CommScope’s Home Networks Unit Craters 31% in Q4 on Declining Pay TV Set-top Biz

Technology vendor’s ongoing involvement in the video business looks uncertain as it ramps up ‘CommScope NEXT’ streamlining initiative

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

CommScope reported a 31% decline in net sales to $571 million in its Home Networks segment during the fourth quarter, as brisk movement of DOCSIS 3.1 gateways failed to offset the cratering demand for pay TV set-tops.

Overall, Q4 net sales for the Hickory, North Carolina, technology vendor dropped 7% to $2.29 billion, with the Broadband Networks business showing particular strength. Driven by the network capacity needs of its cable operator clients, Broadband Networks net sales increased 17% to $789 million in the quarter. Outdoor Wireless Networks ticked up 1% to $295 million, while the Campus and Events portfolio declined 6% to $477 million.

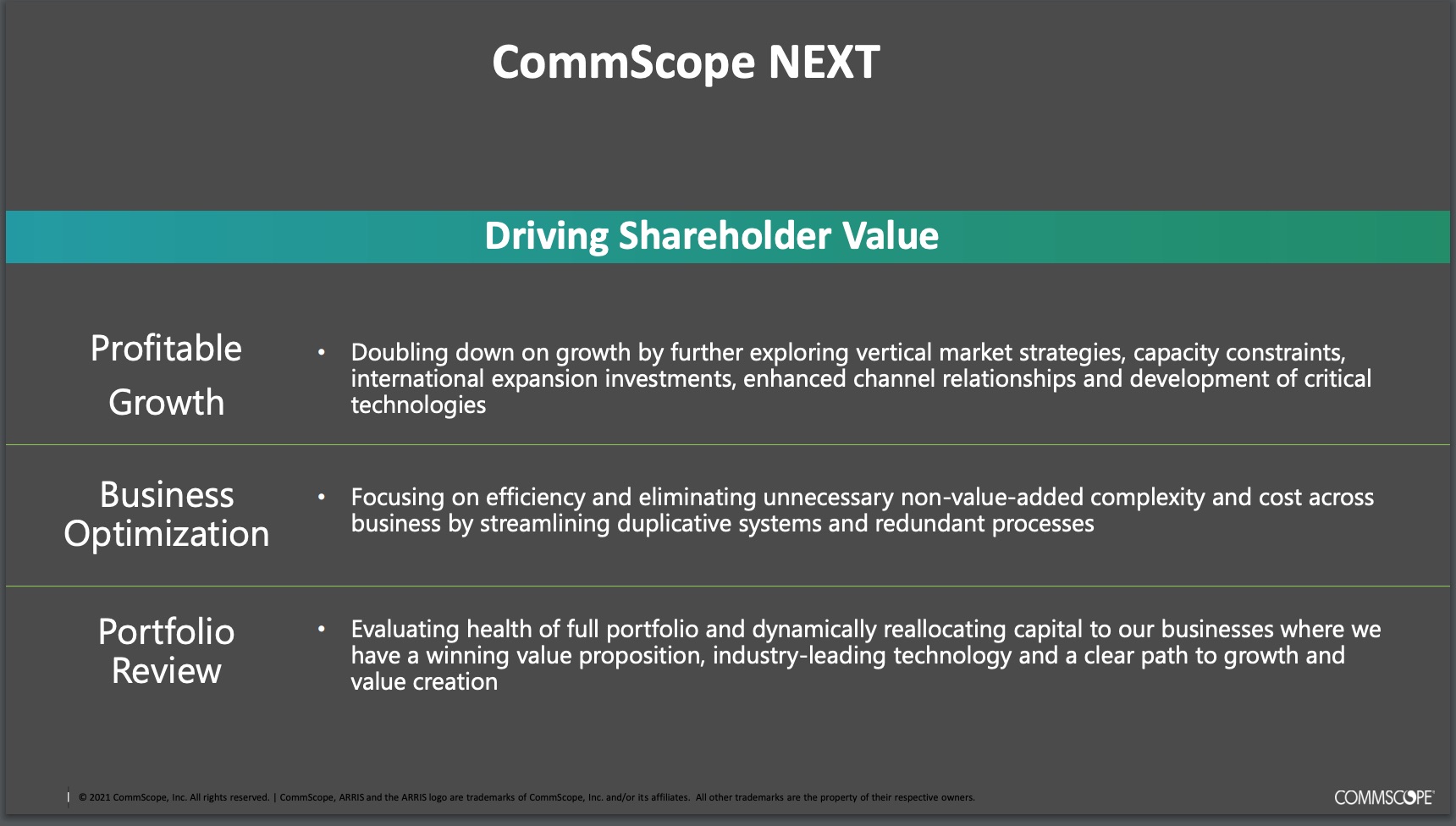

The conspicuous erosion in video technology sales comes at a precarious moment, with the company kicking off a new business-wide evaluation called “CommScope NEXT” under recently appointed CEO Charles Treadway.

Also read: CommScope Pitches DAA, Virtualization at Cable-Tec Expo

Outlined in the slide below, CommScope NEXT will kick the tires on everything from head counts to business systems to product portfolios, looking for ways to streamline, cut costs and generate more net sales, more than two years after its $7.4 billion swallowing of Arris Corp.

“When you think about duplicative systems, just think about the acquisition of Arris—we've brought two very large companies together, two $5 billion plus companies. When we put those together, you find a lot of duplicative systems,” Treadway explained to investment analysts during Wednesday’s earnings call.

“A great example is what we have in the IT side,” he added. “One company runs Oracle, and one company runs SAP. As we move to one system, we're going to have significant savings from that.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

CommScope is trying to offset the decline in full-featured DVR set-tops with OTT-centric devices. But the longer term trend lines don’t look nearly as attractive as the ongoing “dance” the company says it’s involved in with cable operators over broadband network capacity.

“They come back to us when they need more capacity in their network,” said Morgan Kurk, executive VP, CTO and segment leader of CommScope’s Broadband Networks unit, describing the interaction Wednesday.

“They buy physical cards, and then they add additional capacity to those cards in effect,” Kurk added. “It's a software related capacity add over time, and they do that until they exhaust the amount of bandwidth that's available to them. So, it is an opportunity to continue to sell additional licenses to them until they reach a certain point and then they go back to buying hardware to increase that available capacity again. That's the dance that's going on. Of course, there is also the upgrade to the network, whether it is to go to DOCSIS 4.0 which expands the amount of spectrum available and thus the amount of both hardware and software that they can buy from us. And also, the change in architecture from the centralized CCAP to distributed access architecture, whether it's Remote MAC or Remote PHY. This puts more of this equipment out toward the edge of the network to reduce some costs in the headend and to increase the capacity of the backhaul network and to reduce latency. So, all of those things will be going on for the next decade.”

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!