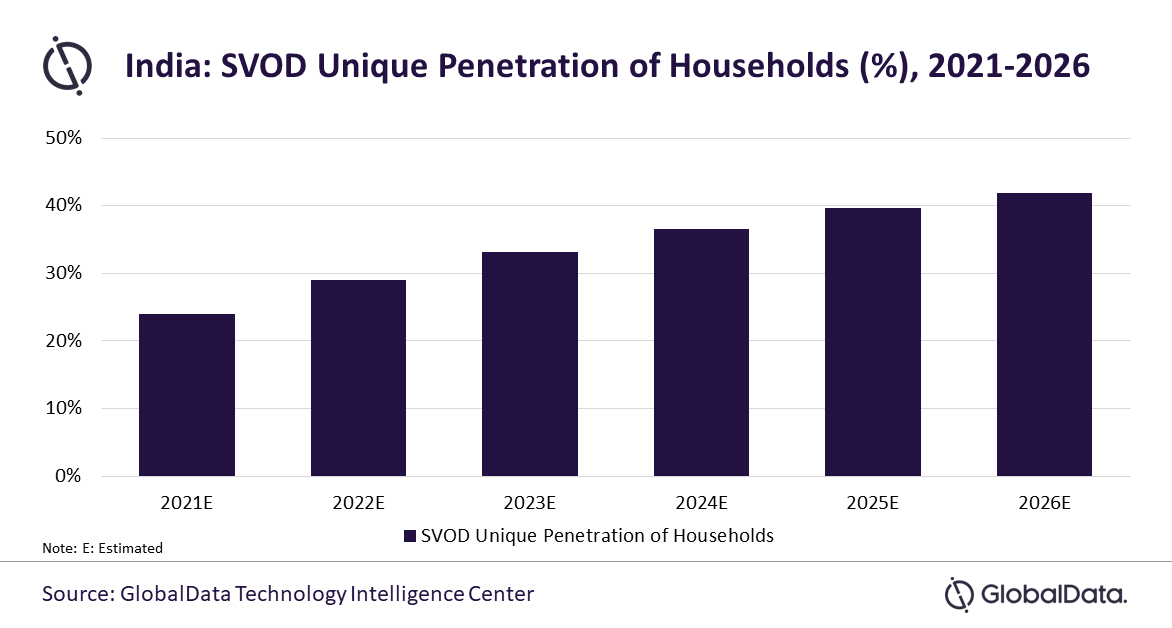

Disney+ Hotstar Leads an Indian Market That Currently Has Less Than 30% SVOD Penetration (Chart of the Day)

Research report shows that one of the world's last big unsaturated streaming markets won't reach 40% household penetration until 2026

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

As perhaps the largest remaining market not yet saturated by subscription video-on-demand streaming services, India is heating up as a nexus of investment for Disney, Netflix and Amazon, as each tries to spur growth for their respective SVOD platforms and get them to this happy, Nirvana-like place known as "scale."

Data just released by UK-based research company GlobalData Technologies shows that India currently has household penetration for subscription video-on-demand services of less than 30%.

Subscribing households will expand at a compound annual growth rate of 16.2% to surpass 40% by 2026, the research company estimates, while total SVOD revenue in India will grow at a CAGR of 15.5%, expanding from $1.3 billion in 2021 to $2.7 billion in 2026.

“The Indian SVOD market is on an accelerated growth path thanks to the availability of high-speed broadband services, growing smartphone penetration, and widespread popularity of OTT content among the younger population," said Hrushikesh Mahananda, telecom research analyst at GlobalData.

Adding 8 million subscribers in the Subcontinental region in the first quarter, Disney+ Hotstar leads the market, Mahananda said.

The Disney-owned service's growth, he added, "can be attributed to the company’s wide, distinct pool of multilingual local and original content library, competitive pricing, and exclusive coverage rights to the Indian Premier League (IPL), one of the biggest sporting events in the country."

Well, not so fast. Disney just lost out on the bidding to renew IPL streaming rights for Disney+ Hotstar, with Viacom18, a Mumbai-based joint venture between Paramount Global and Reliance Industries' TV18, paying $3 billion for the prize.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

But Amazon just unveiled a slate of 41 local productions in India.

And for Netflix, which is also pouring money into the region, India has been one of the company's brightest glowing embers of growth as it deals with a larger global customer and revenue recession.

“There has been a remarkable change in the viewing habits of Indian consumers in recent times with traditional pay-TV services losing subscriptions, while binge-watching shows on various OTT platforms is becoming more common," Mahananda added. "While SVOD services have managed to gain a sizeable viewership in urban areas, the rural markets will provide a large untapped market potential for OTT players in the coming years.”

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!