Churn Was Way Up Again in Q3 for the Major U.S. SVOD Services

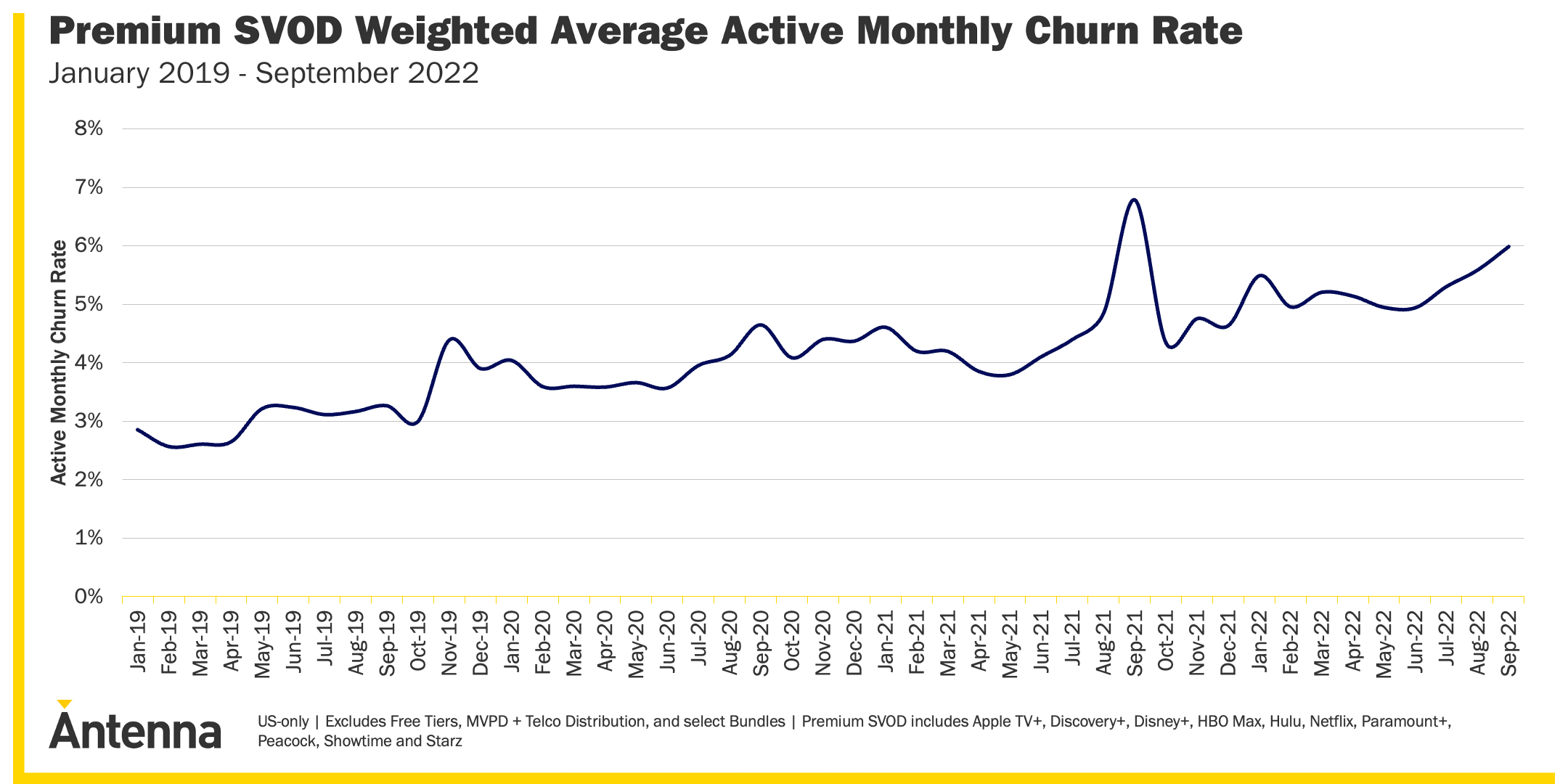

After weighted active monthly churn spiked to nearly 7% a year prior, it increased significantly once again in September for premium subscription streaming services including Netflix, research company Antenna found

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

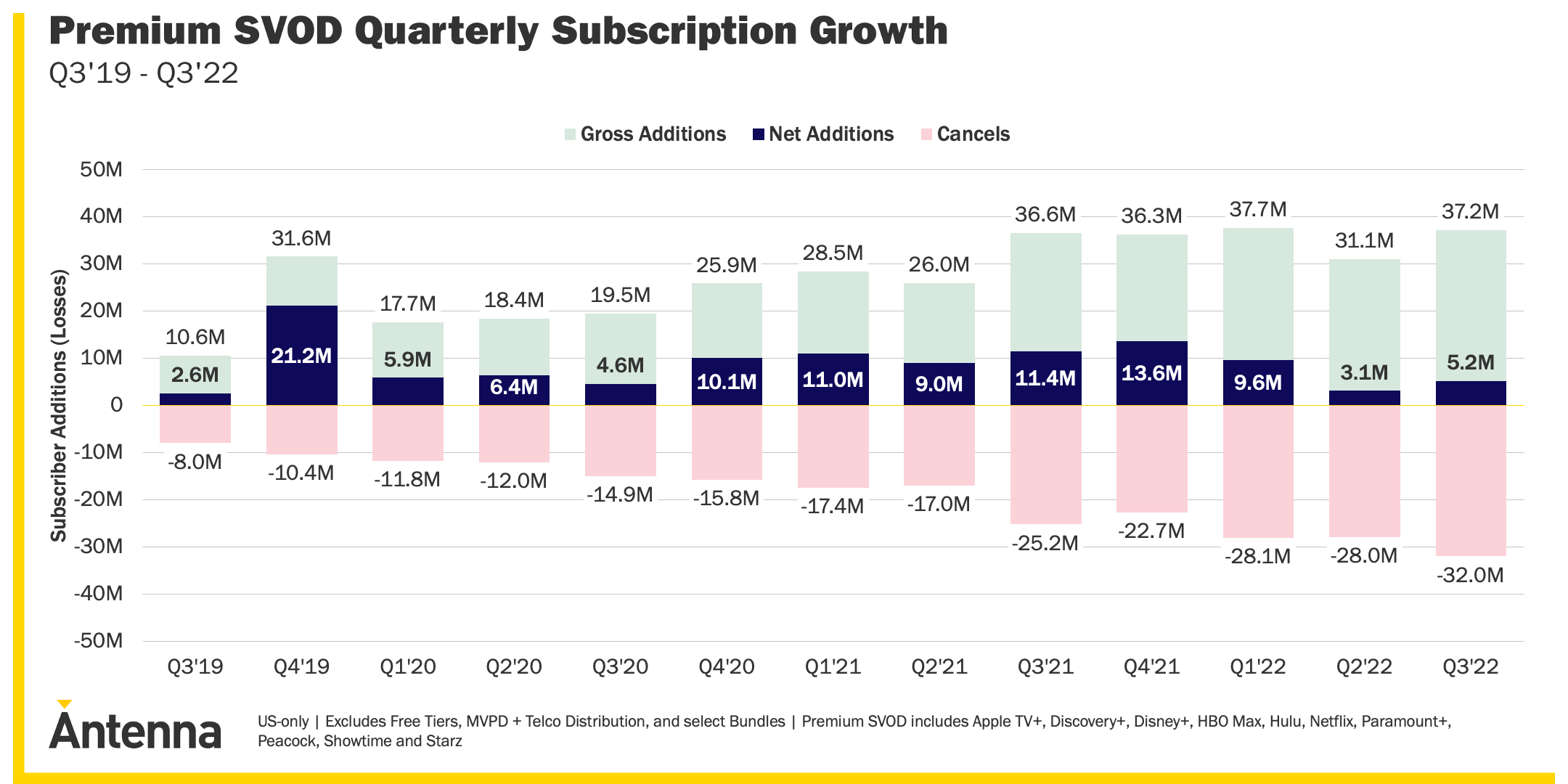

Thirty-two million subscribers canceled what research company Antenna identifies as the 10 premium U.S. subscription streaming services in September, offsetting the gross addition of 37.2 million new customers.

The overall 6% churn rate represented a significant uptick over the spring and was matched only by a similar spike in Q3 2021, during which U.S. SVOD industry churn reached nearly 7%.

Two years is probably not enough to establish a cyclical trend similar to the pay TV industry, which has traditionally shed subscribers in Q2 as warming weather convinces consumers they don't need to say at home and watch TV as much.

Still, it's interesting.

Also read: Churn Is Back: 32 Million U.S. Households Are 'Service Hoppers,' Parks Says

Overall, churn for the "premium" U.S. SVOD services has been a lot higher in 2022 than it has been previously, with cancellations averaging over 25 million each quarter.

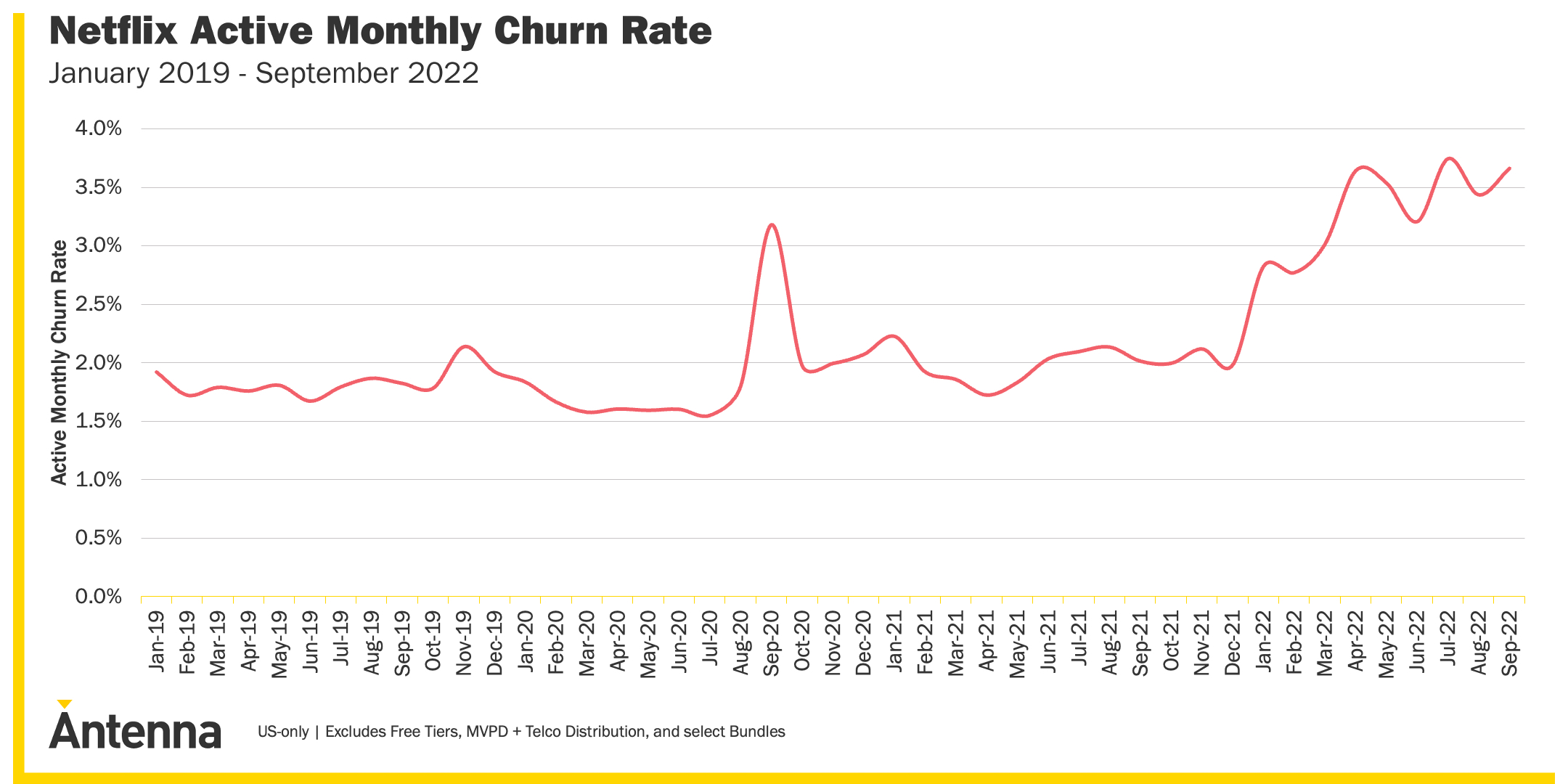

While not the only driver of this increase, Antenna suggests that the biggest U.S. SVOD company, Netflix, could be largely to blame.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Netflix, which experienced a significant uptick in Q3 churn in 2021, had an even bigger one this September, with domestic churn increasing to around 3.7%.

The three charts below analyze churn for every major U.S. SVOD service save for Amazon Prime Video.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!