99 Problems: Dish Faces Investor Lawsuits Over Ransomware Attack, Downgrades From Equity Analysts

As if its painful transition to 5G wireless provider wasn't enough, Dish's cyberattack seems to have come at a really bad time

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The hits keep coming for Dish Network.

The satellite-TV provider turned nascent 5G wireless company is still recovering from a ransomware attack that has shut down or otherwise hampered the performance of critical internal networks for the better part of the month, while compromising private customer data.

Now, Dish is facing numerous investor class-action lawsuits over the crisis, accusing the Englewood, Colorado-based telecommunications provider of making false and misleading statements to investors about the breach.

The latest suit, filed Thursday by law firm Levi & Korsinsky, alleges that Dish “overstated its operational efficiency and maintained deficient cybersecurity and information technology infrastructure.”

The class action also accused Dish of being “unable to properly secure customer data, leaving it vulnerable to access by malicious third parties.” The complaints further states that “the foregoing cybersecurity deficiencies also both rendered Dish's operations susceptible to widespread service outages and hindered the company's ability to respond to such outages.”

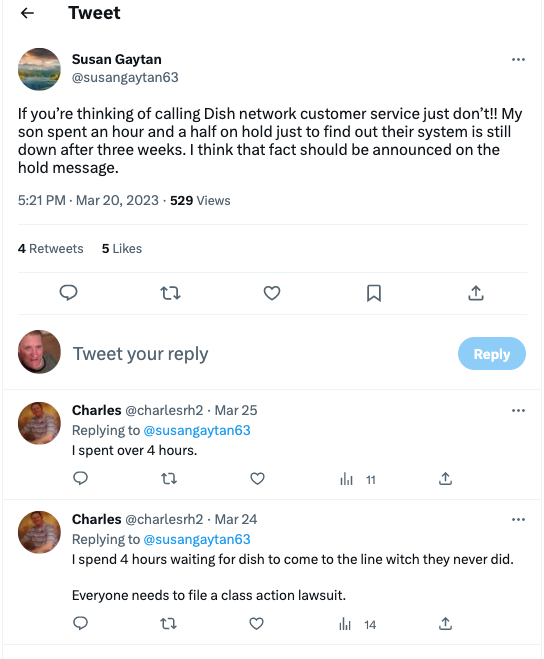

As this Dish customer tweet shows, pay TV and wireless subscribers are still struggling with billing problems and other Dish-system-related issues a month later. It's hard to tell how many customers Dish has lost over all of this.

Dish’s stock price plunged about 6% in the immediate aftermath of the cyberattack, which began February 23. But really, the company's Nasdaq price had already started plummeting from a 2023 high of $15.60 a share on February 2. As of this sentence-typing, Dish is trading at $9.01.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Indeed, Dish has as many as 99 problems, and the cyber attack is just one of them.

On Monday, UBS Securities analyst John Hodulik downgraded Dish from “buy” to “neutral,” citing not just the cyberattack, but myriad other issues related to Dish’s pricey 5G national network buildout.

“We now factor higher wireless dilution amid Dish’s entry into postpaid wireless in late ’23, while enterprise/wholesale 5G is taking longer to scale and the cyber incident (impacting call centers/online channels for weeks) adds pressure that is hard to quantify,“ wrote Hodulik, briefly summarizing Dish’s wireless transition challenges.

And Hodulik wasn't alone, with BofA Global Research already downgrading Dish a month ago.

“Coupled with elevated capex, [free cash flow] trends are increasingly negative for the next two years,” BofA said in its investor note. “Management is confident it has capacity to finance its current business objectives, but notes the company will need to raise ‘equity-linked’ capital to address 2024 obligation and raise new debt, likely spectrum-linked, in ’25+.“

Ironically, on February 23, just as Dish’s cybersecurity issue was beginning, company chairman Charlie Ergen pitched Wall Street on the notion of patience — sure, capital expenditures are really high right now, but Dish was on its way to entering the lucrative post-paid wireless business … and with that, a kind of Valhalla of free cash flow.

“Our network’s gonna start generating a lot of cash,” Ergen said. “So it’s déjà vu for me — back in the DBS business, once we launched our satellite we had a period of time where we had to work out the kinks. Once we did that, we started to generate a lot of cash. Like a slot machine — put a dollar in and got two dollars back every time you got a customer. We're in a very similar situation now.“

Notably, during that hourlong discussion with press and equity analysts, Ergen and his executive team didn't mention the brewing cyberattack once. ■

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!