Not Built for Speed

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

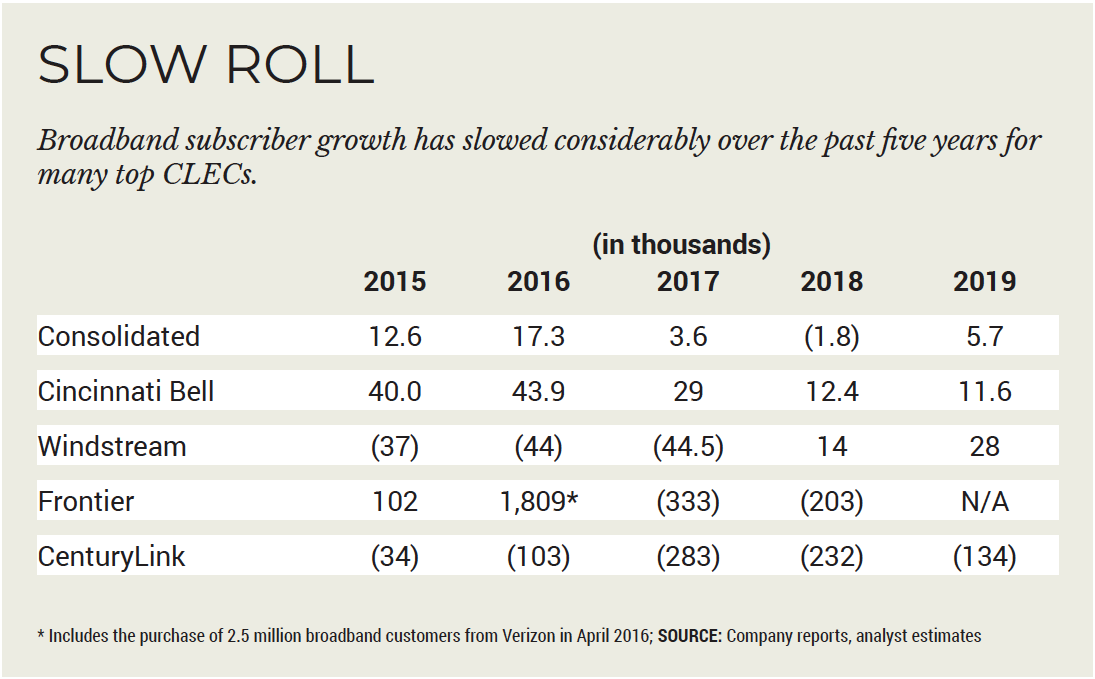

Competitive local-exchange carriers (CLECs), one of the main purveyors of broadband service in rural America, are learning the hard way that, in the cutthroat business that is high-speed internet, speed rules.

The CLEC industry is anxiously awaiting the pending bankruptcy filing by Frontier Communications, expected sometime next month. And Sanford Bernstein telco analyst Nick Del Deo has slapped a “sell” rating on one of the larger CLECs in the business, CenturyLink Communications. In a research note, Del Deo said as much as half of the CLEC business is tied to old technology — voice and copper-based digital subscriber line high-speed data service — that customers in secondary markets are increasingly shunning.

In downgrading CenturyLink to “sell” from “neutral,” Del Deo said the change was more a trading play than a fundamentals play. But there are still potential pitfalls ahead, he said.

CenturyLink lost about 36,000 broadband customers in Q4, and its 2020 outlook called for overall adjusted EBITDA to increase slightly, from $9.07 billion in 2019 to between $9 billion and $9.2 billion in 2020. On the plus side, the company has built out fiber to about 2 million homes and expects that to grow.

“The downside isn’t as juicy as it was, but it’s still quite meaningful and the risk-reward remains favorable,” Del Deo wrote, adding that Q4 2019 results and 2020 guidance didn’t play out as he had hoped. “There was nothing terrible in the report, but neither was there any reason to alter our negative longer-term forecasts.”

To bring home that point, Del Deo kept his 12-month price target on CenturyLink stock at $10, a 25% discount to its closing price of $13.34 on Feb. 18, the day he issued his downgrade.

CenturyLink stock closed at $13.33 on Feb. 19. CenturyLink’s broadband challenges are similar to those of its peers. In markets where it has fiber and is offering speeds of 100 Megabits per second or faster, growth is strong. In markets where its top speeds are 20 Mbps or slower, losses mount.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Nowhere was that more evident than in the fourth quarter. CenturyLink, which ended Q4 with 4.7 million broadband subscribers, lost about 36,000 high-speed internet customers in the period. Breaking out those losses, CenturyLink reported that it shed 73,000 customers that had speeds of 20 Mbps or less, and added 37,000 subs with service at 20 Mbps or higher. Of those additions, CenturyLink added 53,000 customers with service speeds of 100 Mbps or greater, and lost 16,000 customers with speeds between 20 Mbps and 99 Mbps.

Frontier’s Fios Hangover

At Frontier, the declines can mostly be traced back to its 2015 purchase of Fios properties from Verizon Communications for about $10.5 billion. That deal was supposed to be a game-changer for Frontier by doubling its footprint. Instead, it has proved to be an albatross, marred by system outages after a difficult transition period.

Those troubles, along with mounting debt and poor customer service, in part led to last year’s departure of Frontier CEO Daniel McCarthy. He was replaced by former Dish Network chief operating officer Bernie Han, who has reportedly been in talks with Frontier’s creditors to restructure $17.5 billion in debt. Hence the expectation of a prepackaged bankruptcy filing before the next $365 million payment comes due on March 15.

Frontier would be the second major CLEC to file for bankruptcy protection in the past year. In February 2019, satellite TV and broadband service reseller Windstream filed for Chapter 11 protection after it lost a $312 million legal judgment brought by a capital management firm that claimed the spinoff of network assets to a real estate investment trust violated bondholder agreements.

In the meantime, Frontier’s stock has cratered to about 60 cents per share from $3.50 about a year ago.

Telco broadband subscribers as a whole were down about 2% last year, Leichtman Research Group president Bruce Leichtman said, while cable grew by about 5%.

“They [CLECs] are not growing, while cable is growing,” Leichtman said.

He said cable’s growth has been helped by two factors: a superior, faster broadband product and bundling high-speed internet with a competitive video product.

“That has been a significant advantage for cable,” Leichtman said. Cable has dominated the broadband market for a decade.

Cable operators have accounted for 26.8 million of the 27.8 million broadband customer additions between Q1 2010 and Q3 2019, Leichtman estimated.

Leichtman doesn’t count the CLECs out, though. He said that besides debt-burdened Frontier and CenturyLink, the sector has performed well.

There is still opportunity in rural markets, Leichtman said, and broadband service is still a good business, especially from providers like Cincinnati Bell and Consolidated Communications that have invested in fiber.

“Broadband is a fairly profitable business,” Leichtman said. “If you can stay whole, there’s profitability in that.”