How a Time Warner Inc. Breakup Might Go Bad

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Time Warner Inc. — under scrutiny from a trio of activist investors — has moved in a direction that could make it easier for minority investors to affect change.

In the long run, though, it might just be the company’s size and the volatility of the content business that keeps it together.

Time Warner has quietly amended its corporate bylaws, allowing holders of at least 3% of its stock for at least three years to nominate two members to its board of directors.

Also, per documents filed with the Securities and Exchange Commission on Feb. 3, as many as 20 investors could band together to meet the 3% requirement and elect new directors.

Investors who meet those criteria even can have their board slate included in Time Warner’s proxy statement, saving them the hassle and cost of having to contact other shareholders directly.

Other companies have adopted so-called “proxy access” rules. Time Warner had been asked by some shareholders to do so in the past, but the rules failed to win sufficient votes.

ACTIVISTS CIRCLING

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

That the company decided to bypass another vote on the matter and go directly to implementation is a bit curious, given reports that activist investors Carl Icahn, Corvex Management chief Keith Meister (an Icahn protégé) and Trian Fund Management head Nathan Peltz are all circling the company.

People familiar with the company said the move is not a reaction to those reports. “The timing is unfortunate,” one person familiar with Time Warner’s thinking said.

But is it? According to several analysts, breaking up or selling Time Warner wouldn’t just be di_ cult — it also wouldn’t make much sense.

Driving most of the breakup speculation has been the 24% decline in Time Warner’s stock price in 2015.

So far this year, the stock is up about 10.5%, mostly on deal speculation. But the entire sector has been in a tailspin, as media companies across the sector are pressured by sluggish TV ratings, declining ad rates and falling subscriber rolls due to cord-cutting.

Time Warner is unique in that it successfully pushed back against 21st Century Fox’s unsolicited $85-per-share offer in 2014 by growing the stock.

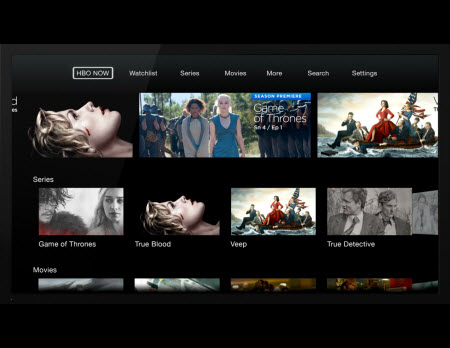

Through bold moves like the launch of its standalone HBO online service HBO Now and significant changes at Turner, Time Warner pushed its stock price above the Fox offer, ending that year at $85.42 per share.

The stock continued to grow in the early part of 2015, but slid again in August after The Walt Disney Co. lost about 3 million subscribers. The Disney losses touched off cord-cutting fears for some investors and sent the sector as a whole into a downward spiral.

TOO BIG TO BUY?

With the latest declines, investors are looking for another bold move and the easiest one to make is a breakup.

Wells Fargo media analyst Marci Ryvicker did a sum-of-the-parts valuation of Time Warner that showed potential take-out values for the company ranging from $71.63 to $105.16 per share, but she couched that data with a heavy dose of skepticism. Ryvicker couldn’t see any company in the programming space that was large enough to swallow Time Warner whole. 21st Century Fox, which tried and failed in 2014 to take over the company, is trading at $26.49 per share — about 1.5 times lower than Time Warner at $71.70.

While premium channel HBO and the Turner Broadcasting System cable networks are obviously valuable assets, Ryvicker didn’t see them as having any more value as separate or spun-off entities.

“A sum of the parts is always just math, and to be frank, our math doesn’t matter,” Ryvicker wrote in her January report.

Credit Suisse media analyst Omar Sheikh took it a step further last week, releasing a detailed report mapping out three potential strategies for Time Warner: spinning off HBO, Turner and the Warner Bros. movie studio as three separate entities; spinning off just HBO; and spinning off just Turner.

One of the biggest barriers to any of the spin scenarios is that they would trigger between $10 billion to $11 billion in redemption penalties to certain bondholders, according to Sheikh. Add in the loss of synergies and scale economies inherent in separating the business, and Sheikh estimated that the value range of a Time Warner breakup is just $79 to $89 per share.

Bottom line: Time Warner is worth more together than apart, according to Sheikh.

According to the analyst, Time Warner in its current form could grow cash flow by 25% and net income by one-third over the next three years. And initiatives to slow down content licensing to third-party subscription video-on-demand services like Netflix could help expand multiples. Taking those factors into account, Time Warner could increase its valuation to $90 per share in 12 to 18 months, Sheikh estimated.

BETTER TOGETHER

According to Sheikh, vertical synergies benefits to Turner and HBO from buying content from Warner Bros. would mostly be lost in a Turner spinoff, as the studio wouldn’t have as much incentive to sell its content to the networks and could lose the benefit of having an anchor buyer for its TV and movie output.

A spinoff would also erode horizontal synergies — mainly higher affiliate fees — because Time Warner’s networks would no longer be bundled. And content costs could also rise for Turner and HBO, which would no longer have the economies of scale of being part of a larger parent.

Sheikh said he also believes that separating Turner from HBO eliminates any potential benefit from the premium network’s relationship with Apple for HBO Now.

“These benefits are highly likely to grow over time, in our view, particularly if the cost of developing content is pushed higher by competition from new digital competitors like Netflix and Amazon,” Sheikh wrote.

That could be significant, given the growth the analyst expects from HBO Now. The over-the-top service could have 14 million subscribers by 2020, with 4 million of them churning off the MVPD service, according to Sheikh.

SIDEBAR: For What It’s Worth

Credit Suisse media analyst Omar Sheikh doesn’t believe much is happening via speculation around a possible breakup of Time Warner Inc. Here are three potential scenarios he foresees:

Scenario Market Value Market Value Per Share

Three-Way Breakup . . . . . . .$66.7B-$74.4B . . . . . . . . . . . . . $79-$88

HBO Spinoff . . . . . . . . . . . . . .$67.3B-$75B . . . . . . . . . . . . . .$80-$89

Turner Spinoff . . . . . . . . . . . . $66.7B-74.5B . . . . . . . . . . . . . . $79-$88

SOURCE: Credit Suisse estimates