Stations Reaped a Blackout Bounty

Retrans disputes reached another record in 2020, according to ATVA

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

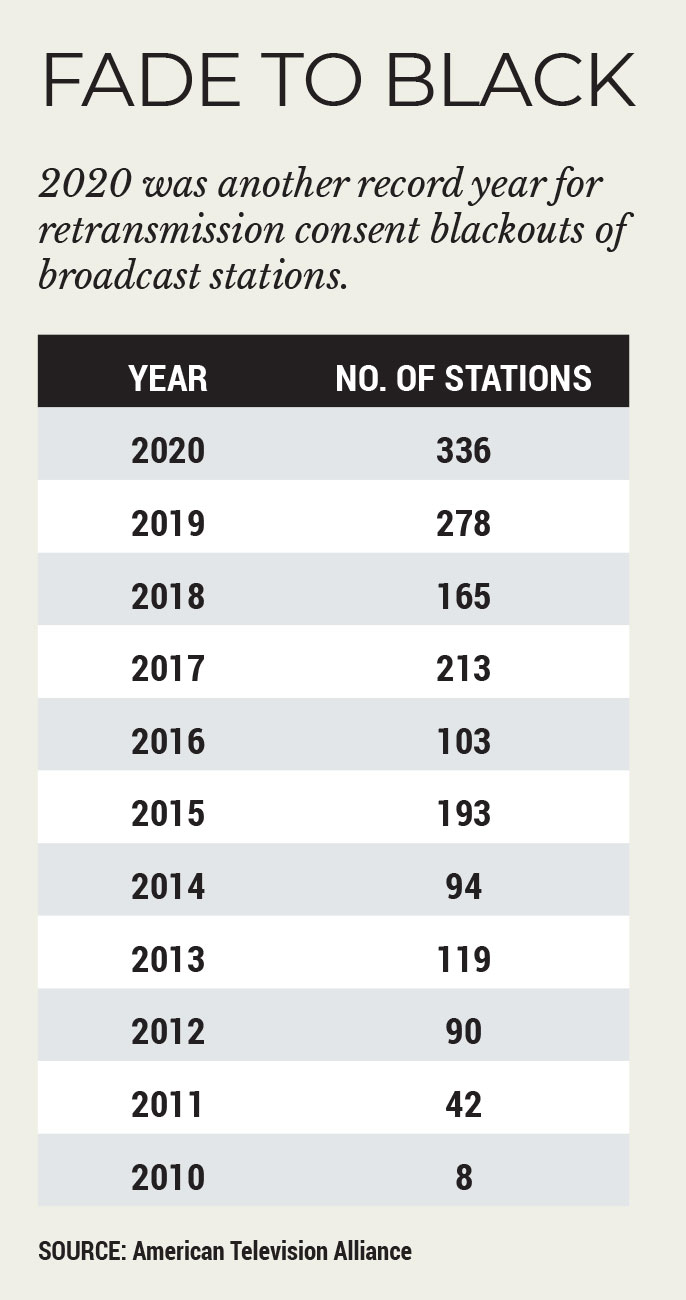

While the end of the year appeared to be pretty quiet on the retransmission-

consent front with only a few disputes ongoing in 2021’s first week, 2020 was another record year for blackouts, as 336 broadcast stations went dark to pay TV customers vs. 278 in the prior year, according to industry group the American Television Alliance.

In a statement, ATVA said the broadcast industry’s use of blackouts as a negotiating tool, especially during a pandemic, was outrageous and reiterated its call for regulatory reform. Whether that will come in a new administration with obviously bigger concerns is anyone’s guess.

Retrans revenue has become an important part of broadcasters’ bottom lines, and the industry has long said its content has value to distributors that far exceeds the fees they pay for that content.

Either way, retrans revenue is expected to continue to rise, albeit at a slower pace than in the past. According to Kagan, a unit of S&P Global Market Intelligence, retrans fees were expected to increase by about 2.5% to $12.2 billion in 2020, rising 5.7% to $12.9 billion by 2023.

Blackout periods in 2020 ranged from just two days (Hearst Television’s Jan. 3- 5 dispute with DirecTV involving about 25 stations) to the 59 days (Jan. 18 to March 16) that Dish Network customers were without 18 stations in New York, California, Louisiana, Mississippi, Idaho, Oregon and Washington owned by Northwest Broadcasting.

As far as ongoing disputes, most were limited to smaller pockets of the country.

At press time, Mediacom Communications, which negotiated a successful retrans deal with Gray TV stations in 35 markets on Dec. 28, was still in talks with Tegna, which darkened 16 stations in 19 markets including Davenport, Iowa, and Decatur, Alabama, to the cable company’s customers on Dec. 31. Three stations owned by GoCom Media in Central Illinois went dark to Cable One customers in that area on Dec. 31. Those stations, WSRP/WCCU (Fox) and WBUI (The CW) in Springfield, were still unavailable as of Jan. 7.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Also on Dec. 31, Alaskan cable operator GCI lost access to ABC, Fox and The CW stations owned by Vision Alaska and Coastal Television. In a statement, GCI said it continues to negotiate with the stations for their return, but added the broadcasters are asking for “a 40% rate increase that is not the best outcome for GCI and our valued TV customers.”

Capitol Broadcasting darkened three North Carolina stations — WRAL (NBC) and WRAZ (Fox) Raleigh-Durham and independent WILM Wilmington — to Dish customers on Dec. 31.

There are also a couple of deals pending. Cable One is facing a deadline of Jan. 11 to reach a retrans agreement for WICD, Sinclair Broadcast Group’s ABC affiliate

in Champaign/Urbana, Illinois; and Cox Media Group said six of its stations in

Tulsa, Oklahoma; Memphis, Tennessee; Spokane, Washington; Eureka, California; Greenville-Greenwood, Mississippi; and Alexandria, Louisiana could go dark to Suddenlink Communications customers “soon.” Talks between both parties were ongoing at press time.

In a press release, Cox Media, owned by private-equity giant Apollo Global Asset Management, was pretty vague, but seemed to be setting the stage for a fight.

“Rather than reach a fair and reasonable deal with CMG, Suddenlink may instead choose to adversely impact their customers,” the broadcaster said in its release. “Now, more than ever, viewers need daily access to important and evolving information on the pandemic, and social and political issues.”

At press time, Suddenlink parent Altice USA said it was in negotiations with Cox Media, adding that the broadcaster was demanding “higher rates than we pay any other broadcaster,” but seemed to hold out hope a deal could be reached.

Charter-NBCU Deal Feathers Peacock

Other larger retrans deals were made as the year progressed. Comcast’s NBCUniversal struck a comprehensive carriage agreement with Charter on Jan. 7 spanning its cable and broadcast networks, as well as an extended free trial for NBCU’s Peacock streaming service. Charter also agreed to distribute the Peacock app via its Spectrum guide in the future.

Tegna darkened about 60 stations in 52 markets to AT&T’s DirecTV and U-verse TV customers on Dec. 1, but hammered out a deal with the satellite and IPTV services on Dec. 20. Dish Network weathered the loss of 164 Nexstar Media Group stations in 115 markets for about three weeks, eking out a deal Dec. 24. The main sticking point of that negotiation, carriage of Nexstar’s WGN America cable channel, was settled, with Dish agreeing to carry the network on its Sling TV virtual MVPD in “early 2021.”

Comcast reached an agreement with Hearst on Dec. 15, a full 16 days before its deal officially expired, for stations in about 35 markets. Dish reached a retrans agreement with 14 Cox Media stations on Dec. 13, ending a blackout that had started back in July. Terms of all of these deals were not disclosed.

Hearst TV also inked deals with Verizon Fios TV on Jan. 1 for stations in Baltimore; Boston; Harrisburg, Pennsylvania; and Pittsburgh.