Private Equity Looks Toward the Exit Ramp

Broadband business draws interest of would-be buyers

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Private-equity firms, anxious to get back into the cable broadband business just a few years ago, are considering exit strategies, with at least one big deal in the works and others in the wings, according to sources in the cable financial community.

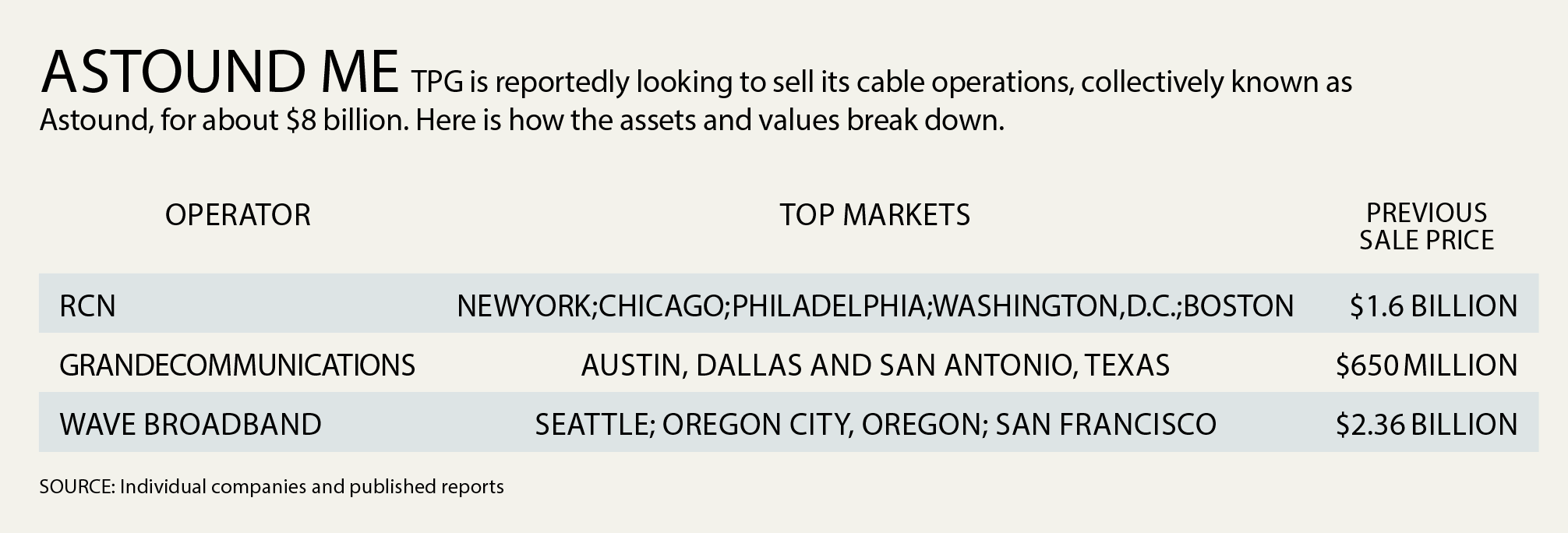

Perhaps the biggest deal in the pipeline is the possible sale of Dallas-based private equity giant TPG’s interest in Astound, its rollup of RCN, Grade Communications and Wave Broadband. TPG, which spent around $5 billion rolling up those three overbuilders between 2016 and 2018, is seeking about $8 billion in a sale and has hired investment bankers Morgan Stanley and J.P. Morgan Chase to handle the auction, according to a Reuters report.

TPG declined comment.

Sources in the financial community confirmed the Reuters report, adding that TPG originally tried to start an auction for the properties in March, but pulled it back when the COVID-19 pandemic hit. The second round of bidding is expected to take place in the next two months, with a winner expected to be chosen early next year.

Already, interest among larger operators is beginning to rise. On Sept. 2 Altice USA launched a $7.8 billion unsolicited takeover bid for Canadian telco Cogeco, the parent of Quincy, Massachusetts-based Atlantic Broadband. Altice USA has partnered with Toronto-based Rogers Communications, which would buy Cogeco’s telecom businesses for $4.8 billion. Altice USA would pay

$3.6 billion for Atlantic Broadband, about

10.2 times the cable company’s forward-looking cash flow. Cogeco’s controlling shareholder rejected that offer on Sept. 3, although most analysts expect Altice to raise its bid. Either way, the offer itself could mean that valuations for other assets would start at even higher multiples.

Riding the Broadband Wave

TPG burst onto the distribution scene in 2016 with its $2.25 billion purchase of Grande Communications and RCN and has ridden the broadband wave over the past several years, as large and small cable companies have shifted their primary focus away from video and toward faster data speeds. All three companies serve diverse geographies. Grande focuses on metro and rural Texas, and has customers in Austin, San Antonio, Dallas, Corpus Christi, Midland, Odessa, Greater Temple and Waco. Wave, which TPG purchased in 2018, focuses on Washington (including the Seattle area) Oregon and California. RCN, the largest of the three, operates in Boston; Chicago; Washington, D.C.; Lehigh Valley, Pa.; New York and Philadelphia.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

When TPG closed the Wave deal in 2018, it claimed the combined companies passed about 2.7 million homes and had 925,000 residential and business customers, delivering nearly 1.7 million data, voice and video services.

Just who would buy the TPG assets is the big question. Because of its status as an overbuilder in some of its larger markets like New York, Chicago and Boston, incumbent operators like Comcast and Charter Communications would be prohibited from buying. Midsized cable and broadband provider Cable One has been aggressively buying smaller cable companies and fiber network owners over the past three years: Emporia, Kansas-based broadband services company ValueNet Fiber; Sullivan, Missouri’s Fidelity Communications; Sikeston, Missouri-based NewWave Communications and ClearWave Communications. But a TPG deal could be too pricey for Cable One, which paid about $735 million for NewWave and $526 million for Fidelity. The company didn’t reveal the price of the other purchases, but it is believed they were for considerably less.

In a research note, MoffettNathanson principal and senior analyst Craig Moffett said CableOne needs to add scale to justify its high valuation, either organically or by other means. Its stock has been the best performer in the distribution sector for three years running, currently priced at nearly $1,900 per share. In the second quarter, Cable One beat analysts’ expectations by adding more than 44,000 high-speed internet customers, an 11.3% growth rate and more than double the 5.1% rise in Q1.

Broadband is driving much of the interest in cable at the moment. According to one member of the cable financial community who asked not to be named, familiar names in the smaller cable business that had sold their systems in the past — like NewWave’s Gleason family and former Wave Broadband CEO Steve Weed — have been dabbling in companies in the fiber-to-the-home business to help address the broadband boom.

Fiber Draws Interest

“It’s been nuts,” said the cable financial executive who asked not to be named. “There’s a lot of interest in fiber-to-the-home. It’s a new chapter for overbuilders.”

Weed, who sold Wave Broadband to TPG in 2018 for $2.36 billion, formed WaveDivison Capital with former Wave Broadband executives Harold Zeitz and Wayne Schattenkerk shortly after closing that deal, and in May 2019 teamed up with Searchlight Capital to purchase former Frontier Communications properties in Washington, Oregon, Idaho and Montana with 350,000 residential and commercial customers for about $1.35 billion, renaming the company Ziply Fiber.

At the time of the Frontier deal, Weed hinted that more deals could come.

“We are big believers in the Northwest’s future growth opportunities and that future runs on broadband,” Weed said in 2019. “Our plan is to invest further in our markets, specifically by extending fiber to more homes and businesses, to bring them the high speeds they want.”

Overall broadband growth has been strong and continues to be dominated by cable distributors. Leichtman Research Group estimated that cable operators added about 1.4 million high-speed internet customers in Q2, compared to 530,000 additions in the prior year. While much of that was due to work-from-home and stay-at-home orders in many states due to the pandemic, Leichtman Research president Bruce Leichtman said in a press release that the increase was the largest since 2008. Some believe the momentum

will continue. λ

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.