Reading the WarnerMedia Tea Leaves

Restructuring spurs talk that more changes could be underway

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Five years after its grand content experiment began, continued restructuring at AT&T’s WarnerMedia business has two top analysts that follow the stock speculating the telco is asking for a do-over.

A report in The Wall Street Journal earlier this month citing people familiar with the company said that “thousands” of layoffs at WarnerMedia could be coming in the next several weeks, part of ongoing efforts to reduce costs at the programming unit by at least 20%. It was the second part of a restructuring that began in August that saw top executives like WarnerMedia Entertainment chairman Bob Greenblatt and chief content officer Kevin Reilly leave, as new WarnerMedia CEO Jason Kilar continued to put his imprint on the unit. In an Oct. 4 interview with the Journal, AT&T CEO John Stankey, who ran WarnerMedia just six months ago, hinted that even assets housed within its flagship HBO and Turner brands, gleaned through its 2018 $108.7 billion merger with Time Warner, could feel the executioner’s axe.

Sale Speculation

Stankey used Turner’s Cartoon Network as an example, telling the Journal that the network becomes less valuable for every hour consumers watch its programming on HBO Max instead of the linear channel. But he said he wasn’t ready to jettison Cartoon yet.

Nevertheless, in a research report, MoffettNathanson principal and senior analyst Craig Moffett said that Stankey’s characterization sounded a lot like a “trial balloon of perhaps selling Cartoon Network.”

Other streaming reorganizations have occurred throughout the industry, and The Walt Disney Co., which restructured its operations around Disney Plus earlier this month, is a prime example. But at AT&T, which has struggled with its media strategy nearly from the get-go, pressures to maintain its dividend, pare down debt and bolster its wireless business are forcing it to look for ways to raise quick cash.

Possible asset sales are mounting up. AT&T is reportedly entertaining offers for its satellite-TV business, DirecTV, whose purchase in 2015 for $48.5 billion ($67 billion including assumed debt) kicked off the telco’s bold entrance into the media business. According to the New York Post, offers for DirecTV are coming in the $15 billion to $20 billion range, about one-quarter what AT&T paid for it. Also on the block: AT&T’s Xandr interactive advertising unit, which was earlier expected to take advantage of the 170 million customer relationships throughout AT&T’s product portfolio; and Vrio, formerly DirecTV Latin America, which withdrew its IPO in 2018.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Stankey told the Journal that the moves were part of a “wash-repeat cycle” that the company has used to fuel growth for decades, adding that AT&T’s balance sheet “has always been used as a strategic tool.”

Moffett stressed that he has no direct knowledge of AT&T’s reasoning for the layoffs and divestitures. “But the pattern is clear: 1) AT&T is trying to sell almost anything that isn’t nailed down; 2) they are, by and large, getting a disappointing response to the assets being offered for sale; 3) they are therefore left to dramatically cut costs, even in businesses that are ‘core’ to their latest version of AT&T.”

Concerns Over Scale

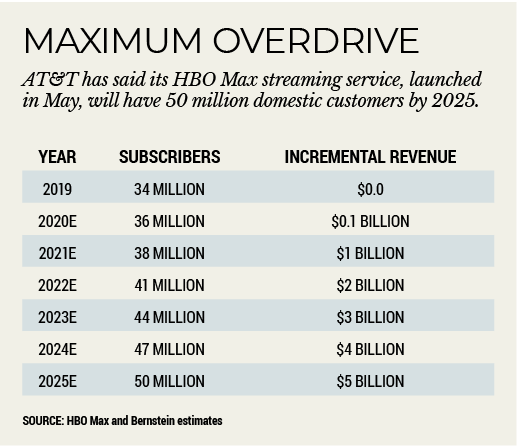

Moffett isn’t alone in his thoughts. In a telecom black-book report issued Oct. 13, Bernstein media analyst Peter Supino said that HBO and Turner are “suddenly sub-scale and their audiences are under assault. With management instability and difficult industry trends, we think Warner Media is the next shoe to drop for AT&T.”

Supino applauded AT&T management for running a solid telecom business, “but in today’s rapidly evolving, increasingly competitive video market, we think they are way outside its circle of competence.”

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.