Chicken Soup Reports $637 Million Loss for 2023, Preps Investors for Bankruptcy

In its delayed 10-K filing, the streaming and Redbox kiosk company does outline a proposed mutual forbearance agreement with its primary lender that could provide some help

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Chicken Soup For the Soul Entertainment rendered its delayed 2023 10-K filing to the Securities and Exchange Commission late last week, and the news out of the troubled media company got worse, not better.

Reporting a net loss of $636.6 million for the year versus $111.2 million in 2022, the Cos Cob, Connecticut-based Chicken Soup said that without the ability to somehow generate additional financing, it “will likely require us to diminish or halt operations and seek protection under applicable bankruptcy laws.”

The dour SEC filing came after Chicken Soup received a delisting notification from the Nasdaq earlier this month.

“Our relatively recent acquisitions of Redbox, 1091 Pictures, Crackle, and the assets of Sonar, required time-consuming and costly integration efforts,” the company said in its 10-K filing. “To date, these efforts have not been successful as we have not realized the anticipated benefits of such acquisitions and our operations have been adversely effected. We believe in the value of these assets but would require additional capital resources to fully realize their value, and we may not be able to secure such capital resources on commercially reasonable terms or at all.”

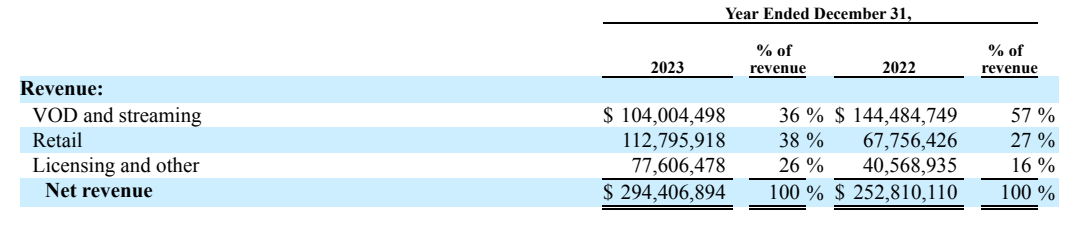

Business for Chicken Soup’s 40,000 DVD rental kiosk locations across the U.S. actually picked up last year, with the theatrical movie pipeline recovering a bit following the paralysis of the COVID-19 pandemic. The kiosk business saw a 66% increase in annual revenue to $112.7 million.

But the other shoe dropped with Chicken Soup's Crackle- and Redbox-branded streaming businesses, sales for which declined 28% to $104 million. Chicken Soup said its financial crisis has kept it from programming its streaming channels in such a way that would increase audience usage, and subscription and advertising revenue along with it.

Meanwhile, the lawsuits are piling up from unpaid vendors and programming partners, one of which told Next TV recently that he'd settled a Chicken Soup debt owed to his company for pennies on the dollar. The latest suit to emerge in the press, as detailed by the Penske showbiz trades on Monday, is from a consultant who helped Chicken Soup manage its $370 million acquisition of Redbox in 2022.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

However, as a Chicken Soup rep pointed out to us, the 10-K outlines a "mutual forbearance agreement" it proposed it its primary lender that could improve the company's financial position.

According to page 40 of the 10-K, "The proposed transactions include a $50 million sublicense and a $125 million agreement with a third party comprised of a $65 million line of credit and a $60 million equipment lease to Redbox secured by assets owned by Redbox."

Chicken Soup for the Soul Entertainment was trading at 15 cents a share as of late-day trading Tuesday.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!