Cable, Telcos Will Fight for Broadband Market Share as Growth Opportunities Wane, Kagan Says

U.S. residential broadband to top 122 million subscribers by year’s end

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

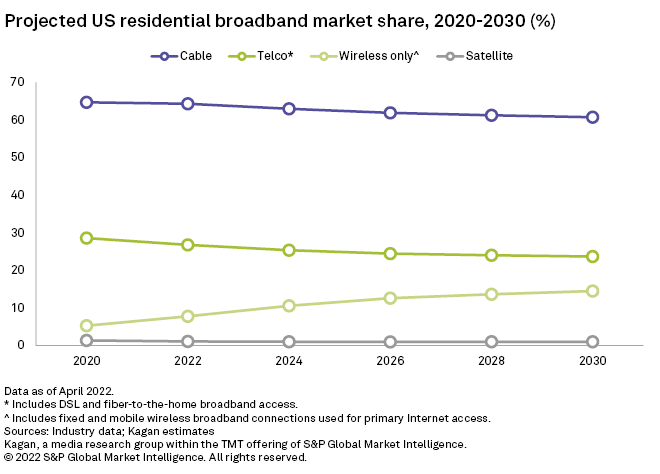

Growth in residential broadband subscriptions will mainly be a market share game between cable, telco and satellite providers for the foreseeable future, as total high-speed internet penetration passes 90% in the U.S., according to Kagan, the media research unit of S&P Global Market Intelligence.

Kagan estimates that total U.S. broadband subscriptions will reach 122 million at the end of 2022, as cable operators continue to expand their existing footprints through edge-out programs, telcos upgrade their plant with fiber builds, wireless carriers deploy 5G service, and the federal government offers incentives to bring broadband to rural markets through programs like the $42.5 billion Broadband Equity Access and Deployment (BEAD) project.

Cable broadband growth has been on a slower pace compared to the record growth during the pandemic, a combination of high penetration rates, stiffer competition and a slowdown in new housing starts.

Both Comcast and Charter reported broadband subscriber growth in Q1 that was half that of the prior year, and while most analysts expect operators and telcos to grow their high-speed data customer bases, none expect the pace to quicken anytime soon.

Kagan warns that growth will come at the expense of other players. In the research report, Kagan analysts Ian Olgeirson and John Fletcher write that “there simply are not enough subscribers to accommodate the growth ambitions of each segment.”

As a result, Kagan expects cable, the hands-down dominant player in the broadband segment for the past decade, to begin to show signs of slippage, with market share dipping slightly to 61.9% through 2026. Telcos will see the biggest market share jump -- from 8% to 12.6% by 2026 -- mainly due to their aggressive fiber buildout, although that is somewhat muted by their legacy copper DSL offerings.

Although the next generation of satellite broadband offers some hope, unfavorable cost and speed comparisons should limit growth expectations, according to Kagan, who estimates their share of the market will remain steady at 1% through 2026. ■

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.