Gigabit-Speed Internet Is Still in Only 15% of U.S. Internet Homes

Adoption of 1 Gbps provisioned speed internet has heated up a bit recently, but the uptake remains small given the telecom industry's expensive ramp-up to multi-gigabit speeds

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The telecom industry is about to spend a fortune upgrading its broadband networks so that they can deliver crazy-fast, multi-gigabit speeds, symmetrically across downstream and upstream channels.

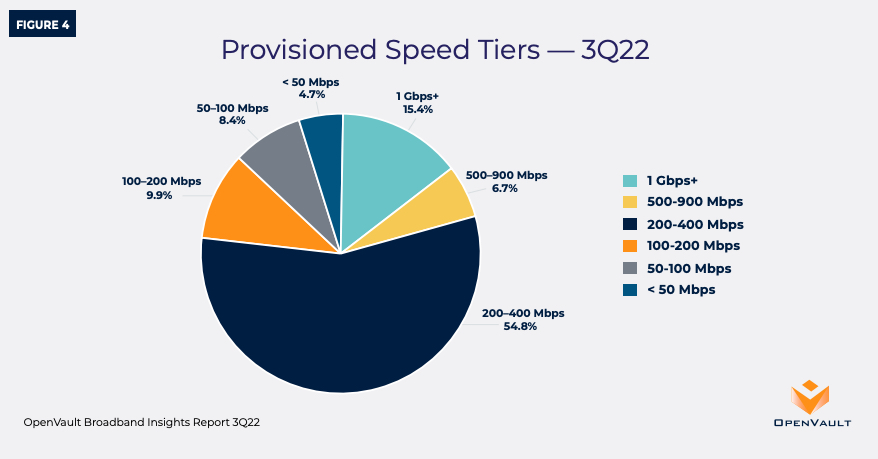

But nearly five years after Comcast completed its national rollout of 1 gigabit-per-second internet service, only 15.4% of U.S. broadband homes subscribe to even a 1-gig service.

The latest report from OpenVault Broadband Insights (OVI) reveals that gig-speed uptake is accelerating -- 1 Gbps subscribers represented only 11.4% of homes in the third quarter of 2021.

But the vast majority of the market seems to be successfully streaming Netflix, conducting online learning and quitting Twitter using more pedestrian 200 Mbps - 400 Mbps speeds (see OVI chart below).

Is demand for a near-term "10G" future really a thing?

Armed with case studies of future usage paradigms requiring ultra-fast speeds and super-low latency -- think remote surgery -- cable companies and other telecoms insist the massive infrastructure investment remains vitally necessary.

So how much are we talking about?

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

On Tuesday, Elad Nafshi, executive VP and chief network officer for Comcast Cable, surprised investors at the RBC Capital Markets Global Technology, Internet, Media and Telecommunications Conference when he said the "mid-split" required to deliver symmetrical multi-gigabit speeds on Comcast's current DOCSIS 3.1 hybrid-fiber coaxial (HFC) network would cost less than $200 per home passed.

The investment, Nafshi said, is "not all incremental, because in many ways we would need to make that investment for capacity augmentations, anyway."

Comcast said earlier that it would start introducing multi-gig symmetrical speeds to its customers in 2023, completing its rollout to 50 million homes by 2025.

According to "back of the napkin math" performed by Light Reading, Nafshi's declaration means that passing 50 million homes with multi-gig services will cost Comcast less than $10 billion -- a bargain, given that full fiber-to-the-home delivery would run $1,000 per home passed ($50 billion total).

The move, however, would only "lay the groundwork," Light Reading said, for upgrades to a next-generation "10G" standard like Full Duplex DOCSIS 4.0 -- at a cost that would run tens of billions more.

Usage Continues to Spike

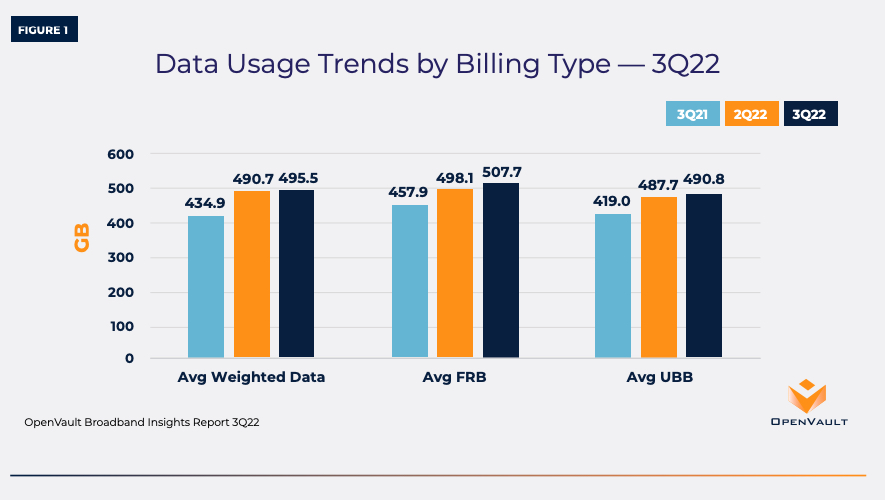

OVI's third-quarter 2022 "Broadband Insights" report does show broadband usage demands in the U.S. continue to increase at a rapid clip. The average subscribing home used 495.5 gigabytes of data in the third quarter vs. 434.9 GB a year ago.

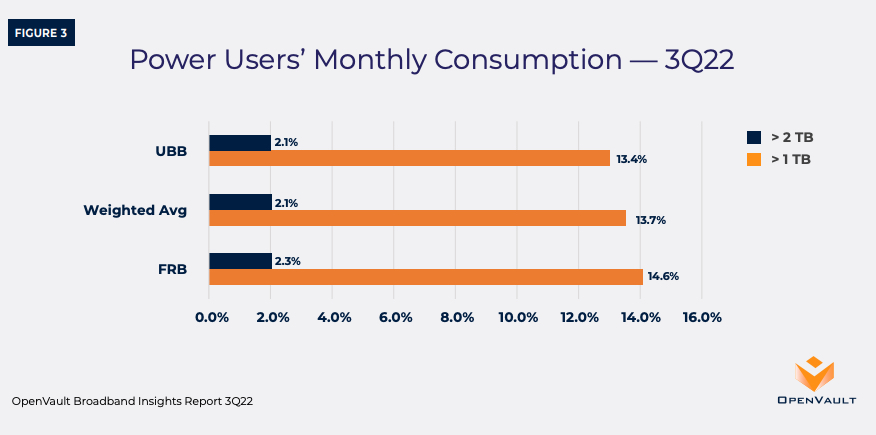

Meanwhile, the number of "power users" -- subscribing households that consume 1 terabyte of data each month or more -- keeps increasing, particularly for those with flat-rate service plans.

According to OVI, 14.6% of flat-rate-billed homes now fall under the power user definition. In fact, 2.3% of this cohort used 2 TB or more in the third quarter.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!