Islands in the Streams

Despite early growth spikes, analysts caution that not all streaming services are alike

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Discovery Plus and Paramount Plus, the two latest big entrants in the streaming wars, came out of the gate swinging, but despite some impressive early subscriber-growth numbers, some analysts were wary of what appear to be very lofty valuations.

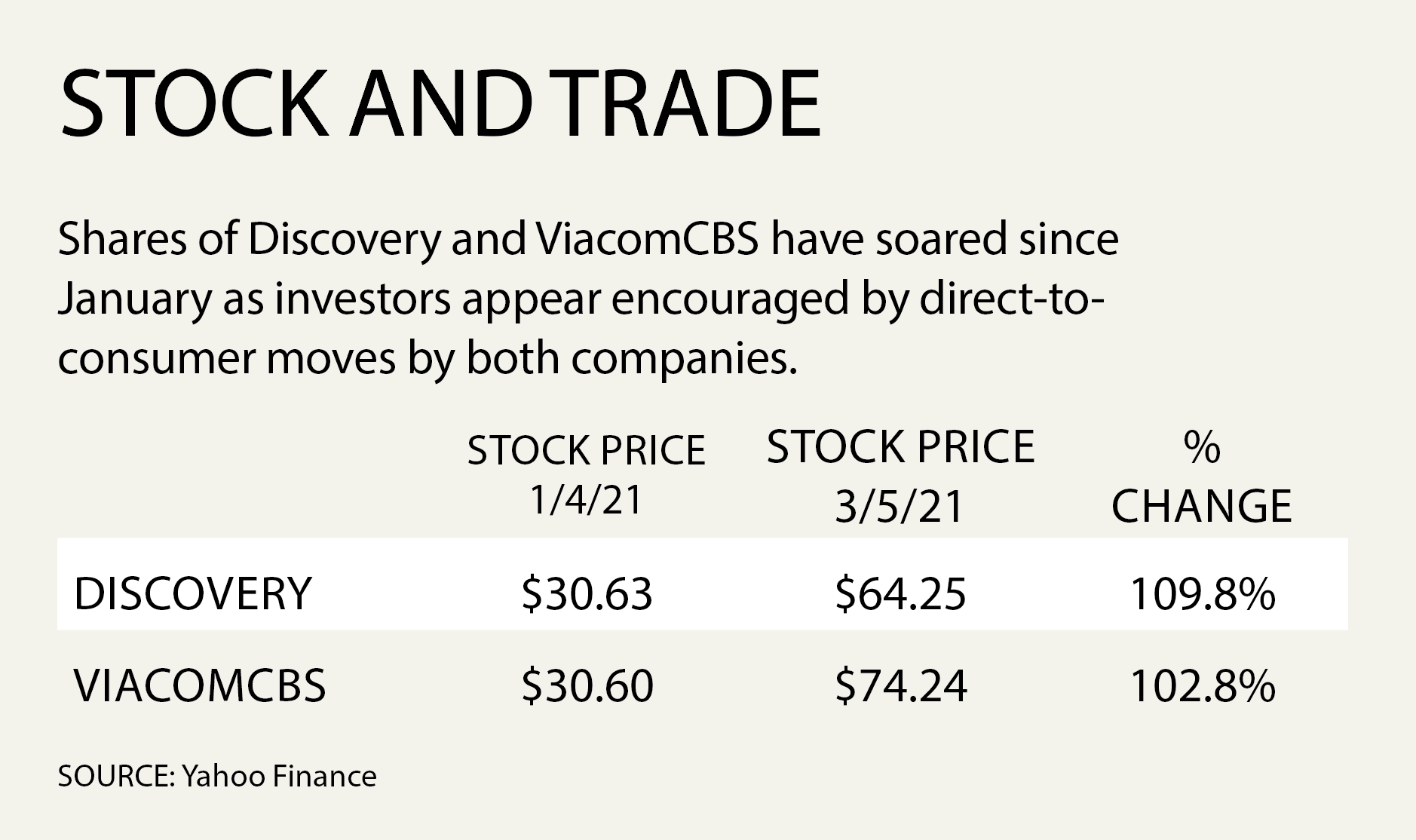

Discovery launched Discovery Plus on Jan. 4 and about seven weeks later said the service had attracted about 11.3 million global subscribers and was on track to finish February with more than 12 million customers. That impressive growth — about 7 million more subscribers than the 5.2 million Discovery said the service had in December, just prior to its official debut — helped drive the company’s stock price to the stratosphere. Discovery shares have more than doubled since the Jan. 4 launch of Discovery Plus from $30.63 each to $64.25 on March 5.

There was some question as to how many of those 7 million additions were actual paying customers. Discovery has a promotional agreement with Verizon Communications where customers of the telco’s unlimited wireless plan the streaming service for free for six months. For the most part, though, analysts were cautiously optimistic about the service’s growth potential.

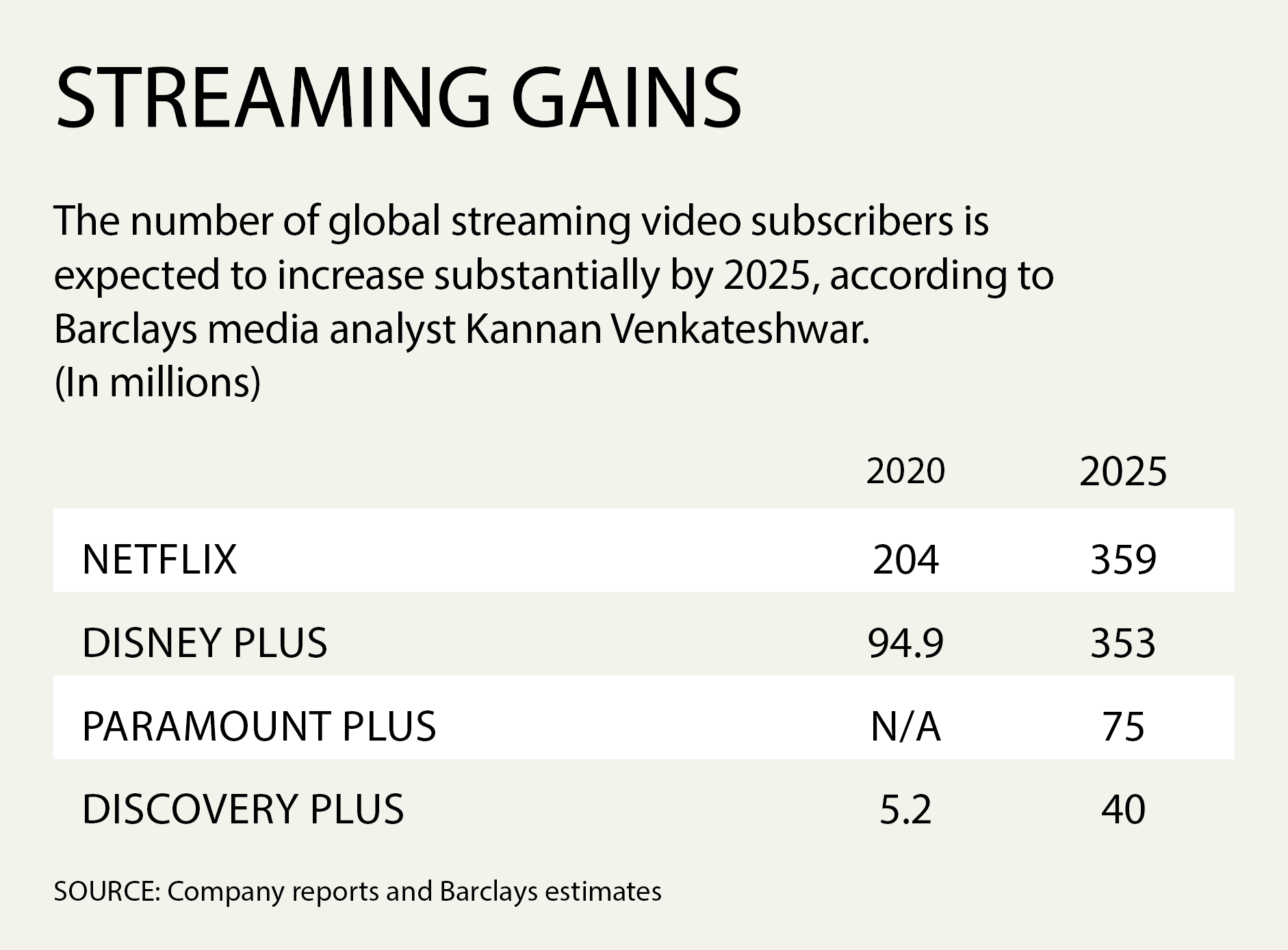

“More than half of these net additions appear to have come from the U.S., which is likely benefitting from the Verizon promo,” Barclays media analyst Kannan Venkateshwar said in a February research note. “While the headline figures are encouraging, it is tough to know what the underlying economics for this base are at this stage.”

Paramount Plus Hits Heights

At the same time, enthusiasm has been strong for ViacomCBS’s Paramount Plus service, which launched globally on March 4. While the company hadn’t released subscriber figures for the new service, a beefed-up version of its former CBS All Access offering with new and library content from all of the programmer’s networks, mobile analytics company Sensor Tower estimated there were about 900,000 downloads of the Paramount Plus app during its first two days. Some analysts expect Paramount Plus to attract as many as 75 million customers by 2025.

ViacomCBS stock has been on a similar run as Discovery based on that streaming enthusiasm. Shares have doubled since Jan. 4 from $36.60 to $74.01 on March 5.

Since November 2019, when The Walt Disney Co. launched Disney Plus, streaming has been the only part of the video content business that has excited Wall Street. While the space has been dominated by three heavy hitters — Disney Plus, HBO Max and Peacock — there are other smaller offerings from programmers like AMC Networks (AMC Plus), FuboTV, Pluto TV and more. Sports-centric FuboTV stock reached 545,000 subscribers in Q4, a 73% increase over the prior year period, which helped drive up its stock more than 10% at the beginning of the month.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

But it is just those stock price increases that have some analysts scratching their heads.

Recalculating Linear TV’s Value

In a research note in late February, Bernstein media analyst Todd Juenger wrote that Discovery was trading at about 16 times its 2023 estimated cash flow and ViacomCBS was trading at about 25 times 2023 cash flow. By comparison, Facebook trades at about 16 times cash flow estimates and Google about 17 times.

“We understand there are plenty of smart investors who are less negative than us on the decline of linear TV, and a more positive than us on the DTC potential for these companies,” Juenger wrote. “But does anybody really believe Discovery and ViacomCBS have similar/better growth and sustainability than Google and Facebook?”

Wells Fargo Securities media analyst Steven Cahall, who puts Discovery’s stock multiple at about 15 times cash flow and ViacomCBS at about 13 times, also had no explanation for the market’s valuation of the shares. He estimated that Discovery was trading on about 10 times core EBITDA and 5 times forward direct-to-consumer revenue. For ViacomCBS, he estimated the split was 9 times on core cash flow and a similar DTC valuation.

“We cannot fully explain the changes to valuation but our gut is that it has more to do with non-Media issues (e.g. low rates, Growth to Value, retail/quant, de-risking) than Media (e.g. DTC, improving economy for ads),” Cahall wrote. “... it’s the unknown unknowns to worry about, the things we don’t know we don’t know. We can’t explain these stock reratings fully, which means we can’t tell if they’re defensible or if they’re fleeting. As long as that’s the case, the market will chase valuation rather than be normative (our current tact as well), and for Media investors we simply advise to limit or hedge exposure in these three stocks until the dust settles.”

In a March note to clients, Venkateshwar proposed a new way of valuing legacy media companies like Disney, Discovery and ViacomCBS that have pivoted toward a growth business like streaming based on customer lifetime value. For many companies that have entered the streaming realm, he noted, cash-flow estimates for the new service make up the bulk of their enterprise values in the early days. He pointed to Discovery and ViacomCBS, where the next three years of estimated EBITDA account for 42% and 45% of their respective enterprise value. For Disney, it’s 19%.

Juenger continued that the multiples are so far beyond his estimates as to the value of those businesses that “it’s not much worth debating next quarter’s or next year’s advertising or distribution revenue or margin or [free cash flow], or whether 7 million DTC net adds in launch quarter (at mystery ARPU) is awesome/ok/terrible.”

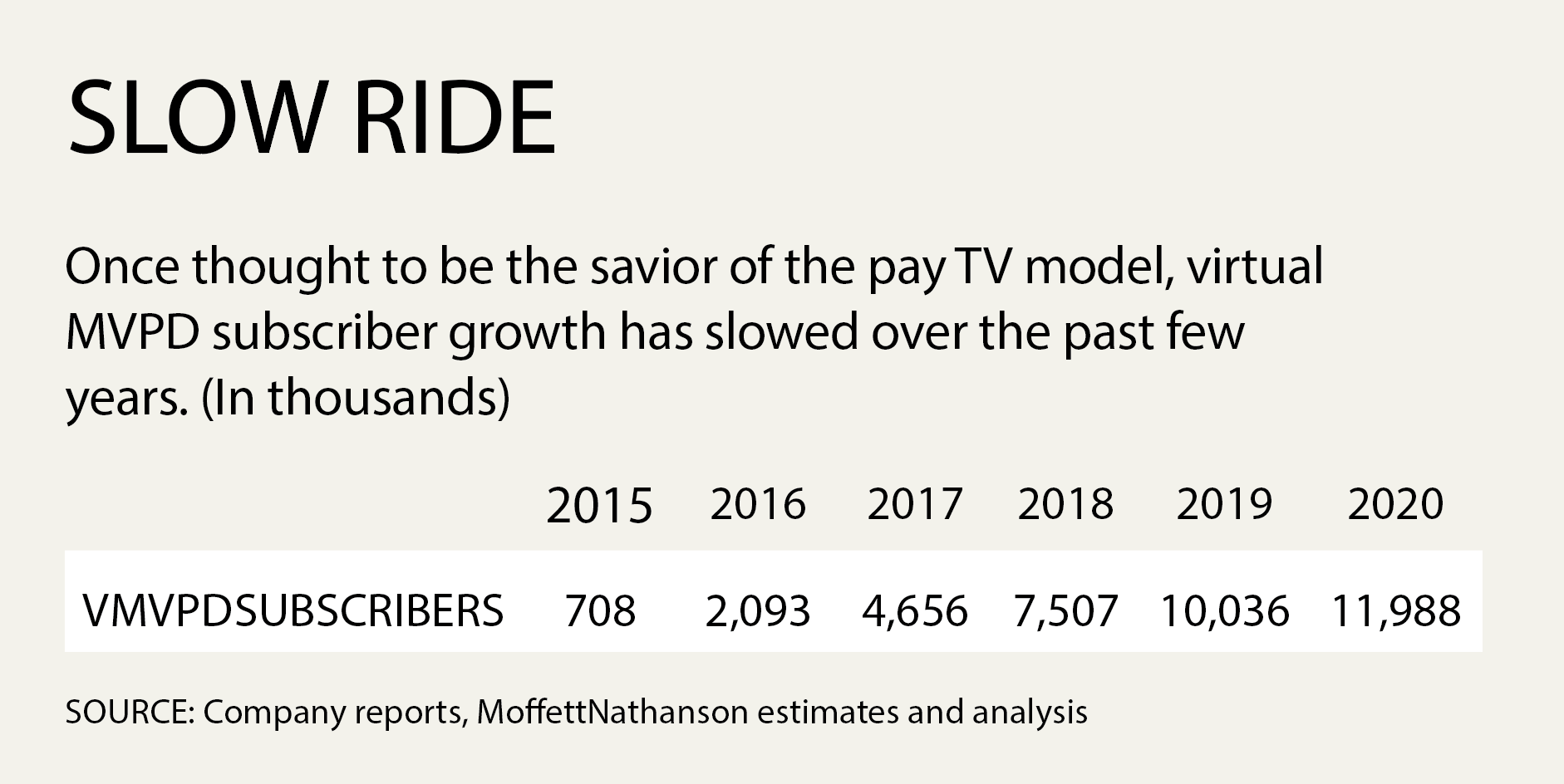

Discovery Plus and Paramount Plus joined “old school” streamers Disney Plus (launched on Nov. 12, 2019), HBO Max (launched on May 27, 2020) and Peacock (launched nationally on July 15, 2020) to compete for consumer entertainment dollars just as the traditional pay TV market hit another all-time low. Multichannel video programming distributors (MVPDs) — cable, satellite and telco TV companies — lost a collective 6 million subscribers in 2020, another record decline in what has been a steady stream of “worst-ever” years. Pay TV subscriber losses have broken records every year since 2015.

At the same time, virtual MVPDs like Sling TV, YouTube TV, Hulu Plus Live TV, Fubo TV and Pluto TV started to show some signs of slowing down. Hulu Plus Live TV lost about 100,000 customers in Q4, while the entire segment itself added about 515,000 new customers in Q4, less than half the 1.3 million it added in Q3.

vMVPDs Don’t Meet Expectations

In a research note, MoffettNathanson principal and senior analyst Craig Moffett wrote that whether the vMVPD segment’s nearly 12 million customers is impressive is still up for debate, it still has fallen far short of the expectations of just a few years ago. Back in 2015, when vMVPDs were expected to capture almost all of the subscribers shed by traditional distributors, the hope was that the segment would save the pay TV category. Now, as vMVPDs have increased prices — Hulu Live and YouTube TV each charge about $65 per month — the segment has become like much of the rest of the video industry, a pricing play.

“What has become increasingly clear is that SVOD and AVOD are simply better mousetraps for a very large number of customers, particularly those who aren’t sports fans,” Moffett wrote. “The problem they are trying to solve is not means of distribution — frankly who cares whether the bundle is delivered encoded in MPEG or IP? — but instead one of price. For most customers, the answer is not to replace the existing bundle of networks at a somewhat lower price, but instead to blow up the bundle entirely and replace it with SVOD and AVOD subscriptions that are by almost any measure a better solution.” λ

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.