Cord-Cutting Alarm Sounds Anew as Comcast's Q3 Video Losses Exceed the 10% YoY Mark For the First Time

Comcast's heaviest linear pay TV losses yet come after Verizon Fios TV recorded its own significant cord-cutting uptick

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Two Q3 earnings reports by major pay TV operators in, and we can already see that cord-cutting is up in a big way.

Comcast on Thursday reported the loss of 540,000 residential Xfinity TV subscribers and 21,000 business pay TV customers, upping its 2020 year-to-date linear video sub losses to nearly 1.6 million.

Also read: Economy, Hurricane Have Comcast Looking Ahead To Tough 4th Quarter

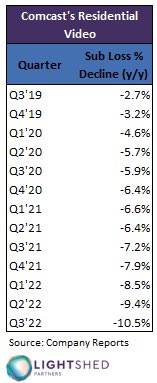

As the graphic from LightShed Partners Group (left) shows, Comcast has lost just over 10.5% of the 18.549 million video customers it had on Sept. 30, 2021 — the firm said it's the first time that the rate of Comcast's cord-cutting has exceeded 10%.

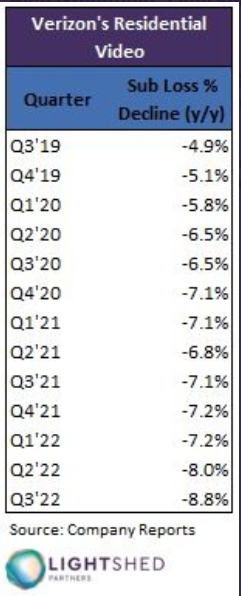

The narrative, on a larger scale, matches a similar chart LightShed published late last week (below right) for Verizon Fios TV, which reported a heightened loss of 95,000 customers in the third quarter.

Also read: Verizon and Snap Q3 Earnings Foretell Coming Hard Times For the Media Biz

After remaining largely stable during pandemic-influenced 2020 and 2021, the year-over-year rate of erosion to Verizon’s video customer base began accelerating abruptly in the second quarter.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Updated: Charter Communications, the second largest pay TV operator in the U.S., reported on Friday that it lost 211,000 Spectrum TV customers in Q3, a 4% year-over-year decline in its video base. This is compared to a loss of 121,000 customers in the third quarter of 2021. On Sept. 30 of last year, Charter's rate of year-over-year video attrition stood at 2.3% -- so, not a marked uptick, but an increase just the same.

Beyond that, with DirecTV’s customer metrics now shrouded from public view following the pay TV company’s spinoff last year from AT&T to a JV run by private equity, our next major signpost will be Dish Network earnings later in November.

In the second quarter, the largest pay TV operators covering 92% of the U.S. market lost a combined 1.925 million subscribers, according to Leichtman Research Group. Look for them to beat that awful benchmark soundly in Q3.

Sustained loss of distribution could be devastating to media companies, who are already looking at a souring advertising sales market. ■

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!