MSOs Like the Look of 2018 Sub Trends

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

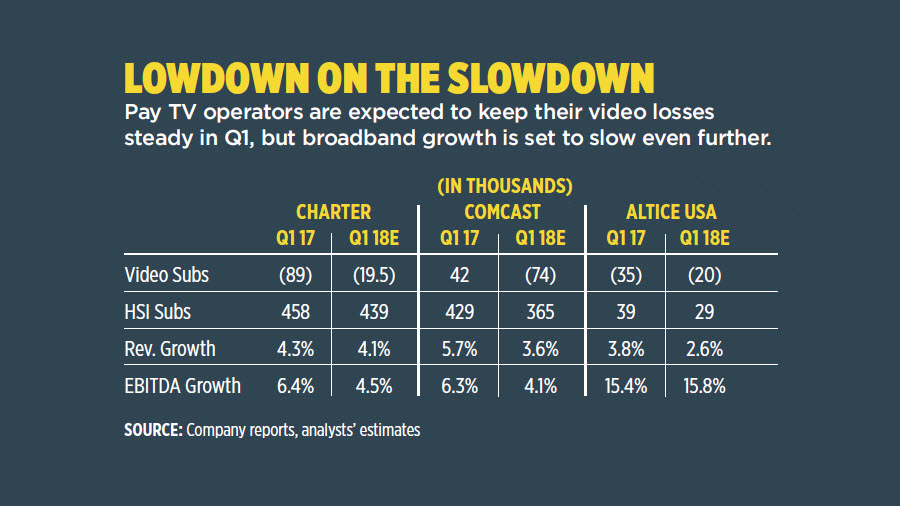

Cable operators are expected to show better subscriber trends in the upcoming quarters, but forecasts suggest broadband additions will continue to soften, weighing on the stocks.

Broadband growth has been slowing for about four years. But it has become more pronounced in the past 12 months, as cable operators saw their high-speed data additions slow to 2.7 million in 2017, down from the 3.3 million they added in 2016, according to Leichtman Research Group. Broadband still commands the biggest piece of the subscriber pie for the top two cable operators: Comcast had 22.4 million video and 25.9 million broadband subscribers at the end of 2017, while Charter Communications had 16.95 million video and 23.9 million broadband customers in the same period.

Comcast, Charter and Altice USA are all expected to release quarterly results in the next few weeks, with Comcast first out of the gate on April 25, followed by Charter on April 27.

Projections show Charter will improve its video losses in the first quarter, shedding about 19,500 video customers in the period, compared to a loss of 89,000 in the prior period, according to Morgan Stanley media analyst Ben Swinburne. While cable flirted briefly with video subscriber gains — Comcast was the first cable operator in a decade to finish the year (2016) with positive video customer growth (161,000) — that isn’t expected to continue. Charter, however, is set to reap the benefits of the winding down of its integration with Time Warner Cable, even though, as Evercore ISI media analyst Vijay Jayant put it, “video and phone markets continue to shrink, while competitive intensity is increasing somewhat in broadband.”

Times Look Up for Charter

Charter is expected to continue the migration of its customers to the Spectrum brand this year, including new pricing and packaging and the rollout of all-digital service in former TWC markets.

“We believe Charter is finally realizing the benefits of Spectrum pricing and integration in the legacy assets and that the substantial subscriber bleed we saw post acquisition of [Time Warner Cable/Bright House Networks] is beginning to taper,” Jayant wrote.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Morgan Stanley’s Swinburne was equally enthusiastic, adding that as of early 2018, more than 50% of TWC/Bright House customers were on Spectrum pricing and packaging. “That should materially ramp through 2018 and accelerating growth,” he wrote.

At Comcast, the string of video losses that started in Q2 2017 will continue, and broadband growth is projected to slow significantly. That, coupled with Comcast’s Feb. 27 play for U.K. satellite firm Sky — which few believe will actually come to fruition — spooked investors and help drive its down stock even further.

Comcast shares fell 15.5% this year — 14.5% since the Sky bid — and are likely to drop further as the Sky situation plays out. In a note to clients, Pivotal Research Group CEO and senior media & communications analyst Jeff Wlodarczak said he expects Comcast will lose out on the Sky asset and won’t make a play for the Fox properties being sold to Disney.

“The bottom line is that while it may take a while to play out, we expect Comcast will not win out for Sky and Fox, alternative deals are likely to be smaller, cheaper and make more sense to investors, and in the end Comcast is simply too cheap for an entity that controls the dominant way consumers will access the internet for the foreseeable future,” Wlodarczak wrote.

Altice Ups and Downs

Altice USA has also been on a roller coaster ride for the past year — its stock has dipped 12%, mainly on concerns that it could someday be on the hook for the heavy debt load carried by parent company, European telecom company Altice N.V. Altice USA made moves to alleviate those fears — it will separate fully from Altice N.V. in June and can then focus all of its energies on its so-far-successful European approach to U.S. cable.

Altice USA has managed to significantly cut costs at the former Cablevision Systems and Suddenlink properties it purchased over the past two years, squeezing out the highest cash-flow growth rates in the industry. That is expected to continue in the first quarter: Analysts are estimating EBITDA growth will be 15.8%, slightly higher than the 15.4% growth in the prior year. In contrast, Comcast and Charter are expected to have cash-flow shifts of 4.1% and 4.5% in the quarter, respectively.

Altice USA also has managed to squeeze out cash-flow margins well above the industry norm of 38% to 41% over the past several quarters, mainly through aggressive cost cuts and greater efficiencies. While significantly higher programming costs in the U.S. could hinder the company’s plan to eventually achieve European- style growth at Altice USA, Evercore ISI analyst James Ratcliffe noted that Altice’s continued slashing of non-programming costs could eventually help pare down programming expenses as well.

Ratcliffe wrote that once it can demonstrate that its non-programming cuts are sustainable, Altice can turn to programming expenses, particularly for regional sports networks. He added that programming costs in its New York-area Optimum markets are 40% higher than its Suddenlink areas in the Midwest, largely due to RSNs.

“We believe that Altice might look to those RSNs in the future as a potential source of programming cost savings,” Ratcliffe wrote.