Forget Amazon’s $100 Million Black Friday NFL Rout, It’s NBC That Paid Too Much for the Real Turkey Bowl

NBC is paying $350 million for primetime Big Ten games this season. And have you seen the audience numbers?

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Each week, Next TV writers Daniel Frankel and David Bloom engage in a text chat about the TMT industries. This discussion is vitally interesting to at least three people in the global population. Are you one of them?

Daniel Frankel: Hello, David. Hope you had a good holiday. Great Thanksgiving weather out here in the SoCal high desert town of Indio. But we still stayed inside and did what we were supposed to do — watched a lot of football on TV. Nice rout by your Missouri Tigers of Arkansas Friday. (it was either watch a midtier SEC game that I had no connection to whatsoever or talk to my in-laws again.) And a turkey NFL game on Amazon between the explosive Miami Dolphins and the not as dynamic New York Jets, who are winding down yet another season rendered hopeless by quarterback Zach Wilson’s … inabilities. Beyond the young Wilson’s obvious limitations, there was a lot of talk about how ingenious Amazon was to pay $100 million for that single game, which served as a Black Friday funnel for its broader retail platform. My question about all of that is, how do we really know?

David Bloom: It has been a gratifying holiday, with the Tigers capping a marvelous season with a blowout win, a fabulous Thanksgiving meal with friends in the canyons of Los Angeles, and cabin time in the mountains far above your “high” desert. But that Amazon game poses a near unsolvable problem: how do we evaluate the deal? Outsiders keep applying traditional metrics to the tech giants’ online video hobbies, saying they don’t add up. But trillion-dollar tech beasts clearly don’t use such prosaic things as traditional metrics. As with algebra, we need to solve for X (the mathematical variable, not the lame social-media outlet). Apple spends $250 million on Martin Scorsese’s Flowers of the Killer Moon, then debuts it to a thudding $23 million. But that’s fine! Apple TV Plus will get some glitz when it eventually runs there as a secret miniseries (don’t tell Marty), and there’s probably some other stuff. Alphabet drops $15 billion for NFL Sunday Ticket. But that’s fine! It’ll encourage more YouTube TV subscriptions, attract advertisers and probably some other stuff. And then there’s Amazon. For $1 billion a year, they brought a fresh look to a tired Thursday-night format. But they still can’t fix Thursday night’s traditionally terrible matchups.

Now they’re innovating with this additional Black Friday game for an absurd amount of money, plus pricey shoulder programming like a Garth Brooks concert. Will Amazon make back that $100 million, plus all the production costs? Amazon sold ad spots for double their Thursday rate, at $880,000 for 30 seconds, Ad Age reported. And Amazon used the entire telecast to sell more stuff on its own platform on what’s still the year’s biggest shopping day. But would it have been more efficient to take, say, $50 million and buy ads on everyone else’s games and shows and concerts? Could they have made nearly as much money, and saved a bunch more? Will we ever see a true accounting? What’s X? Only Andy Jassy knows.

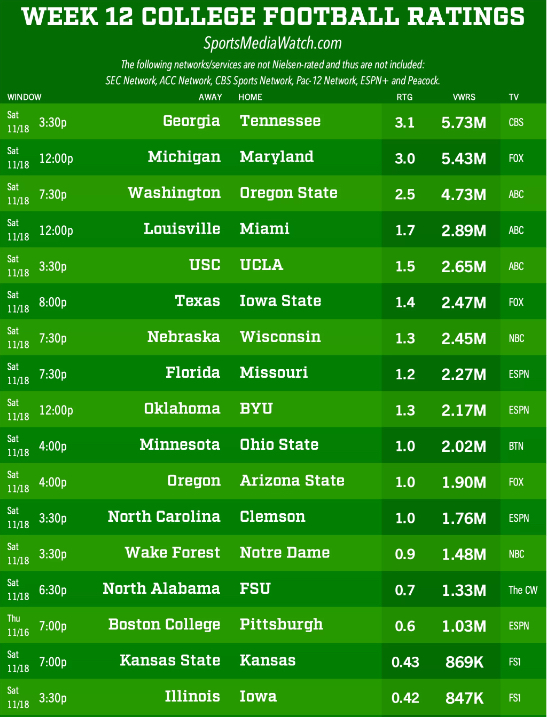

Frankel: Meanwhile, there are some metrics we do know ... and just don't seem to talk much about, for whatever reason. Take NBC's primetime Saturday night Big Ten Football schedule this season. Only 2.45 million viewers, on average, watched Wisconsin beat Nebraska last week in prime time. NBC is paying $350 million a season for the package ... and there’s no “Black Friday” discount there. I’m headed to the Rose Bowl in a few hours to watch UCLA play Cal. I don’t have a dog in that hunt, but it’s the last regular-season Pac-12 game ever in this town. Maybe USC, UCLA, Oregon and Washington will reinvigorate Big Ten football on TV, but it certainly seems like NBC — and CBS, which also paid $350 mil per season — got had.

Bloom: I think a late-season matchup between Nebraska and Wisconsin is a great one … in 1994. That year, Nebraska won the first of three national championships under Tom Osborne, while the Badgers were an extremely respectable 8-3-1 in Barry Alvarez’s fifth season as head coach. Of course, the schools wouldn’t have played each other in the regular season. Nebraska was still in the Big Eight, which that year said it would merge with half the collapsing Southwest Conference to become the Big 12 in 1996. Nebraska wouldn’t move to the Big Ten until 2010, after Osborne retired, served three terms in Congress and then retired completely. All of which is to say that college teams have been moving around like Garry Kasparov chess pieces for a very long time.

As for market metrics on the latest college sports chess moves, what else could the three media companies financing the Big Ten deal do to grab a reliable, substantial, tune-in audience that advertisers love? Pretty much nothin.’ And the arrival of the four highly regarded West Coast schools makes the deal even better, with a continent-wide footprint in TV markets from L.A. and Seattle to Chicago, Detroit, New York, Philadelphia and Washington, D.C. It also gave the Big Ten an excuse to end its two-division format, which put three powerhouse programs in the East and a bunch of fading weak sisters in the West. Now there’s a chance for more good matchups pretty much most of the season. By 1994 metrics, those rights deals might look wildly overpriced. By the ugly realities of broadcast TV in 2024, they’re looking better and better, or at least less bad.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Frankel: I don’t know that even by 2024 standards that a 1.3 million rating in primetime is worth $350 million. But we'll see how realignment shakes out. No choice! Moving on, interesting quote from an institutional investor this past week about Elon Musk and the ongoing fiasco surrounding his X/Twitter ownership: “I've never had this with any company I've ever invested in ever in my life where the CEO of the company himself does so many detrimental things that [are] destroying the brand,” said Ross Gerber, head of Gerber Kawasaki Wealth and Investment Management, to Yahoo Finance. Meanwhile, there’s lots of regard and concern for Linda Yaccarino from her peers to get out while the gettin’s good -- advice she seems to have ignored. What’s in her head that’s not in ours?

Bloom: It’s possible the formerly esteemed Yaccarino has fallen into the Elon Musk equivalent of Steve Jobs’s infamous Reality Distortion Field. Inside the field, rational thought struggles. Is it really OK for your CEO and chief shareholder to repeatedly post or repost dumb antisemitic spew that once again spooks big-name advertisers, costing your company millions of dollars in revenue? In Elon’s RDF, it is! Yaccarino’s pals are right to be concerned about her burning through decades of goodwill. She is! But whenever she escapes Elon World, perhaps when X is down to an enterprise value of $12.59, or somehow becomes that do-everything app only Elon seems to want, she’ll venture back into the real world. People will look at her with a mix of curiosity and pity, shake their heads and say it really wasn’t her fault. And then she’ll get on a couple of corporate boards, buy another house in the Hamptons and/or Malibu, and laugh about it all with friends over a glass of really good Barolo or Bordeaux. I mean, we’ve all had that friend who disappeared for years into a bad relationship before reemerging, blinking, back into our lives. It’ll happen for Linda too.

Protecting the freedom of speech could not be more urgent and important. Now, more than ever! https://t.co/bhZk6cNrNYNovember 18, 2023

At least the Yacster is getting paid for her X dalliance, presumably quite a lot. What’s the excuse for everyone else who’s still using X, maybe even paying to be there? What about the hand-wringing liberals, journalists, politicians and others similarly situated who are devoting countless hours there, effectively propping X up? The Hamas-Israel disaster seemed to pull everyone back into old, unhealthy habits like serial posting, doom-scrolling and flame wars with chatbots, disinformation saboteurs and other random disagreeable trolls. It’s like a bad paraphrase of Brokeback Mountain: they just can’t quit X, even if there’s no good reason to still be there.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!