AT&T, DirecTV Set to Be Hit Hard by COVID-19 Recession: Analyst

While telecom had hoped that its pay TV fortunes had finally turned the corner, Craig Moffett says its cord cutting problem is actually going to get worse

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

After losing nearly 5 million pay TV subscribers across their various platforms in 2019, AT&T executives had told investors that cord cutting should start to decelerate this year amid the launch of the company’s new IP-based video platform, AT&T TV.

But the COVID-10 pandemic, and the related economic recession, will likely disrupt those plans and place AT&T’s pay TV business on an even more accelerated path of degeneration, said MoffettNathanson analyst Craig Moffett

Also read: AT&T Stops Selling U-verse TV

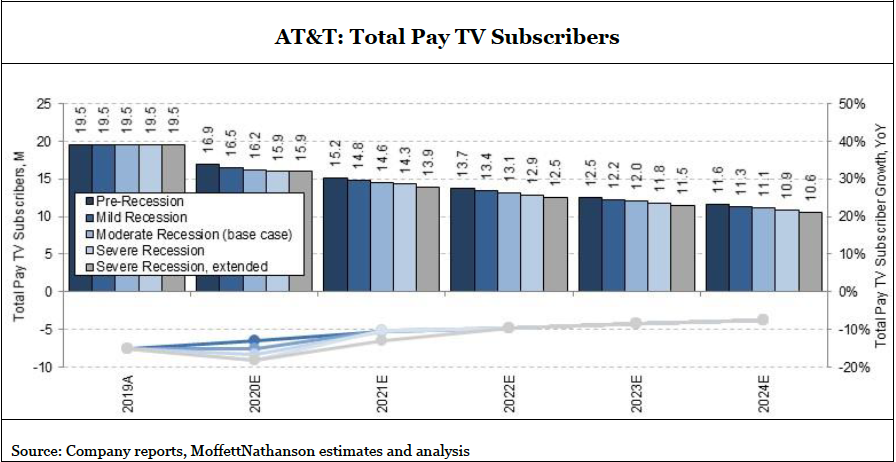

Moffett predicts that instead of an earlier prediction, which called for AT&T’s pay TV base to shrink by 13.1% in 2020 to 16.9 million subscribers, he believes it will now decline by 16.6% to 16.2 million customers.

For starters, Moffett said economic recession will likely accelerate cord cutting for all providers, with subscribers under pressure to reduce household costs they deem non-essential.

In the more immediate term, however, the loss of live sports amid the pandemic will obliterate the pay TV market’s major lynchpin. And no platform is more exposed than AT&T’s DirecTV satellite service, which is built around a robust portfolio of regional sports networks and expensive live-sports assets, like NFL Sunday Ticket.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Despite losing nearly 3.2 million customers last year, DirecTV is still AT&T’s biggest pay TV asset, with more than 16 million subscribers. AT&T has stopped promoting DirecTV, and is not longer coining new subscribers for its other linear pay TV platform, U-verse TV, as it tries to transition its pay TV base to its new IP-based platform, AT&T Now. As Moffett noted in his missive to investors sent April 3. “That would have been a difficult transition under the best of circumstances. These aren’t the best of circumstances.”

Speaking to investors during AT&T’s fourth-quarter earnings call, COO John Stankey said, “As we move through this year and we start shifting to AT&T TV, our gross add performance starts to get much stronger.”

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!