Can More Inclusive Shows Make AVOD Services Stand Out?

Across all AVOD services, Black viewers account for nearly a quarter of viewing (24%), compared to just 14.7% of the U.S. population.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Being everything for everybody sounds like a good idea, at least amid the streaming business’ mad cavalry charge for market share. But a Nielsen study suggests it may be time for AVOD and other streaming services to specialize, leveraging more inclusive and targeted programming to better serve the niche demographics that are their most loyal customers, and to grab more highly targeted advertising as a result.

That sounds like a) a good idea, and b) an inevitable one. Aside from Disney (and possibly HBO/HBO Max), very few companies in Hollywood stand for much of anything, a branding vacuum reiterated in their respective streaming operations, too. But if you’re too much like everyone else, and pretty much everyone’s services and shows are available everywhere, why is anyone going to watch you?

Also read: Redbox Gets Into the Kevin Hart Business

In response to the Differentiation Dilemma, subscription services have been creating loads of pricey new originals (pandemic permitting), backed by as big a library of older stuff of their own and other outlets as possible. That’s expensive and possibly unsustainable if market growth doesn’t follow the programming expenditures.

And ad-supported services, historically addled with modest budgets and nothing for originals, have featured even more homogenized programming, including much the same shows and channels. Now that’s changing. It’s why you’re starting to see news like the Roku Channel buying the Quibi library for a reported $75 million, Amazon buying MGM in part to flesh out IMDb TV, Tubi and Redbox doing original production deals.

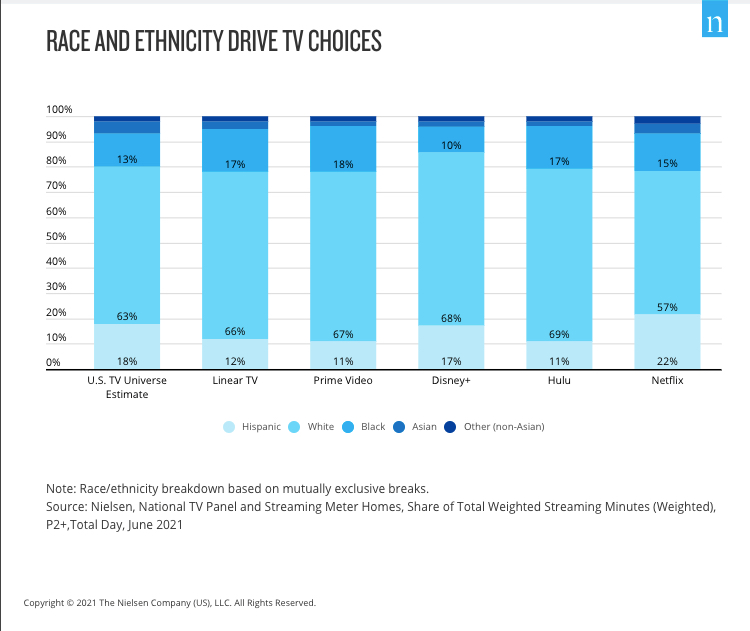

Certain demographic affinities are already surfacing, Nielsen said. More than a third of the audiences for Tubi (39%) and Pluto (36%) are Black, more than double their share of the population. More than a fifth of YouTube viewers are LatinX. And the audiences of corporate siblings Disney Plus and Hulu are overwhelmingly white (68% and 69%, respectively). By comparison, only 57% of Netflix viewers are white.

I know from previous conversations that Tubi has leaned hard into programming that appeals to Black audiences, and that it’s paid off for the largest of the ad-supported services. Netflix has made several splashy content deals with prominent Black creators such as Shonda Rhimes and Kenya Barris. And it’s not surprising Pluto might have particular appeal to Black audiences; owner ViacomCBS also owns BET and BET Plus, and has cross-programmed and -promoted heavily between the services.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Across all AVOD services, Black viewers account for nearly a quarter of viewing (24%), compared to just 14.7% of the U.S. population. But most of that viewing is happening online. Black audiences watched just 17% of the minutes spent on traditional linear TV.

That could be yet another reflection of legacy TV’s long and sorry history of lily-white programming, made worse as studios shift more spending to their online outlets. Regardless, Black, LatinX and other niche audiences have a far better chance regularly finding shows that appeal to them online than they ever had on legacy TV.

At the same time, Nielsen suggest all’s not lost for more traditional “TV,” at least not yet. After all, those old folks on linear TV still like to watch it a lot: “Linear streaming TV programming has become a media mainstay that kept the attention of TV viewers for three hours per day” in June.

To some extent, the study calls for a far more nuanced approach beyond the mega-service mentality that has shaped early days strategy for many big platforms. The mantra has been more, more, more, and grab the biggest possible set of eyeballs as you go. But that’s not enough to win the future.

“…there is still a notable opportunity for publishers outside of the more traditional channels seeking to engage racially and ethnically diverse viewers with unique content that reflects their unique experiences,” the study says. “Amid the sea of growing choice, content becomes a key differentiator, especially when publishers identify needs that are not being met.”

The differences are about more than race, too. Disney Plus, no surprise given its children’s programming, is overwhelmingly watched by under-18 audiences (44%), but only 9% of people over 55. Compare that with traditional linear TV, where the numbers more than flip, with 60% of viewership over 55, and less than 10% under 18.

It’s time that services lean hard into these opportunities. The real power of connected TVs and addressable, targeted advertising will be the ability to connect brands to very specific sets of viewers, especially those who are happily seeing more programming that’s relevant and meaningful to them, not merely time fillers among a handful of bad options.

And where the eyeballs go, the money will follow. The past year has seen a game-changing shift in mindset among brands and media buyers. Now they’re putting far more of their ad dollars into CTV, at a rate that eMarketer forecasts will hit $13.4 billion this year.

“Importantly, TV is no longer just a tool for mass reach,” the study says. “Consumers today would be hard-pressed to find a TV that is not internet-capable, and nearly 80% of U.S. homes now have at least one enabled device…That connectivity and growing options in the streaming video space provide advertisers and media buyers the ability to engage with viewers in live, linear, on-demand and streaming environments.”

Black and LatinX audiences have long over-indexed on entertainment, i.e., consumed an outsized amount compared to their share of the population. The Nielsen study suggests that audience has now shifted enthusiastically to streaming to get that entertainment. The services need to figure out how feed that audience.

David Bloom of Words & Deeds Media is a Santa Monica, Calif.-based writer, podcaster, and consultant focused on the transformative collision of technology, media and entertainment. Bloom is a senior contributor to numerous publications, and producer/host of the Bloom in Tech podcast. He has taught digital media at USC School of Cinematic Arts, and guest lectures regularly at numerous other universities. Bloom formerly worked for Variety, Deadline, Red Herring, and the Los Angeles Daily News, among other publications; was VP of corporate communications at MGM; and was associate dean and chief communications officer at the USC Marshall School of Business. Bloom graduated with honors from the University of Missouri School of Journalism.