Pay TV Sub Rolls Take a 2nd-Quarter Hit

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

After a seasonally weak second quarter, analysts and investors hope better broadband subscriber results and continued improvement in basic video-customer growth in the third quarter will lead to better days for the sector.

Pay TV took a beating in the second quarter, as steady basic subscriber performance by cable companies was off set by greater telco and satellite losses. Like the previous period, the third quarter also is seasonally weak, as students return to campus in September, but analysts are optimistic that stronger broadband growth will off set any video declines.

“The good news about Q3 which, like Q2, is a seasonally weaker time of the year (all the additions are weighted to September) is that whatever the results, Q4 trends should be seasonally stronger, so they will likely be able to point to solid Q4 trends,” Pivotal Research Group CEO and senior media and communications analyst Jeff Wlodarczak said. “The overall focus, though, for cable investors should be on data subscriber results, which is clearly the key in the cable investment thesis.”

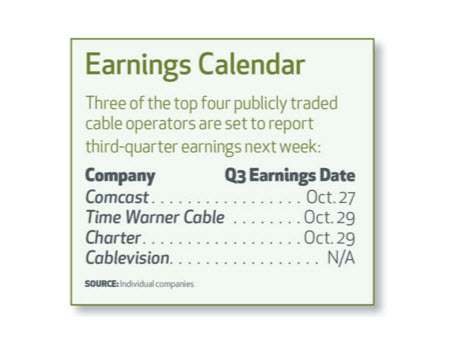

EARNINGS CALENDAR

Comcast, Time Warner Cable and Charter Communications are slated to be the first two out of the box with third-quarter results — Comcast is scheduled to release earnings on Oct. 27 with Time Warner Cable and Charter following on Oct. 29.

Both cable giants managed to report strong second-quarter customer growth — Comcast reduced its basic-video losses to 69,000 from 144,000 in the year-ago period, while keeping broadband customer additions relatively stable (180,000 in Q2 2015 vs. 203,000 in Q2 2014.)

Time Warner Cable, which is currently winding through the regulatory approval process in its $78.7 billion merger with Charter, reported some of its best quarterly subscriber growth in years in the second quarter — basic-video losses were down to 45,000 (compared to a loss of 152,000 in the prior year) and residential broadband additions were 172,000, nearly triple the 67,000 adds in the prior year. The consensus is that both companies will continue on that path in the third quarter.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Telsey Advisory Group media analyst Tom Eagan said the momentum of the past few quarters should continue for cable operators.

“We expect the numbers to be better than last year,” Eagan said of third-quarter results. He added that satellite TV providers DirecTV (now part of AT&T) and Dish Network are expected to continue their subscriber slide. And while telcos are expected to report video gains, growth is likely to be slower. That was evident last week when Verizon Communications said it added 42,000 FiOS TV customers in the third quarter, compared to 112,000 additions in the same period last year.

Charter lost about 33,000 basic-video customers in the second quarter, on par with the 29,000 it lost in the prior year.

In a note to clients, Morgan Stanley media analyst Ben Swinburne wrote that he expects third quarter pay TV subscriber losses to be slightly higher than last year — 90,000 compared to 55,000 in Q3 2014. But he expects cable to fare much better in the period — he predicts overall cable customer declines of about 110,000 compared to 345,000 last year.

All eyes will be on Time Warner Cable, which has dramatically changed its subscriber fortunes in the past year, Eagan said.

“They were one of the worst performers last year in terms of customer loss,” Eagan said. “Now [TWC chairman and CEO] Rob Marcus has said most recently they expect to add subscribers this year. That’s probably the biggest turnaround.”

The Charter deal is supposed to close by the end of the year and is currently winding through the regulatory approval process. While some analysts believe that the actual closing will take a little longer, possibly lasting into the first quarter of 2016, Eagan said investors are confident the transaction will be completed. He noted that the spread between Time Warner Cable’s trading price and the Charter offering price has narrowed from 7.2% to about 6.8% in the past few days, “which shows that the market feels better about the deal closing.”

Several companies have come out in favor of the deal and even its opponents said they would change their stance if certain conditions — mainly involving net neutrality and access to content — were adhered to. The Federal Communications Commission is shifting its focus away from distributors that could potentially restrict access to over-the-top video to another aspect of the industry, Eagan said.

“We think the sector most impacted by the FCC in 2016 is going to be content, not cable,” Eagan said, adding that the agency will be especially interested in retransmission-consent fees and network nonduplication rules that prevent distributors from importing distant broadcast signals into local markets.

NOT MUCH OTT IMPACT

The analyst added that fears of over-the-top video taking a chunk of cable subscribers for the most part have been unwarranted and that SVOD services like Netflix and Hulu, as well as OTT offerings like Sling TV, have proven to be a complement to the pay TV subscription.

“Every five to seven years there’s a new competitor — first it was satellite, then it was telco and now it’s over- the- top,” Eagan said. “I think, ironically enough, OTT will be less of a competitor than satellite and telco were to cable. You’re seeing those customers already being pay TV customers or they were never pay TV customers in the first place. OTT isn’t a replacement. ”

That could change if over-the-top offerings offer more channels at an affordable price, though.

“I would say cable has to get significantly worse or more expensive or OTT service has to get significantly better or cheaper for them to take material market share,” Eagan said. “I don’t think we’re quite there yet, especially with the average viewer watching 149 hours a month.”