SiliconDust Steps Into Skinny-Bundle Fray

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Yet another Silicon valley pay TV service has jumped into the streaming video brawl, hoping to to defy the odds in an increasingly crowded market.

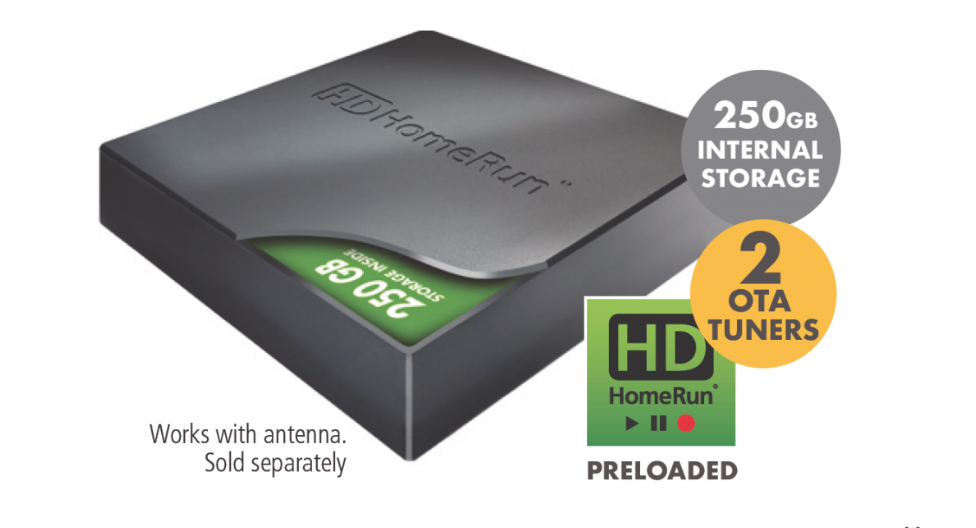

Pleasanton, Calif.-based, privately held technology company SiliconDust, maker of the HDHomeRun line of networked over-the-air tuners and DVRs, quietly rolled out its own virtual pay TV service, offering 45 channels for $35 a month.

How on earth is this maker of a niche video device, popular with some tech enthusiasts, going to make its bones in the harsh realm of program licensing, where scale is king?

Turns out SiliconDust isn’t wading into the deep, ever-more-expensive waters of direct-to-consumer service along with the industry giants, making its own network deals. It’s merely licensing the program networks from a cable company as a white-label product and putting its own name on the bundle.

45 Channels on Offer

“We are offering what we feel is a great set of 45 cable TV channels, allowing cord-cutters to watch much of their favorite programming without having to change between applications and manage fees with multiple companies,” SiliconDust CEO Theodore Head told Multichannel News in an email exchange.

With SiliconDust’s new subscription streaming service, users of HDHomeRun devices now have access to ESPN, TNT, CNN, AMC, FX and 40 other cable channels, in addition to the local broadcast affiliates these WiFi-enabled devices are able to access from OTA antennas. HDHomeRun sits on the user’s WiFi network, and the user can stream the content on iOS or Android mobile devices, Xbox One gaming consoles, Amazon Fire TV over-the-top devices, or Mac and PC laptops.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

With the introduction of the live-streaming service, HDHomeRun closely resembles Dish Network’s AirTV business, which similarly combines a WiFi-enabled OTA tuner with the Sling TV virtual pay TV service, the latter of which is now deployed with more than 2.3 million subscribers.

SiliconDust is distributing its streaming bundle under the HDHomeRun Premium TV banner. In addition to not disclosing the name of SiliconDust’s MSO partner, Head also would not reveal the number of HDHomeRun devices currently distributed into the marketplace.

“We investigated several options and it came down to which package we felt offered our customers the most options of popular cable TV channels,” Head said, explaining why SiliconDust didn’t simply partner up with one of the more than half-dozen virtual MVPDs that have already launched. “Customers all have their favorite [channels], and there is still not one service that offers everything to all, but we wanted offer a good complement of channels to cover a wide range of programming. There is always room for growth and addition, but for now we will focus on this launch. The response has been very positive.”

Head wouldn’t discuss the economics of the MSO partnership. But white-label distribution of programming bundles would seem to make sense in an era in which cable companies, particularly smaller ones, are marginalizing their video businesses and looking for any reason at all to stay in it.

The deal with SiliconDust is not only helping some cable company with added video revenue, it’s also providing additional scale with each HDHomeRun Premium signup.

Indeed, looking out at the pay TV landscape, there’s a definite changing of the guard as to who distributes video content and who actually licenses it.

Verizon Communications, for example, has clearly stated its intent to exit the program licensing business, leaving the task to partnership deals. The company recently announced that YouTube TV would be bundled into its soon-to-launch 5G fixed wireless product.

Pivoting From Linear

“I’ve said this a couple of times — I think the linear model is dead,” Lowell McAdam, chairman and former CEO of Verizon, said in an interview with his company’s Yahoo News division in May. “Our view is we should partner with those that are in the linear game, let them be very good at what they do. We’ll add digital content to that mix and we’ll position ourselves for where we become more of an over-the-top video culture, versus the linear model that we have today.”

Meanwhile, a number of small cable companies are looking for ways to exit the program licensing business, but still be in the video business.

Through the National Cable Television Cooperative, for example, virtual MVPDs including Sony PlayStation Vue, fuboTV and Philo have recently signed revenue sharing agreements that let smaller cable operators bundle live-streamed video services with their broadband products.

This kind of video distribution scheme, however, isn’t as intuitive as the traditional cable model, in which the subscriber merely turned the TV on to get to their program guide.

“I do think more work needs to be done with the digital MVPDs to make a more friendly execution of the user experience,” NCTC CEO Rich Fickle told MCN.

Head, though, said he likes the idea of SiliconDust offering its one branded video solution that spans both hardware and content.

“Many [cord-cutters] are missing cable TV channels,” he said. “They eke out a la carte services and piece together segmented solutions. Not one is perfect. Now we are offering one more choice in the streaming market that we feel fits with our model of TV viewing.”

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!