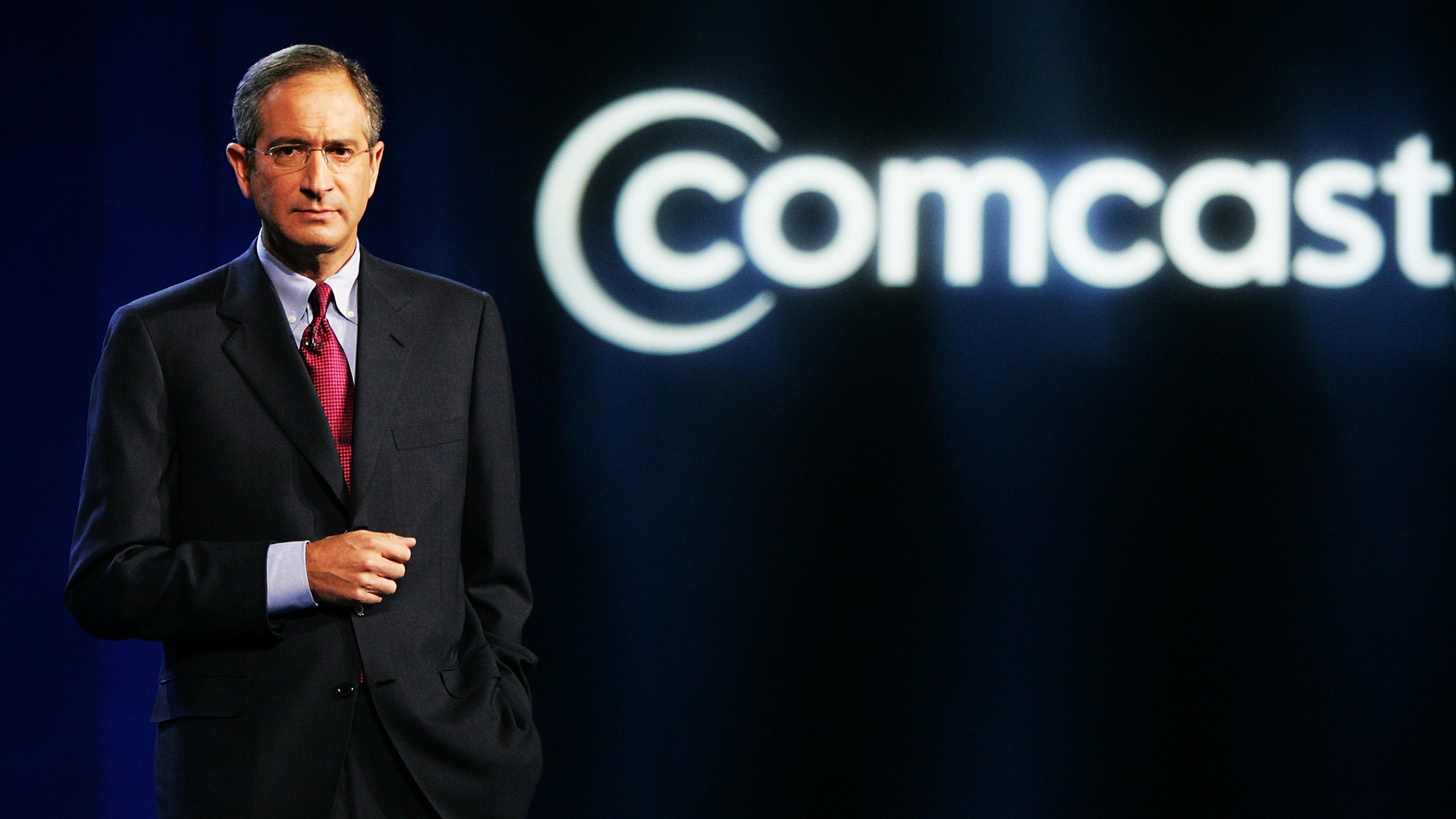

Comcast Mulling Big Roku and ViacomCBS Buys? Read The Room, Brian, There’s a Growing Antitrust Fervor

Lina Khan’s ascendance to FTC Chair suggests the MGM deal, and any acquisition big enough to stir Comcast CEO Brian Roberts’ soul, will get far more than a cursory review and rubber-stamp approval

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Apparently, presiding over a media giant that sits astride two continents and multiple distribution platforms isn’t quite enough for Comcast’s second-generation CEO Brian Roberts, who reportedly wants to add little side hustles like Roku or ViacomCBS to keep up with, well, everyone else, despite everything he already has.

A Wall Street Journal piece Thursday said Roberts wants to beef up Comcast holdings, either with a lot more content, or yet another distribution platform, or perhaps both. Well, of course he does.

But while buying America’s best-selling streaming hardware maker, or the biggest of Hollywood’s few remaining independent broadcaster/cable/movie studios, makes plenty of business sense for Comcast, it makes far less political sense given current sentiment in Washington, London and Brussels.

A key U.S. House committee this week approved a far-reaching set of antitrust bills that would prevent companies from engaging in conduct that advantages their own products or services on a platform, or puts competitors at a disadvantage, or even that discriminates against similar business users.

While the legislation largely targets the Big Tech firms whose digital platforms dominate so many parts of our lives, the bills could set plenty of landmines in front of Comcast or other media companies trying to catch up in the latest round of Hollywood consolidation.

To pass, the bills faced down a furious lobbying effort by tech and other business interests, and it’s harder to read their prospects in the evenly divided Senate. But even there, conservatives who might traditionally oppose any kind of business restrictions want tougher controls over social-media and online companies they feel are censoring them. Out of such grievances are cross-party political coalitions crafted.

And the Senate did just sign off on Lina Khan’s appointment to the Federal Trade Commission. President Joe Biden then named Khan FTC chair, cementing in power a former law professor and Congressional aide who built her reputation calling for an overhaul of antitrust policy in the digital era.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

The FTC has already asserted jurisdiction over Amazon’s $8.45 billion acquisition of MGM, on top of another investigation in Amazon’s pricing practices with its third-party sellers.

Again, it’s easy to understand why Amazon wants to overpay for MGM’s fat library, which it hopes to mine endlessly for Prime Video remakes, reboots and spinoffs that it can own forever.

But Khan’s ascendance suggests the MGM deal, and any acquisition big enough to stir Brian Roberts’ soul, will get far more than a cursory review and rubber-stamp approval.

Antitrust concerns aren’t limited to North America either. UK regulators want to bring international streaming services on its shores under the same programming and other strictures facing traditional broadcasters there. The EU continues to aggressively regulate anti-competitive behavior, with most of the tech giants in the middle of various expensive investigations over their practices.

All of which suggests that what’s happening is a fundamental shift in understanding, among creators and regulators both, of the power of distribution platforms.

Hollywood always said content was king, presuming that its hot shows would magically open distribution channels desperate to attract users. Then a couple of things happened. First, everyone started making way more good content than any normal human could watch. Second, HBO Max and Comcast’s Peacock got stoned for months when they tried to sashay onto Roku’s platform this time last year.

This understanding of platform power is also playing out on the game side. This past week, Microsoft’s Satya Nadella used his Windows 11 debut event to throw shade at competing app stores that don’t allow access by competitors.

Nadella never mentioned by name a certain fruit-associated $2 trillion company (the only one worth that much besides Microsoft), but Nadella didn’t have to, three weeks after the end of testimony in Epic Games’ landmark antitrust lawsuit against Apple over its App Store practices.

And all of this jockeying is only partly about streaming video and games right now. It’s also about who’s going to control the next generation of devices beyond mobile, in augmented- and virtual-reality devices.

Amid those kinds of big-picture strategic imperatives, adding Roku and ViacomCBS to Comcast’s quiver seems almost like a retro idea straight out of 2007 or so. But it still isn’t likely to look good to regulators.

Comcast is already soup-to-nuts in production, distribution, and delivery of video in just about every current form. Truth be told, it’s difficult to figure out what the Comcast octopus doesn’t already do. And that’s exactly why any big deals seem doomed to a difficult birth at best.

Comcast already has more broadband than TV subscribers, and it’s still the nation’s biggest traditional cable provider. It already owns a Roku quasi-competitor, the Flex streaming box. And the WSJ said Comcast is collaborating with Walmart and Hisense to build branded smart TVs expected to hit store shelves as soon as this winter.

Comcast also has analogues to everything ViacomCBS does, from its own broadcast network to a sheaf of cable networks, a movie studio and TV production unit. On the streaming side, both own major SVOD and AVOD networks already.

Adding to possible antitrust concerns for the European Union and a newly activist post-Brexit UK, Comcast also owns Euro satellite power Sky and its many production arms.

Brian Roberts faces plenty of pressures beyond a filial sense of duty to build up his birthright, including from activist investor Trian Fund Management LP, which questions Comcast’s current mashup of content and distribution.

Other investors are unimpressed by Comcast’s growth prospects, pricing its stock at a far lower earnings multiple than competitors Disney or Netflix, whose respective production facilities are a couple of miles either way from Universal City, where NBCUniversal is headquartered. Even No. 2 cable operator Charter Spectrum has a higher multiple, which has to grate.

The spring was filled with what the consultants like to call M&E M&A, some 410 deals in media, entertainment and telecom, totaling $83 billion in value, according to PwC in its mid-year report on the state of play.

It was, the report said, “the highest level in years … As these media giants compete with the likes of Netflix and Disney, we expect to see a continued race for content and sports rights, as well as further consolidation among other streaming providers and studios as they seek the scale needed to remain competitive.”

No matter. Now that Biden has scored victories on other legislative priorities, and signaled his regulatory intent with key appointments at both the FTC and the Department of Justice, it likely will be far more difficult to secure approvals for game-changing deals going forward than it was just six months ago.

At least until we see what happens with the MGM-Amazon deal, media companies may be better advised to hunker down. That’s particularly so for Comcast and NBCU, which have to white-knuckle it through whatever the pandemic-cursed Tokyo Olympics become next month.

Then, Roberts and his company can figure out where to allocate their capital going forward.

Here’s an idea: instead of sinking tens of billions of dollars into an acquisition that might get tossed out by the Biden Administration, maybe spend more to make your own content, so you can keep up the old school way. Maybe content is king after all.

David Bloom of Words & Deeds Media is a Santa Monica, Calif.-based writer, podcaster, and consultant focused on the transformative collision of technology, media and entertainment. Bloom is a senior contributor to numerous publications, and producer/host of the Bloom in Tech podcast. He has taught digital media at USC School of Cinematic Arts, and guest lectures regularly at numerous other universities. Bloom formerly worked for Variety, Deadline, Red Herring, and the Los Angeles Daily News, among other publications; was VP of corporate communications at MGM; and was associate dean and chief communications officer at the USC Marshall School of Business. Bloom graduated with honors from the University of Missouri School of Journalism.