Costa didn’t want to take credit for the rise of broadband, saying there are a lot of factors that could be attributed to its success. But wireless is becoming an increasingly important component of the overall connectivity value proposition, he said.

“The success has been the proof of how well we’re telling the story to consumers and how valuable that has become to them,” Costa said.

Those subscriber increases have helped substantially reduce the mobile unit’s EBITDA, or cash flow, losses. Comcast cut its wireless EBITDA losses by nearly half in 2019, to $402 million from $746 million in the prior year. In Q4 alone, the unit’s EBITDA losses improved by 40%, prompting Cavanagh to predict wireless would be cash-flow positive for the full year of 2021.

Analysts see strong growth ahead for the wireless product: Moffett has estimated that Xfinity Mobile will more than double its subscribers to 5.7 million by 2024.

“The strategy has been, and is and will be, how can we use mobile as a benefit back to our broadband and connectivity business?” Costa said. “It is working because we see a benefit translated in many ways — churn, and attachment of other products. The other is the halo that has been created on the back of this new way of doing business with us.”

Spectrum Mobile

Charter launched Spectrum Mobile in September 2018 and in a little more than a year grew its wireless customer base from virtually nothing to 1.1 million. According to chief mobile officer Danny Bowman, Charter’s recipe for wireless success can be summed up in two words: simplicity and speed.

“We’ve integrated mobile into our core business,” Bowman said. “We introduce mobile into every possible transaction, whether that’s inbound sales or someone walking into our stores. The channels themselves have built a lot of mobile muscle memory and it’s just become part of what we do.”

Charter was also expected on March 6 to launch 5G in 14 cities via its Verizon MVNO. (Comcast also has said it would begin offering 5G handsets on March 6.) Speeds of the service will range from 700 Megabits per second to 1 Gigabit per second. According to Bowman, 5G will be included at no extra charge to Spectrum Mobile’s $45 per month unlimited data customers.

“We already provide the fastest mobile experience from coast to coast,” Bowman said. “This is just another proof point that we’re always going to have the fastest mobile experience for our customers. We’re keeping it super simple. We’re not creating some high premium rate plan that you have to buy. I think it’ll be easy for our channels to sell. You pick a 5G device, you get a $45 rate plan; you pick a 4G device, you get a $45 rate plan.”

Also helping with sales of the 5G product, as well Charter’s other offerings, are the more than 350 Spectrum retail stores with mobile service across the country. More are planned, Bowman said, adding the stores have played a key role in mobile’s success.

The stores are just another choice on a long list of options customers have for buying mobile service, including online, or by making a phone call and having a device or a SIM card shipped to their home.

“We’ve made it really easy for a customer to do business with us,” Bowman said. “Whether you want to say, call, click or visit, we’ve made it very simple and we can be very disruptive because of how we support our customers and what channel they want to use.”

Altice Mobile

Altice USA, the newest cable player on the wireless block, launched its mobile service in September 2019 and finished the year with about 69,000 customers, an initial pace the company claimed was twice that of its peers. The smallest of the three cable players, Altice — with about 4.2 million broadband customers, compared to 28.6 million for Comcast and 25 million for Charter — also has the most aggressive offering. Altice Mobile launched at a price point of $20 per line for life, less than half the $45 per line Comcast and Charter were charging. Altice Mobile has since said it ended that $20 promotion in March, increasing the price to $30 per line for new customers (legacy customers will still pay $20 for as long as they have the service). Still, even at the higher price point, Altice Mobile is cable’s best wireless bargain.

Altice’s ability to keep its prices so low is tied in part to its MVNO deal with Sprint (now T-Mobile). Altice USA CEO Dexter Goei has said its original MVNO deal will remain intact after the merger.

Analysts have pointed to Altice USA’s MVNO as the gold standard for such deals among cable operators. Based on the structure of that agreement, Altice pays less as more and more traffic moves off the MVNO to Altice’s network. Given the architecture of the Altice network, that won’t be as hard as it seems.

Under Altice’s deal, Sprint is allowed to build small cells on Altice’s network. Sprint pays nothing to Altice aside from construction costs. In turn, the cable company gets to ride on those small cells for free. The more cells there are, the lower the cost of the MVNO.

After the T-Mobile-Sprint close, Altice will have access to what Moffett called “a best-in-class network at a disruptively low price. It seems a foregone conclusion that they will attract subscribers. They already believe they can offload enough traffic from the network that they will be profitable even at super-low prices.”

Altice USA added about 69,000 mobile customers in Q4 — about twice the quarterly pace of its peers’ initial offerings — and is expected to end 2024 with 876,000 customers, according to MoffettNathanson, or about 17% of its total broadband base, inline with its larger peers.

At the Morgan Stanley Technology, Media and Telecom conference on March 3, Goei said Altice counts about 100,000 wireless customers, a signup pace about 2.5 times faster than its peers at launch.

Altice USA also will have access to 5G tech through its T-Mobile-Sprint MVNO, Goei added. While 5G could be perceived as a threat to Altice’s own wireless business, Goei said he views it more as an opportunity, especially since the technology is expected to be deployed over time.

“There’s obviously different strategies amongst different operators, but by and large, it’s an opportunity for MVPDs to work with wireless operators, particularly those who want a small cell,” Goei said. “And for those who want to go deep into the residential neighborhoods with fiber, good luck, have fun.”