Telcos Taking More Broadband Share

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

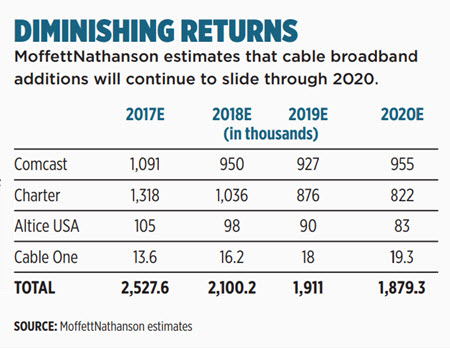

Broadband, long the segment of the cable business that has propped up declining video performance, is showing signs of slower growth, a byproduct of both its immense popularity and a fiber push by telco competitors that threatens to take back share.

Cable has long dominated broadband, accounting for well above 90% of overall growth for at least a decade and more than 100% of new subscribers since the first quarter of 2015, according to MoffettNathanson principal and senior analyst Craig Moffett. While that dominance didn’t decline dramatically in the most recent third quarter — 111% compared to 123% in Q3 2016 — it is starting to become more pronounced for large and small providers alike.

Related: Barclays Downgrades Cable Sector to ‘Neutral’

At Comcast, broadband additions slowed to 818,000 in the first nine months of the year, 17.2% behind last year’s pace of 988,000 adds. The same has held true for Charter Communications, with 908,000 broadband additions in the first nine months of 2017, down 17.9% from a year ago.

Broadband-centric MSO Cable One actually lost high-speed internet customers in its legacy systems in the last two quarters of this year — about 3,300 subscribers — and its broadband sub base is growing at a 1.7% annual rate, according to Moffett, considerably lower than the 2.9% growth rate of six months ago.

Overbuilder WideOpenWest, another provider that has concentrated on broadband, reported its first quarter of positive broadband subscribers in nine months in Q3, with 2,400 customers.

Double-Digit Decline in Adds

In the cable sector as a whole, broadband additions have declined 15.5% from 2.74 million in the first nine months of 2016 to 2.32 million in the first nine months of this year, Moffett noted in a recent report.

The stocks are beginning to reflect the sluggish broadband growth, too. WOW stock has fallen 44% in the past six months, followed by Comcast (down 11.8%), Cable One (down 4.5%) and Charter (down 3.8%). Altice USA, which went public in June, has dipped 44% since then, but much of that decline has been due to leverage concerns for its parent company, European telecom provider Altice N.V.

Overall, though, cable valuations are down. Pivotal Research Group CEO and senior media & communications analyst Jeff Wlodarczak said that trend is expected to continue. “Cable multiples are contracting over concerns about pay TV, slowing overall data market growth and competition,” Wlodarczak said. Add in WideOpenWest’s leverage (about 5 times cash flow) and the fact that it overbuilds some of the largest cable operators and telcos in the country, and the decline becomes less shocking.

And it doesn’t take much to spook the market. When Comcast said prior to releasing Q3 results in September that because of recent hurricanes and competitive factors it would lose 100,000 to 150,000 video customers in the period, shares fell as much as 7% to $38.60. The stock has not yet fully recovered — priced at $36.25 per share on Nov. 28 — even after results came in at the middle of the new guidance (a loss of 125,000 video customers). Part of the reason for that could be slower-than-expected broadband additions at 214,000 customers, behind the 330,000 additions in the prior year.

The shift started happening in the beginning of the year, when the two biggest telcos, AT&T and Verizon, reported net gains in broadband subscribers. It was the first time in almost two years that has occurred, other than a small increase in Q3 2016.

As AT&T continues to build out its fiber network, the gap is closing. In 2015, as part of the conditions around its purchase of DirecTV, it pledged to build out 12.5 million more homes with fiber by the end of 2019; now it says it will pass 14 million homes. Overall, AT&T said it expects to offer speeds of 50 Megabits per second or greater to 50 million homes by 2020. Those efforts have helped lift AT&T’s total broadband subscribers into positive territory for all three quarters this year. As Verizon’s losses decline, cable’s advantage should shrink.

Reversal of Fortune for Telcos

Cable is still expected to dominate, just not as much. Telsey Advisory Group analyst Thomas Eagan estimated telcos could end the year gaining 6.7% in broadband customers, compared with a loss of 8% in 2016. The shift is also cutting into trading multiples for the stocks. Wlodarczak noted that trading multiples have contracted between 0.5 times and 2 times in the first half of the year and will continue to fall.

Eagan also noted that Comcast’s trading multiple has dropped from about 8.2 times cash flow in the summer to 7 times after it released Q3 results. But despite the slowdown, he said, there is still plenty of growth ahead for cable broadband. “To me, it means they are underpenetrated and there is a lot of runway left,” Eagan said.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.