No Half Measures for Cable Stocks

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

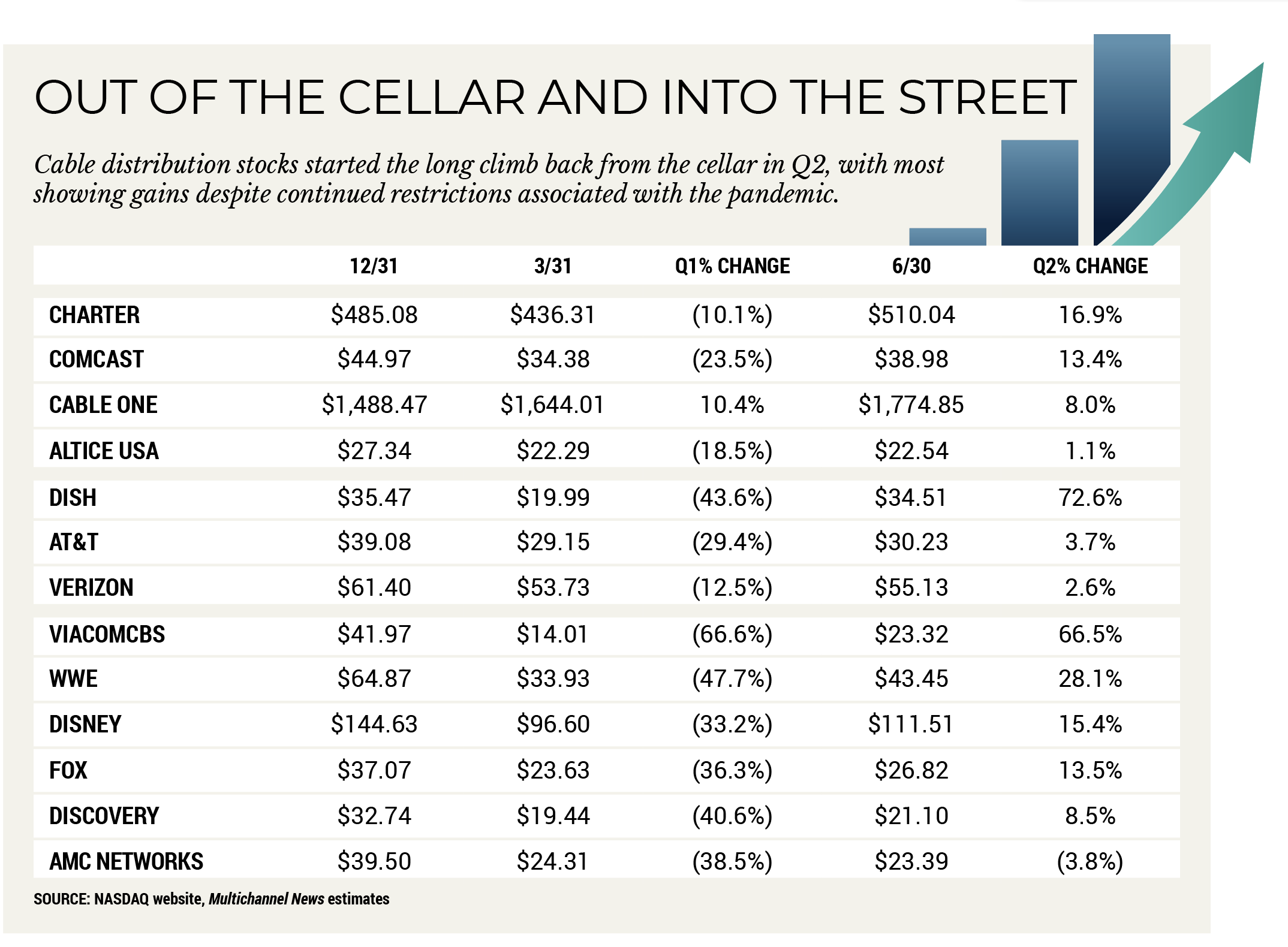

Cable distribution stocks, battered by the fear that a prolonged pandemic would wreak havoc on their businesses, proved their resilience once again by clawing back from their low points in March to strong gains in Q2. And though some analysts expect the tide to rise in the second half of the year, they warn of a potential broadband pullback as people return to work could hurt the stocks in early 2021.

The four major cable distribution stocks — Comcast, Charter Communications, Cable One and Altice USA — all posted strong Q2 gains; Charter led the way with a nearly 17% gain in the period. The increase was a welcome change from the first quarter, when every stock in the sector hit new 52-week lows.

FBN Securities media analyst Robert Routh said COVID-19 helped cable on the broadband side because customers were working from home and, in some cases, their employers helped pay for higher-speed tiers. That could change once people start returning to offices.

“I don’t think you have to worry about it this year,” Routh said. “But after that, that’s what I’m worried about.”

A Case-by-Case View

MoffettNathanson principal and senior analyst Craig Moffett said investors are no longer looking at cable as an individual market sector. “There is no monolithic ‘cable sector’ anymore,” Moffett said. “Each company now has a different story to tell.”

For example, he noted Charter outperformed its peers in Q2 after showing better-than-expected video and broadband results, while vertically-integrated Comcast shares, despite a strong broadband showing, grew at a slower pace. Pure-play cable operators Altice USA (up 1.1%) and Cable One (up all year despite the pandemic), had varying results.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

“Comcast has lagged Charter badly, not because its cable business isn’t as good, but because the rest of its portfolio is an albatross,” Moffett said. “Altice has struggled because it is so much more mature … making it harder to forecast long-term growth. And Cable One is just so inexplicably overvalued that it doesn’t really get discussed in the same conversation.”

Comcast, which still relies on cable distribution for most of its revenue (56% in Q1), was hit hard by declines at its NBCUniversal content unit. The rapidly eroding advertising market, declining pay TV subscriber rolls (which means less affiliate fee revenue for programmers) and the rise in streaming services have all helped batter the content sector. And though NBCU launched its own streaming offering (Peacock) in July to strong reviews, some analysts have called for Comcast to separate or spin off the content business to unlock greater value on the distribution side.

“A lot of investors I have talked to who own Comcast are upset because they think they would have done much better if there was some way to value the two separately,” Routh said.

Routh isn’t alone in that thinking. Sanford Bernstein media analyst Peter Supino wrote an open letter to Comcast chairman and CEO Brian Roberts at the end of June, pleading for a spinoff of NBCU and British satellite company Sky. Supino argued that spinoff would result in a doubling of the price of a pure-play cable Comcast stock in three years.

Content companies are facing growing uncertainty as streaming services proliferate and traditional pay TV distributors, which have pulled most of the freight regarding affiliate fees, lose subscribers.

Content Headwinds

That perception has proven itself in the stock prices of even the biggest programmers. While the programming sector improved its position during Q2 — five of the six stocks in the segment rose above their Q1 lows — many have just barely squeaked by.

The biggest, The Walt Disney Co., finished Q2 up 15.4% to $111.51. But even with one of the most successful streaming services (Disney Plus, with about 55 million global subscribers in June) Disney stock was still far short of its Dec. 31 close of $144.63. AMC Networks, down 38.5% in Q1, fell another 3.8% in Q2. Other stocks like ViacomCBS, which fell 66.6% in Q1 to $14.01, gained more than 60% in Q2. But at $23.32, it was still nearly half the price it was at the beginning of the year.

Wells Fargo media analyst Steven Cahall said in a note he expects Disney Plus to climb to 62 million global subscribers in fiscal Q3 and to 81 million by year-end. But he believes that torrid pace will slow down, estimating 95 million subscribers by 2025.

Even Disney Plus’s exponential growth won’t be able to stem the bleeding elsewhere. Cahall estimates that total revenue for Disney, which reports results on Aug. 4, will fall 39% in fiscal Q3 to $12.4 billion.

Cahall’s caution is proven in his $118 per share 12-month price target on the stock: it closed at $118.12 on July 23. He expects shares to “remain range-bound as very strong content assets offset significant end-market uncertainty.”