Liquid Diet for The Pay TV Sector

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

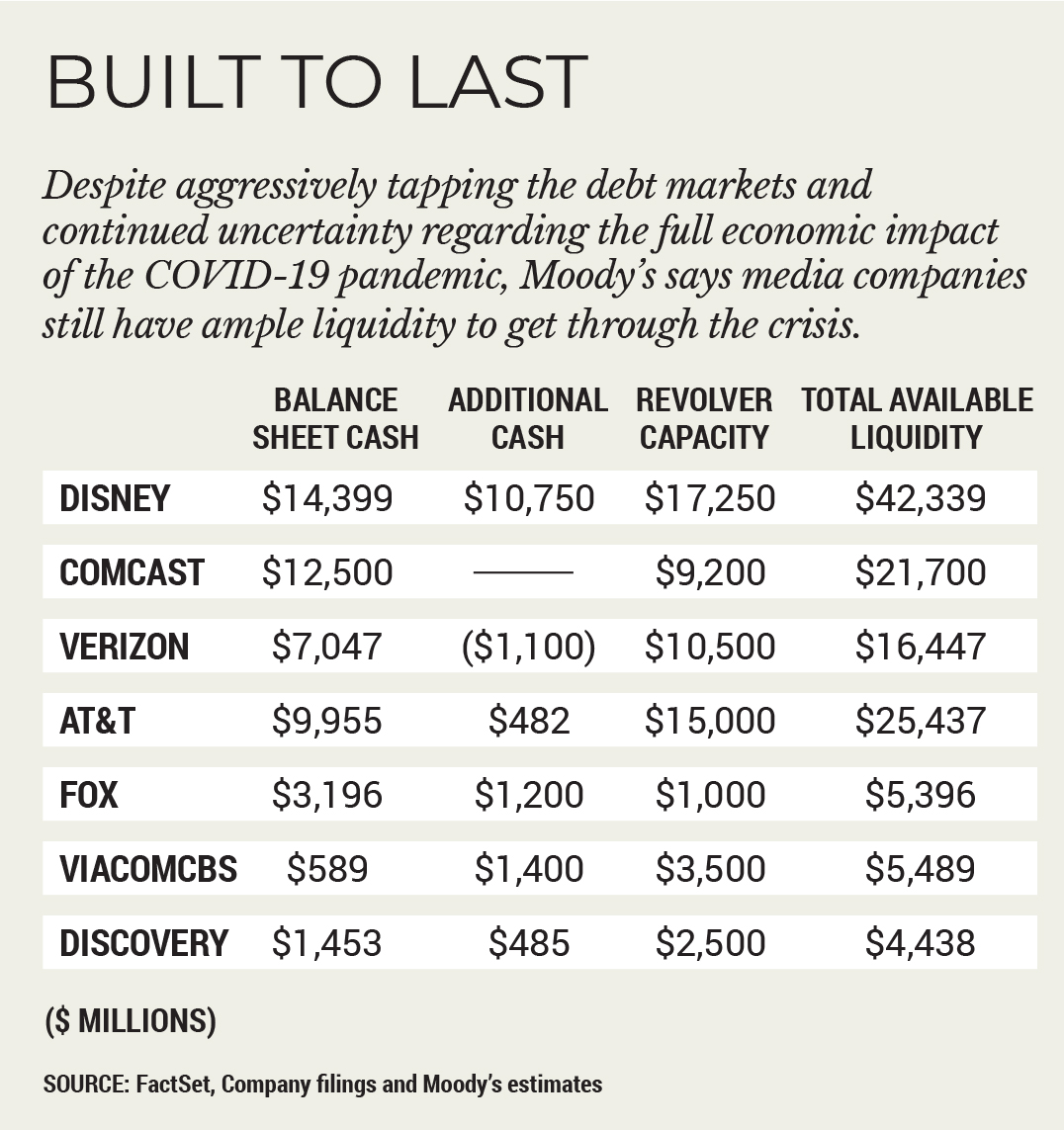

While the rest of the analyst community braces for the COVID-19 pandemic’s full impact on second-quarter results, pay TV distributors and networks appear to have more than enough liquidity to weather the worst the lockdown has to offer, according to Moody’s Investors Service.

Cable distributors and networks have tapped the debt markets in earnest as the pandemic has cut into advertising budgets and a dramatic rise in unemployment has made it difficult for many Americans to pay their bills. Some of the biggest companies in the sector — The Walt Disney Co. and Comcast — as well as ViacomCBS, Discovery Inc. and others have used the bond markets to ensure the flow of available cash.

In the first quarter, Disney issued bonds in the U.S. and Canada worth about $7 billion, while Comcast tapped the debt markets for about $4 billion. At the same time, ViacomCBS issued about $2.5 billion in bonds, while Fox sold about $1.2 billion in long-term notes.

That activity didn’t seem to slow down in the second quarter. In May, Disney issued another $11 billion in notes, Comcast issued $4 billion and ViacomCBS issued $2 billion in debt. AT&T, one of the most highly leveraged media companies after its $100 billion-plus purchase of Time Warner Inc. in 2018, tapped the debt markets three times in Q2: A $12.5 billion bond offering on May 22 to help pare down debt, a $3.2 billion bond offering earlier in May for general corporate purposes, including debt retirement, and a $5.5 billion credit agreement with a consortium of banks led by Bank of America.

Still Room to Borrow

In a research note, Moody’s Investors Service senior VP Neil Begley wrote that despite the surge in activity, most pay TV companies still have ample liquidity as some states begin to lift restrictions associated with the pandemic.

Disney leads the list with about $42.3 billion in available liquidity, according to Moody’s, including $14.4 billion in cash; followed by Comcast, with about $21.7 billion in available liquidity. Even AT&T, which has the highest leverage of any media company after buying Time Warner Inc. in 2018, has about $25.4 billion in available liquidity, followed by ViacomCBS ($5.5 billion), Fox ($5.4 billion), Discovery ($4.4 billion) and Cox Communications ($3.5 billion).

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Domestic advertising spending fell 31% in May, the third straight month of declines, according to Standard Media Index. While the numbers were bad, they were at least better than April, when ad sales dropped 35%, according to SMI. Ad sales fell 11% in March.

The lack of sports was the main culprit in the falloff. SMI said the

absence of NBA playoffs in the month had the biggest effect on WarnerMedia (home of the Turner Networks), which declined 45.5%; and Disney (home of ESPN), down 39.6%.

With sports expected to begin a comeback, the hope is those ad dollars will return. The NBA is tentatively set to finish the final eight games of the regular season and begin an abbreviated playoff schedule beginning July 30 and Major League Baseball is expected to begin its reduced 60-game season July 23 and 24.

“We expect to see a rebound as people leave their homes and increase their consumption and other economic activities,” Begley wrote. “We are forecasting a gradual ramp-up of depressed revenues at a cadence parallel to relaxation of COVID-19 fears and corresponding to the limitations of continued social distancing standards.”

That comes as most analysts are bracing for continued subscriber losses in Q2, the first full quarter affected by the lockdowns. Cord-cutting was at an all-time high in Q1: Cable, satellite and telco TV service providers shed about 2 million subscribers, or 7.6% of their video customer base. Most expect Q2 to be even worse.

An Unprecedented Crisis

Moody’s acknowledges that this more recent economic downturn is unlike any in recent memory, calling the current crisis different “because it is testing the depths of disruption, and for some media sectors will exceed any strains felt previously.” There is hope that by late Q2 and early Q3, as the economy restarts, relief will come.

That sentiment was shared by rival ratings agency Fitch Group, which noted in a June report that the cable sector has shown its resilience in the past, given the value of its video and broadband services. While the business segment may continue to suffer, broadband and mobile services should help take up at least some of the slack.

Fitch estimated the advertising market will decline by mid-to-high single-digit percentages in 2020, and by low-to-mid single digit percentages in 2021. Cable networks, Fitch predicted, will suffer revenue declines in the low-to-high teens, in terms of percentages.