Cable Finally Loses Broadband Market Share in Q2 with First Negative Growth Quarter Ever

The top seven U.S. cable companies collectively lost over 60,000 subscribers from April - June

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

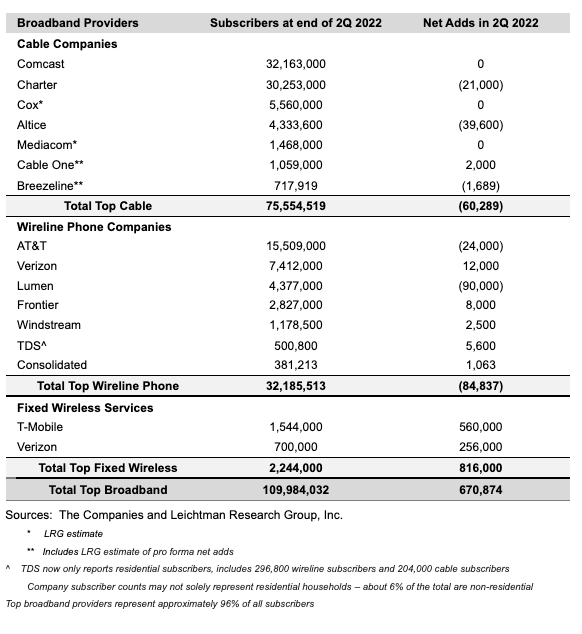

The top seven U.S. cable companies experienced a first from April to June — they lost broadband customers in a quarter, 60,239 of them, according to Leichtman Research Group's quarterly tally of the U.S. wireline internet business.

No. 1 MSO Comcast was flat in high-speed internet growth in Q2, while No. 2 company Charter Communications bled 21,000 customers and No. 3 company Altice USA lost 39,600 of them.

According to LRG principal Bruce Leichtman, the lowest customer growth figure for wireline broadband that he can remember occurring in the last 20 years of tracking this business was the second quarter of 2009, the height of the Great Recession, when the leading MSOs only added 250,000 subs.

For the first time that Next TV can recall, cable operators lost market share in the U.S. wireline business, slipping from 68.7% at the end of June compared to 69.6% after the second quarter of 2021.

The new LRG tally highlights an abrupt braking for the U.S. cable industry, which grew customers by a record 1.4 million in Q2 2020, with quarantined customers outfitting their homes with broadband service en masse. Cable operators added over 843,000 HSI subscribers in the second quarter of 2021. (Note, LRG's tally is pro forma, given the changes to the individual companies in the consolidating telecom industry.)

What's changed?

Not so much the proliferation of fiber wireline by the telcos — they lost nearly 85,000 broadband users in Q2

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Certainly, the emergence of fixed wireless access factored in -- T-Mobile and Verizon are seeing steady gains for their FWA services, which together picked up 816,000 subs in Q2.

“Over the past year, there were about 3,260,000 net broadband adds, with fixed wireless services accounting for 56% of them," Leichtman said.

Perhaps more than anything, saturation in wireline broadband is occurring, with fixed services reaching as far as they feasibly can into rural regions.

Overall fixed broadband services from the leading companies covering more than 95% of the U.S. market added around 670,000 customers in Q2 vs. over 890,000 in the same period last year. In 2020, the Q2 figure was 1.24 million added customers, with telco losses offsetting some of cable's massive gains. ▪️

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!