Altice USA Stock Perks Up in After-Hours Trading as Cable Company Meets Q4 Forecasts

But analyst Craig Moffett is concerned that price cuts meant to rekindle flagging broadband customer growth might also crater ARPU

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

After spiking nearly 6% in regular trading Wednesday, Altice USA’s previously sagging stock price perked up again, by double digits during after-hours business, with the New York-headquartered cable operator reporting fourth-quarter earnings in line with equity analysts’ consensus forecasts.

Total revenue for Q4 was down 2.9% to $2.3 billion, and off 4.3% for all of 2023 to $9.24 billion. Both decline percentages improved from 2022, when Q4 sales dropped by 6% and full-year revenue by 4.4%.

Year to date, Altice USA shares still closed regular trading Wednesday down nearly 33% from a Jan. 2 trading price of $3.21 a share.

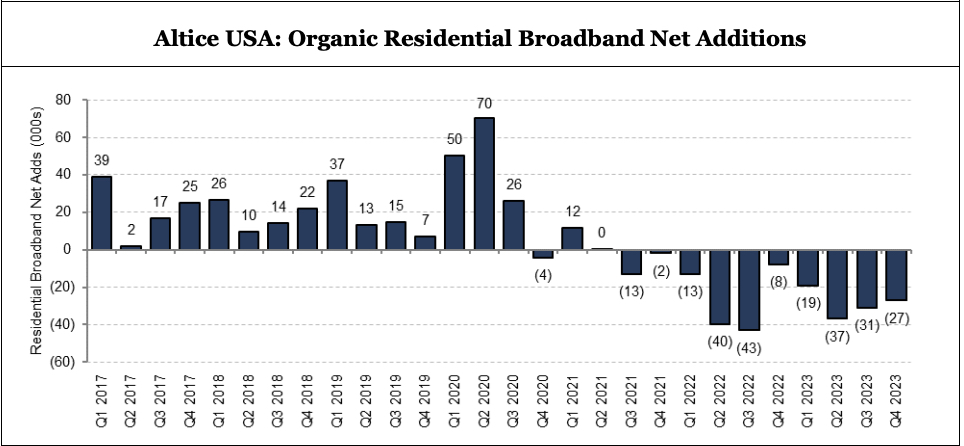

Altice USA, which recently instituted significant price cuts to its fiber services in hopes of rekindling customer growth, lost 62,200 linear video subscribers in Q4 vs. 52,800 in the fourth quarter of 2022. Residential broadband users declined 27,000 in the quarter vs. 7,000 during the same period of 2022. The company, however, did have its best quarter ever for fiber internet customer additions, tacking on 46,000 subscribers in Q4.

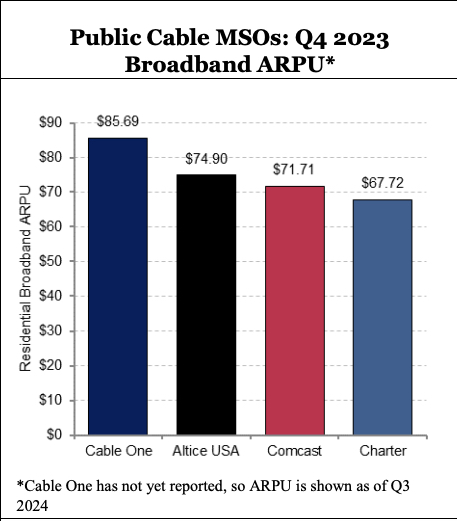

“In cutting their rack rate pricing, Altice has at least acknowledged the obvious; their prices are simply too high given the challenging competitive backdrop in (especially) their Optimum East footprint,” MoffettNathanson analyst Craig Moffett in a note to investors Wednesday.

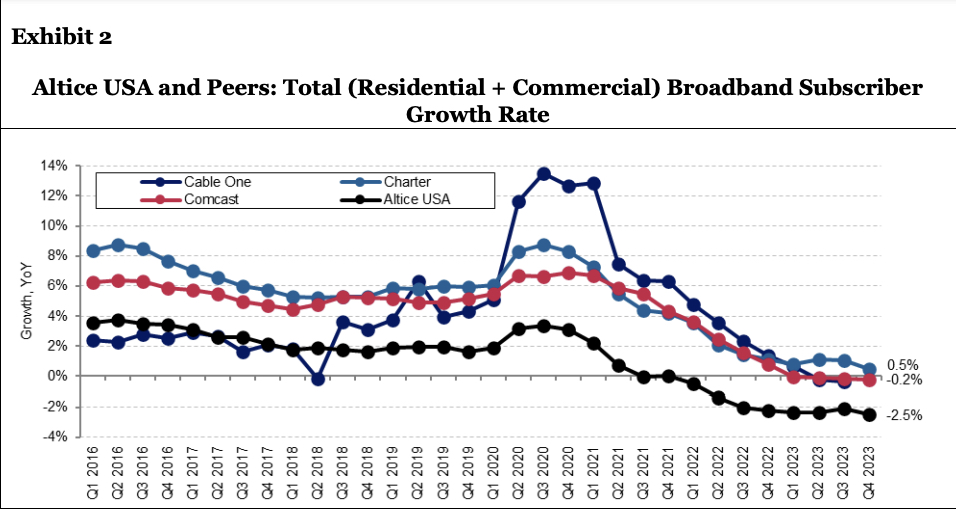

According to Moffett, on a percentage-of-base basis, Altice USA’s broadband customer losses have been among the worst in the cable industry recently.

The challenge for Altice USA will be to rekindle growth without cratering its broadband average revenue per user (ARPU), which is among the highest in the industry.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

In the minds of the folks like Moffett who advise cable-industry investors, if an MSO isn't growing its customer base, it better be growing ARPU.

Let’s just say there’s early concern here.

“In resetting their rack rates, the company projected relatively stable ARPU. At least in Q4, however, ARPU fell quite sharply sequentially (by 1.6% in a single quarter),” Moffett noted.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!