The Race to Catch Netflix: Our Quarterly (and Highly Imperfect!) Global Streaming 'Subscriber' Snapshot

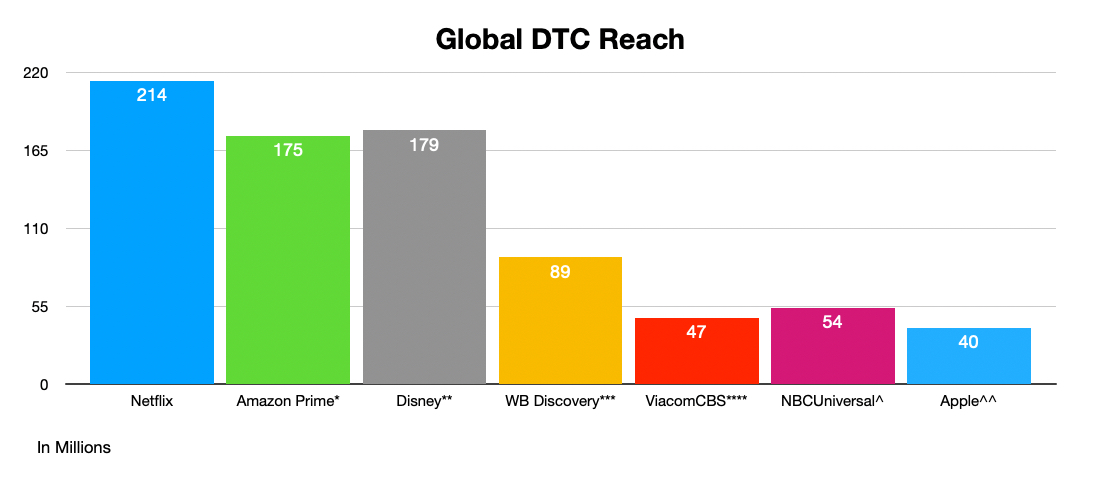

Which TMT companies come closest to matching Netflix’s 219 million global subscribers after the third quarter? Our somewhat apples-and-submarines infographic tries to update the standings

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Comparative analysis is often fraught.

For example, who's the NBA's all-time best pure shooter? Reggie Miller, who played against Pat Riley's "Game of Force" Knicks in a much more physical era of pro basketball, or Steph Curry, who re-imagined the three-pointer in today's modern, small-ball, hands-off league?

Was Kelly Clarkson really a better singer than Justin Guarini in Season 2 of American Idol? What did Mexican software engineer Andrea Meza, crowned "Miss Universe" in May, have that runner-up Teresa Santos, aka "Miss Brazil," did not?

Sure, weird lead, but maybe you can see where I'm going with this. Comparing the reach of very different subscription streaming services operated by companies from very different industries--technology, media and telecom--is a really imprecise process.

The biggest subscription streaming provider, Netflix, ended the third quarter with 219 million paid subscribers globally. One platform. No users subsidized by ad-supported mechanisms. It's as clean as it gets.

As for the rest of the field, just like Major League Baseball's 1998 home run race, let's just say there's some asterisks involved.

* Amazon said back in April that 175 million Prime members had “streamed TV shows and movies in the past year.” It hasn't added to that lean streaming usage morsel since then. But beyond usage of the Prime Video SVOD smorgasbord, "reach" (a better descriptor than "subscribers" for this particular exercise) has undoubtedly grown in the last six months--we're still ranking Amazon ahead of Disney based on that assumption. Amazon, for example, has made aggressive investments in AVOD platform IMDb TV, which merchandises its programming on the Amazon Prime Video app alongside Prime Video SVOD titles in an almost indistinguishable way.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

** Disney added only 5 million users globally across Disney Plus, Hulu and ESPN Plus in the third quarter. Labeling Disney's reach as being paid subscribers is misleading, according to Lightshed Partners analyst Richard Greenfield, who notes that Disney offers its local iterations of Disney Plus for free to 44 million customers in Asia. Disney Plus finished the quarter with 118.1 million subscribers, up from 116 million at the end of the third quarter and 73.7 million a year ago. ESPN Plus ended September with 17.1 million subscribers, up from 14.9 million last quarter and 10.3 million a year ago. Hulu had 43.8 million subscribers, up from 42.8 million last quarter and 36.6 million a year ago.

*** WarnerMedia said that HBO Max finished Q3 with 69.4 million HBO subscribers across HBO Max and HBO linear platforms worldwide, up about 1.9 million over Q2. Growth in the U.S. was slowed by WarnerMedia's withdraw of the HBO platform from Amazon Prime Video Channels wholesale. Discovery reported the addition of 3 million streaming subscribers in Q3 for platforms led by Discovery Plus, upping its total to 20 million. WarnerMedia and Discovery won't officially merge into "Warner Bros. Discovery" until next year, when their $43 billion deal is consummated by regulators. But we can do the math today and say their combined global stream reach is 89.4 million.

***** ViacomCBS said it added 4.3 million global streaming subscribers across platforms including Paramount Plus and Showtime in the third quarter, closing the three-month period with nearly 47 million DTC customers.

^ NBCUniversal didn't update its Q2 data indicating 54 million signups for Peacock, with just over 20 million of those being "active accounts." Last quarter, we went with the lower active accounts figure on our chart. With Comcast on the verge of expanding Peacock to the Sky footprint in Europe, we'll go with the higher figure this time. With Peacock distributed as both a free-to-consumer, ad-supported service and a multi-tier subscription offering, it's already complicated. Throw in the fact that most folks who get Peacock Premium do so as a no-additional-cost add-on to their cable subscription, and the complexity mounts. And then you have NBCU sporadically slicing the lentil with "signups" and "active users"? Forget about it.

^^ Apple is said to have sandbagged paid subscriber figures for Apple TV Plus in negotiations with Hollywood production union IATSE, saying it has less than 20 million users actually paying the $4.99-a-month freight for the service. Given how many users are still on promotion, it may not have just been negotiating rhetoric. But if we're measuring reach, we'll list the 40 million sign-ups figure published earlier this year by Ampere Analysis.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!