Not Quite All in on Sports Betting

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Cable networks and operators waiting patiently to cash in on the sports gambling bonanza are going to have to wait a little longer, some current and former TV executives say.

Sports gambling was expected to be a much-needed shot in the arm to the pay TV business when the U.S. Supreme Court ruled in 2018 that individual states could decide to allow wagering on sporting events. But while many states could reap billions of dollars from sports wagering, most have held back for now.

Among media companies so far only Fox, which launched its online Fox Bet service in New Jersey and Pennsylvania in September, has stepped up to the sports wagering plate. Canadian sports-betting company TheScore has said it plans to run wagering sites in New Jersey and other states.

Other networks have dabbled in sports gambling. NBC has its “NBC Sports Predictor,” a free-to-play app, and individual shows have popped up to focus on betting, including ESPN’s Daily Wager and FS1’s Lock It In. Existing fantasy sports companies such as FanDuel and DraftKings say they are ready to pull the trigger once legalized sports gambling spreads to more states.

Slow to Ante Up

So far, though, only six states have active sports betting. Thirteen states have passed legislation that allows gambling on single games and five have authorized sports betting but haven’t yet made it operational, per the American Gaming Association. Some expect the number of states with active sports betting to grow to 12 to 15 by the end of the year, and to 25 states by the end of 2024.

The New Jersey example, though, is promising to gambling watchers. At an NAB Show New York panel on Oct. 15, Bevilacqua Helfant Ventures co-founder Chris Bevilacqua said the sports betting handle for New Jersey — the state that prompted the Supreme Court ruling — was about $450 million last month, usurping Nevada to become the top state in the country for sports gambling.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Bevilacqua said 75% of those bets came from in-game prop transactions on mobile phones. Proposition bets, or prop bets, involve wagering on specific instances rather than the final outcome of a game.

“What’s really going to move the needle is all sorts of in-game betting,” Sports Media Advisors CEO Doug Perlman said at the same conference. “That’s going to cause people to watch more and watch longer, which is going to drive ratings. That’s going to be a huge part of the mix.”

The prospect of networks or distributors getting involved in actual wagering, allowing viewers to place bets through their remotes while watching TV, depends on a lot of factors. One factor is federal law: The Wire Act prohibits the transfer of gambling money across state lines. If the opening happens, though, avenues to additional revenue and engagement open up.

“The perfect sport with the perfect cadence is baseball,” Bevilacqua said. “You’ve got 170,000 at-bats in a year and about 950,000 pitches. You can offer bets on every single one of those in-game occurrences. That’s really designed for the casual fan.”

Horizon Media senior vice president and director of the sports media investment team Adam Schwartz said potential gambling revenue will be a big consideration in upcoming rights deals. “From a network standpoint, we keep talking about how the next rights deals are going to go up through the roof,” he said at NAB Show. “The networks are looking for where that next revenue stream is for them. Betting is going to play into that.”

Schwartz sees Fox as the network likely to jump in head first. “I think you’ll see more programming around it, there will be ancillary programs, within games they’ll be talking about it.”

Ad Bucks Coming First

Bevilacqua said he expects the initial betting windfall to be in the form of more advertising and sponsorships. Sinclair Broadcast Group, which purchased 21 former Fox Sports regional networks in August, forecasted that by 2025 advertisers will spend about $1.5 billion just in sports, mostly locally and regionally.

Regional sports networks in markets that allow sports gambling, Bevilacqua added, would likely benefit most.

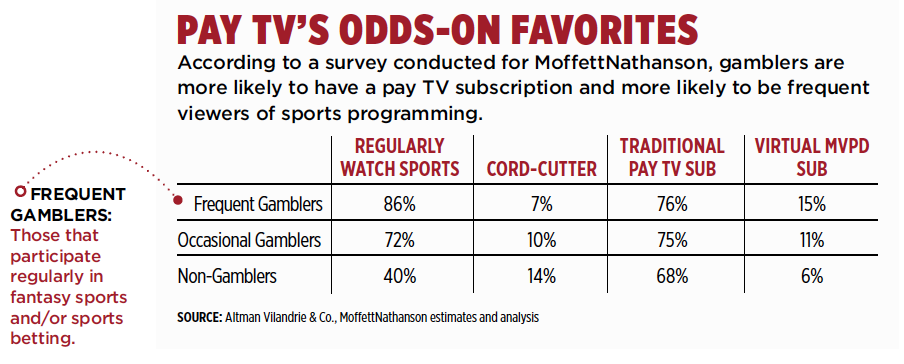

MoffettNathanson analyst Michael Nathanson wrote in a recent report that gamblers have attractive demographics to media (most are men and younger than 44) and are likely to have a pay TV subscription. In a survey conducted by Altman Vilandrie & Co. for MoffettNathanson, 91% of those who considered themselves to be frequent gamblers had a pay TV subscription, while respondents who considered themselves to be non-gamblers were more likely to be cord-cutters. Gamblers also watched more sports, with 86% of frequent gamblers saying they were regular sports viewers. And sports viewing declines by gambling intensity: Only 40% of non-gamblers are regular sports viewers.

“As gambling becomes more nationally legalized, it could provide a stimulant to pay TV formation as gamblers move from occasional to the frequent categories,” Nathanson wrote. “So far, if we were building a prototype pay TV subscriber with a high customer lifetime value, we would look for an older, rich male who follows multiple sports and is a frequent gambler.”