Bernstein’s Todd Juenger Returns to Media Coverage with Discovery Upgrade

But analyst says big hurdles lie ahead in integrating WarnerMedia

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

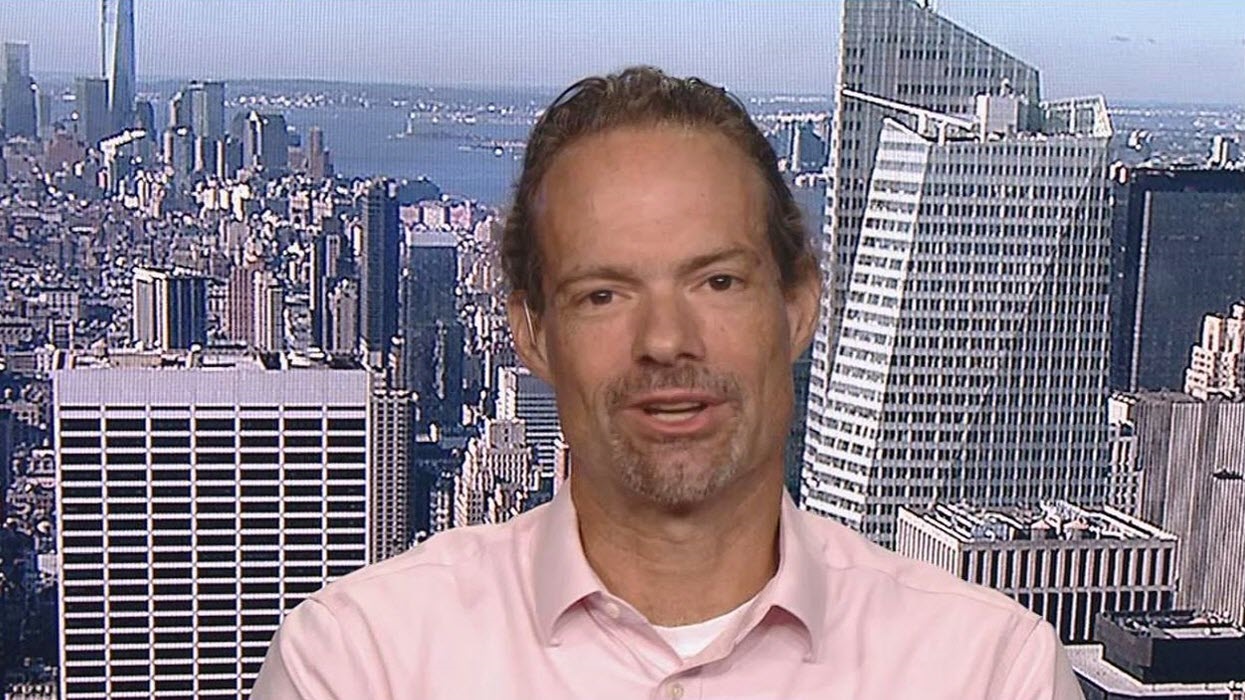

Bernstein Research media analyst Todd Juenger returned to coverage of the industry Monday after a three-month sabbatical, upgrading Discovery Inc. to “Market Perform” from “Underperform,” but cautioning that the programmer, which agreed to merge with WarnerMedia in May, has some heavy lifting ahead.

Juenger took a three month sabbatical beginning on July 30, and Bernstein suspended coverage of media companies in his absence. The analyst, who joined Bernstein in 2012 after heading up TiVo’s Audience Research business, has proven himself to be one of the more insightful analysts covering the programming space.

In upgrading Discovery, Juenger also announced that he was dropping coverage of AMC Networks “to focus on stocks with broader investor interest.”

Juenger didn’t pull any punches upon his return. Although he increased his rating on Discovery, he lowered his 12-month price target on the stock to $26 from $28, reflecting his concerns about its ability to integrate the WarnerMedia business.

“[W]e continue to have high conviction that these businesses face a long list of very serious concerns, including: the legacy business is facing insurmountable structural pressure, the streaming future is riddled with risk for this set of brands, including the daunting complications of the WarnerMedia integration and rationalization,” Juenger wrote of Discovery. “However, the market seems to also share those concerns, and has driven the stock price down to a level where we can no longer argue the risk/reward for investors skews significantly negative from here.”

Juenger continued that he believed Discovery’s stock price already reflects the market’s belief that it will miss its streaming revenue guidance, cash flow guidance or both.

“As the closing date approaches, the key question for investors from a catalyst perspective is: if the company takes down their guide, will that be bad for the stock (confirming tougher business conditions and lower financial results) or good for the stock (clearing the overhang, regaining investor confidence in a believable outlook on which to price the stock)?”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

In his report, Juenger points out that Discovery WarnerMedia is not yet the “streaming powerhouse” depicted in headlines, but instead relies almost entirely on traditional linear cable network revenue to fund its streaming endeavors. How it manages to keep that linear business generating cash while its streaming business grows will be critical.

“Ironically, the more successful the streaming service becomes in the market – the more pressure is put on the linear networks, which is the tyranny of the innovator's dilemma,” Juenger wrote, adding that the new entity will have a leverage ratio of about 5 times cash flow, and has promised to use excess free cash flow to lower debt.

“We think this puts the company in a very difficult box to start from: promises to both invest in streaming and invest in delevering,” Juenger continued. “It also greatly amplifies risk to equity value. Any downturn in either EBITDA/FCF, or the valuation multiple of the stock, will fall sharply on the equity holders.”

Discovery shares were up more than 5% in early trading Monday to $24.70 each. The stock was priced at $24.52, up 4.6% ($1.08 each) at 12:09 p.m. on Nov. 1.

Juenger also didn’t want to downplay the massive integration issues the combined company will face once the deal closes.

Integration Issues Loom

“Which departments survive, which get merged or deleted, who stays/who goes, who's in charge, how to design incentives for leaders of the legacy business and the streaming business, and how to align that market by market, region by region and globally,” Juenger wrote. “All while trying to deliver/exceed on financial synergies promised to the investment community. This complex task will not only require significant expense, but also significant management bandwidth and distraction. And employee trepidation, and time. Important decisions cannot be made before the new leadership is installed (otherwise it undermines the authority of the new leadership).”

Juenger also saw some potential bright spots, including overdelivering on streaming growth and potential synergies. The analyst wrote that the market usually forgives other sins if a company manages to add more streaming customers than expected, and so far most streaming services have.

In addition, Juenger added that if consumers pare down to three or slightly more than three streaming subscriptions, Warner Bros. Discovery will likely be among them.

“This view would be supported by a belief that HBO would continue its history of putting forth a handful of truly distinctive premium entertainment series every year, and the addition of Discovery's portfolio would add complementary engagement value,” Juenger wrote.

As far as synergies, Juenger pointed to Discovery’s 2017 purchase of Scripps Networks. Less than three months after closing that deal, Discovery raised its cost synergy target from $350 million to $600 million.

“One could easily expect Discovery will once again exceed the original target,” Juenger wrote. “Which, theoretically, could be additive to the $14 billion EBITDA guidance (or, give the company that much extra room to invest in streaming, or de-lever).”

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.