FuboTV Moves to Require Three-month Commitment From New Customers

Looking to drive down churn, virtual MVPD wants new customers to cough up $194.96

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

In what appears to be an effort to add a little stickiness to a live-streaming business that's been too easy to quit, fuboTV confirmed that it is now, at least temporarily, requiring new customers to pay on a quarterly basis.

“We have temporarily made our channel packages available to new subscribers as quarterly plans,” fuboTV said in a statement. “We’re always experimenting with our channel package offerings to better understand what our subscribers like.”

Media-tech journalist Phillip Swann first spotted and reported on the change Sunday.

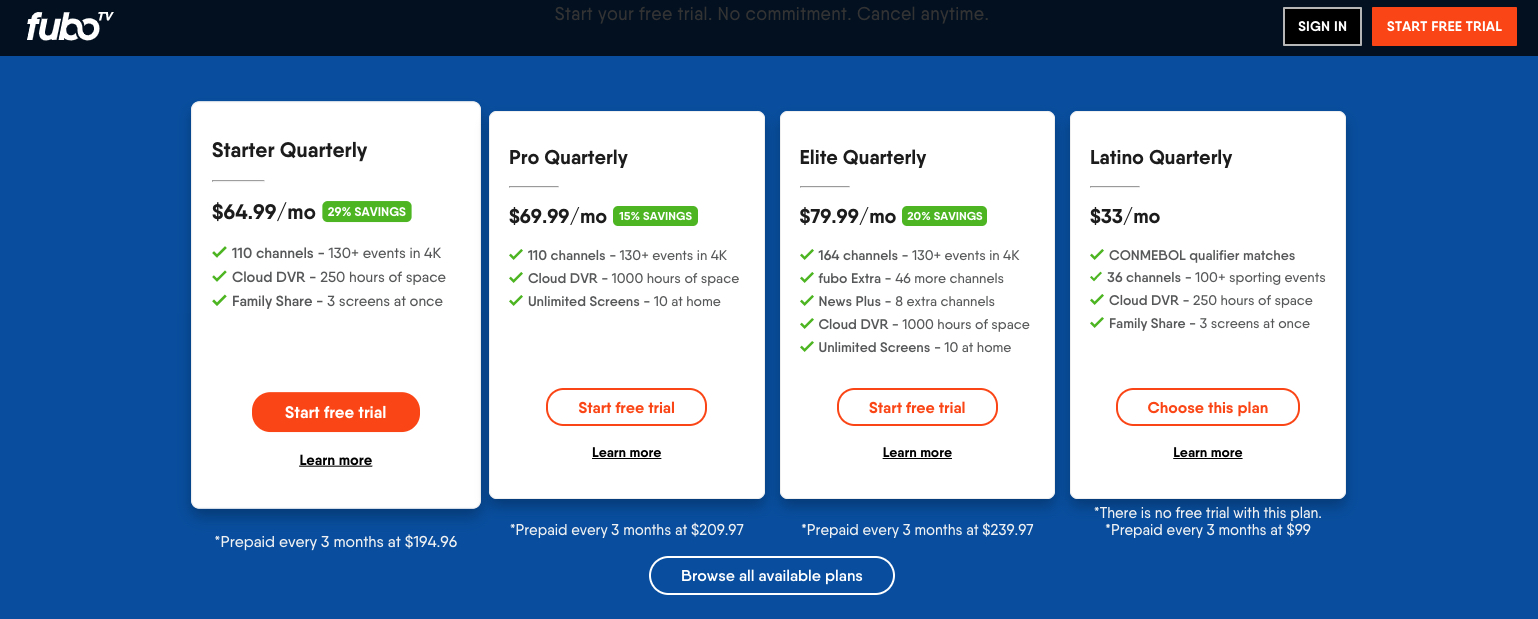

A visit to the virtual MVPD's landing page confirms that each of fuboTV's tiers is now offered on quarterly terms.

With the change, instead of paying $64.99 for fuboTV's cheapest tier, "Starter Quarterly," new customers must cough up a far bigger commitment of $194.96. They still have access to a free seven-day trial of the service, however.

FuboTV announced late last year that it has surpassed 1 million subscribers, and third-quarter revenue once again broke company records at $156.7 million.

Also read: FuboTV Reports Loss as It Makes Sports Betting Plans

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

But as the company, which went public in 2020, continues to build out infrastructure to tie its ample sports programming to sports betting, losses have remained high. In fact, fuboTV reported a net loss of $274.1 million in the third quarter.

Meanwhile, the company's stock price keeps cratering, falling to around $10 a share on the Nasdaq as of Friday.

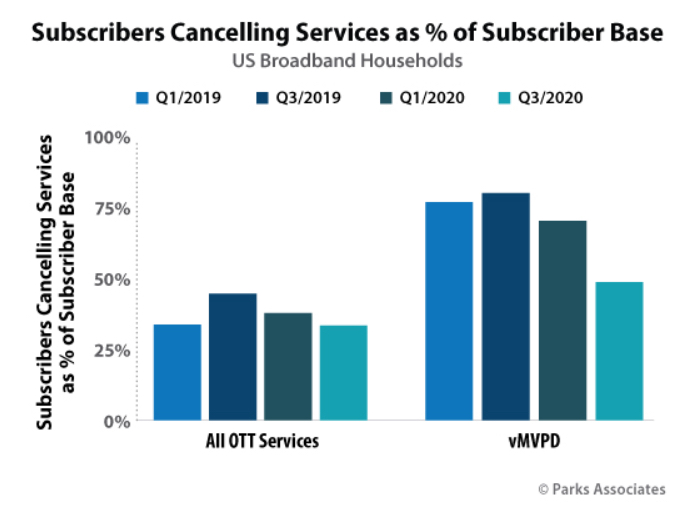

Bad news specific to fuboTV aside, churn is an endemic problem for all OTT services, which are typically as easy to quit as they are to sign up for. But customer churn is particularly acute for virtual pay TV services, which are often used seasonally by fans of specific pro or college sports, and which are also narrowly arbitrated by subtle difference in channel lineups.

This chart from Parks Associates is probably as relevant to today as it was when it was published 14 months ago.:

For its part, fuboTV is striving to prove a cynical equity analyst community wrong -- it wants to create the narrative that it's not a low-margin OTT pay TV service, but the first live streaming platform built around sports gambling.

Perhaps understanding that it's now targeting a specialized customer -- sports betters -- fuboTV isn't as concerned with raw subscriber metrics as it used to be. (After all, investors sure didn't seem too impressed when the company zoomed past 1 million subs.)

Perhaps reducing churn is more useful in turning around investor sentiment than a sub number that probably won't impress Wall Street until it gets to around 3 million?

We're waiting for some additional insight when fuboTV reports Q4/full-2021 earnings on Feb. 23.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!