The New Normal: Streaming Takes Center Stage

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Almost everyone agrees that 2020 will be a landmark year in the history of television, with all the major programming groups spending billions to launch or tout new streaming video services, politicians planning to make record political ad buys and analysts predicting that pay TV operators, after suffering the biggest customer losses in their history in 2019, will see more declines in 2020.

These massive changes — almost unimaginable 10 years ago — promise to further disrupt already fraying traditional business models. Yet many of the industry’s largest major players, from traditional pay TV operators to TV programmers, are embracing the new streaming landscape with hefty investments.

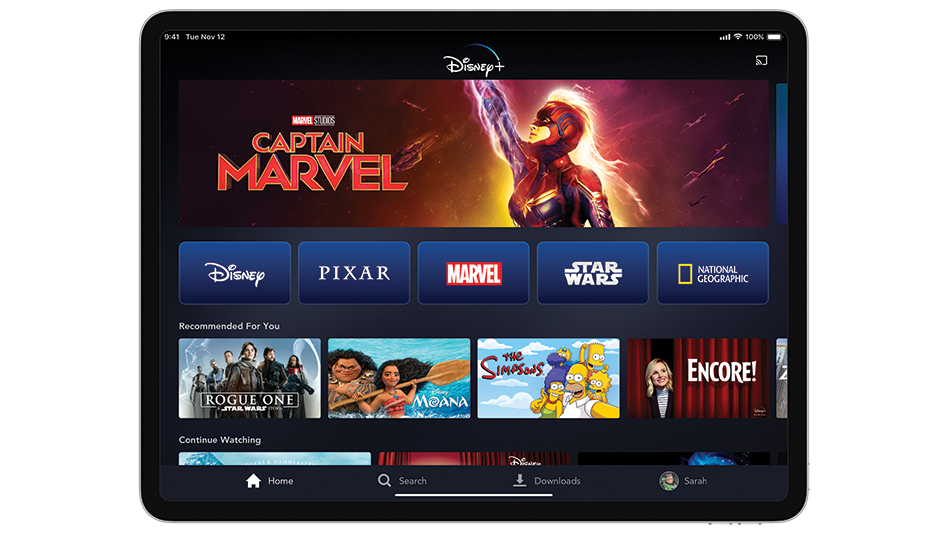

Cable operators, including industry leader Comcast, are now touting broadband-first strategies that include new offerings designed specifically for cord-cutters who’ve dropped traditional pay TV packages as programmers are set to spend record sums on new content for subscription video-on-demand services CBS All Access, Disney+, HBO Max, Netflix and Peacock in 2020.

RELATED STORY:Built for Streaming

Both trends are highly likely to accelerate the movement of subscribers out of the traditional pay TV ecosystem. “You’ve got Disney+, AT&T with WarnerMedia and HBO Max, Comcast NBCU with Peacock, the CBS-Viacom merger,” said Scott Rosenberg, senior VP and general manager of the platform business at Roku. “Those are all examples of traditional media companies finally putting the full force of their balance sheets and their brands behind streaming services. … That is important because the additional investment in streaming is going to further drive more customers out of pay TV into streaming.”

s

“Disney, Warner, NBCUniversal and all the others are going to be spending huge sums to market these services,” Pluto TV CEO and co-founder Tom Ryan said. “That is just going to build awareness for streaming and be great for ad-supported services like Pluto.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Usage is increasing pretty much across the board. Roku, for example, now has about 32 million active accounts and average users are now watching about three and a half hours of content a day on their Roku devices, Rosenberg said.

Likewise, Ryan noted that for Pluto TV, “users have nearly doubled from 12 million to 20 million from the start of 2019 to October, but consumption in total viewing hours has actually tripled year-on-year.”

After the Fall

The rise of streaming to center stage among consumers’ viewing habits marks a big shift from the traditional pay TV channel bundle to a disaggregated world where much content is available via separate apps, Horowitz Research president and founder Howard Horowitz said.

“The dynamic between disaggregation and aggregation is the biggest trend in the industry right now,” Horowitz contended. “There is a lot of choice for consumers with all the different content available on the different apps and at the same time, a lot of confusion in what’s available.”

This is both a major problem and an opportunity. “The consumer and the industry is looking for a way to put Humpty Dumpty back together,” Horowitz quipped. “The fact that we’re seeing the industry trying to create a synthesis should be viewed as a very positive trend for the future.”

A key part of this is an explosion of new content on streaming services. “We will be expanding original content from seven series in 2019 to 14 in 2020, with a major release every month and a tentpole each quarter, starting with Star Trek: Picard on Jan. 23,” said Marc DeBevoise, chief digital officer of ViacomCBS and president and CEO of CBS Interactive.

CBS also won the bidding for U.S. TV rights to UEFA Champions League soccer, which will give CBS All Access streaming rights to about 440 games starting in 2021. It recently announced a significant investment in kids and family programming, with more to come. “The merger [of CBS] with Viacom is going to be a tremendous help,” De Bevoise said.

Aggressive Aggregation

Another major trend is the rise of “super-networks” or “super-aggregators,” which are bundling together massive amounts of content, said Otter Media CEO Tony Goncalves, who is overseeing Warner Media’s SVOD service, HBO Max, expected to launch in May.

“We live in a world with pay TV, where there are 500 channels but the average consumer only watches 15 or 17,” Goncalves said. “If that is really the case, having six large OTT services in the marketplace might actually be better for consumers … In a way, we are solving some of the fragmentation issues by aggregating content into less destinations.”

At launch, HBO Max is expected to offer 10,000 hours of content with a wide array of shows from AT&T’s owned operations such as HBO, Warner Bros., New Line Cinema, DC Comics, CNN, TNT, TBS, truTV, TCM, Cartoon Network, Adult Swim, Crunchyroll, Rooster Teeth and Looney Tunes.

Operators have also embraced the trend towards streaming with new ways of aggregating content. In recent years, Comcast has added Netflix, Hulu and many other OTT apps to its X1 pay TV platform and recently launched Flex, a free service for broadband-only subscribers that bundles free streaming apps with high-speed internet access.

“We are really focused on the rapidly changing needs of the consumer and the real abundance of new content, programming, services and apps,” Rebecca Heap, senior VP of video and entertainment at Comcast, said. “We believe we can really play a huge role [in bringing together the consumer and all the available content] to create a great consumer experience in a much more challenging content environment.”

Such flexibility has been a key part of the success of virtual MVPD Sling TV, which added 214,000 subscribers in the third quarter of 2019, VP of operations Seth Van Sickel said. Sling TV makes it easy for subscribers to move in and out of different tiers.

“We didn’t want to build a product that replicates traditional pay TV because customers are leaving traditional pay TV,” he said. “We built a product around cord-cutters and cord-nevers who have completely different expectations.”

Behind the Numbers

If the industry is now squarely committed to creating new products for some long-standing consumer trends, there remains much debate about what is actually driving some of these trends.

One key issue is the pay TV industry’s video subscriber counts. Traditional multichannel video subscribers fell from 90.9 million in the third quarter of 2018 to 85.1 million in the third quarter of 2019, a record subscriber loss of 5.8 million, said Ian Olgeirson, research director at Kagan, a unit within S&P Global Market Intelligence. Virtual multichannel subscribers grew from 6.9 million to 8.5 million in the same period but that failed to fill the gap, producing a record decline.

“We had a bigger loss in the first three quarters of 2019 than we had in 2018,” Olgeirson said. “With more content and options outside the traditional subscription packages becoming available in 2020, there will just be more pressure on the traditional multichannel model.”

More losses may be on the horizon. In 2020, the bank UBS is predicting that about 6.2 million subs will leave the pay TV universe.

Olgeirson and others stressed, though, that consumer video consumption trends aren’t the only important factor in subscriber losses.

The pay TV industry, including the virtual MVPDs, lost about 1.74 million net video subscribers in the third quarter of last year, compared to a pro forma net loss of about 975,000 subscribers in third-quarter 2018, Leichtman Research Group president Bruce Leichtman said. Losses among the top seven cable operators reached a record 410,000 in Q3, up from 245,000 a year earlier.

“AT&T accounted for 79% of the net losses in the third quarter of 2019 … and they accounted for 62% of the losses over the past year,” Leichtman said. “When the No. 1 pay TV company reports those kinds of numbers, that has a huge impact on the market and the way the market is perceived.”

In AT&T’s case, these remarkable declines reflect a major shift in strategy. “They are really focusing on profitable subscribers and retaining and acquiring profitable subscribers,” Leichtman said. That strategy led AT&T to sharply cut its promotional efforts and retreat from the satellite business.

This stands in stark contrast to Sling TV parent Dish Network, which had the smallest net satellite sub losses in Q3 2019 since Q3 2016.

All About the Consumer

Similar complexity can be found in the TV and digital ad business. “If you look at the 25-to-54 demo, we are projecting that in 2020 about 40% of all video time will be streaming in some capacity,” said Brian Hughes, executive VP of audience intelligence and strategy and media agency Magna.

In contrast, TV viewing continues to decline. “If you look just at primetime across broadcast and cable for the 18 to 49 demo, viewing has dropped about 28% in the past five years,” Hughes said.

How this affects the ad market for TV and digital is both obvious and complex. Magna, for example, is predicting ongoing declines in linear TV advertising, from about $59.4 billion in 2019 to $48.6 billion in 2024. “We see it decreasing at about 2% going forward,” excluding cyclical events like political advertising and the Olympics, said Michael Leszega, manager, market intelligence at Magna.

There are a number of countervailing trends, though. “In 2019, TV advertising remained strong, largely because consumer spending has remained robust,” despite the declines in viewing, Leszega noted.

Likewise, the linear TV ad market is likely to remain relatively strong in 2020. Advertising Analytics and Cross Screen Media are projecting political advertising to hit a record $6 billion, with broadcasters pulling in $3.26 billion in 2020, up from $1.7 billion in 2016, and cable racking up $1.02 billion in political ad sales, up from $450 million in 2016.

While economic growth was supposed to slow in 2020, Magna prejects that “TV advertising could be strong again in 2020,” thanks to consumer spending, which is set to grow by about 4.3%, Leszega noted.

“TV definitely remains the most efficient and best way to get your message out to a large audience in a short amount of time,” Leszega said. “So there are definitely some tailwinds that are helping to grow and stabilize national television. The problem is that the other side of the equation is too powerful. Fewer people are watching, ratings are down and there is cord-cutting.”

On the other hand, Magna predicts digital video advertising will hit about $25.5 billion by 2024, up from $15.8 billion in 2019, and PwC says subscription video revenues are expected to jump from $11.6 billion in 2019 to $17.8 billion in 2023.

The next article will explore how those trends will impact the business climate and the strategies that companies are developing for the new streaming landscape.