Cover Story: Charter's 'Giffen Good'

Operator of the Year drives strong growth during pandemic with high-value products

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Charter Communications’ success over the past few years, to hear chairman and CEO Tom Rutledge say it, is due to the ability of its employees to execute a relatively simple strategy: Offering high-value products at reasonable prices with top-notch customer service. And it doesn’t hurt to have a “Giffen good.”

For non-economics majors out there, a Giffen good is a product that, despite its higher price, continues to be in high demand. For 19th century Scottish economist Sir Robert Giffen, who coined the phrase in 1890, that product was bread. For Rutledge and Charter, it’s broadband. And in the cable business, broadband is everything.

Related: Charter's Wild, Wild West

Charter, the Multichannel News Operator of the Year for 2020, has managed record broadband and positive video subscriber growth during the pandemic by sticking to its game plan, initiated more than four years ago when it completed the purchase of Time Warner Cable. Back then, Rutledge and his team set out to make Charter’s plant across its 41-state footprint fully digital (achieved in 2018), to roll out DOCSIS 3.1 (completed in 2018), to uniformly align products and packaging across all markets (as of Q4 2019, 85% of its customers were in Spectrum pricing and packaging) and to raise broadband speeds (in 2019, it raised the minimum speed to 200 Megabits per second for 60% of the footprint and that rate continues to grow; the remaining 40% are at 100 Mbps). Four years later, the company is reaping the benefits of those investments.

Charter, in the words of Sanford Bernstein media analyst Peter Supino, is “making its own luck.”

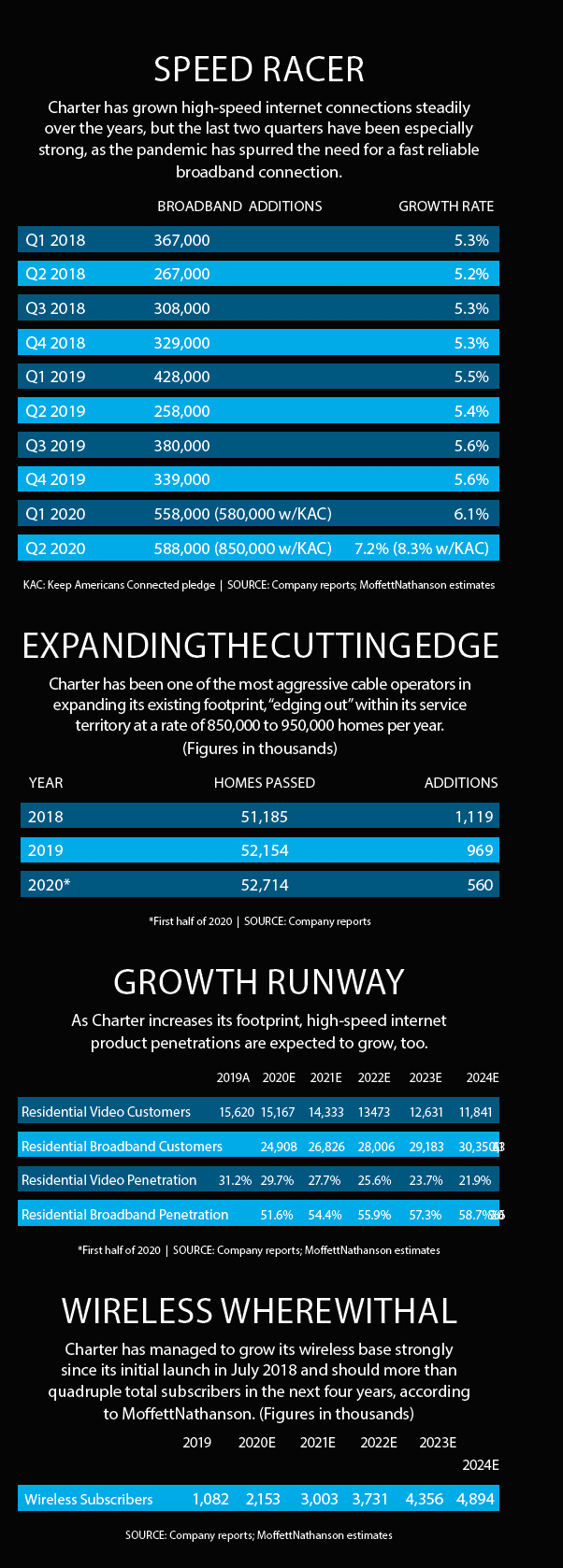

Record-Setting Year

In the second quarter — the height of the pandemic — Charter added a record 850,000 broadband customers, outpacing the old mark, set in Q1, by nearly 50%. It also managed to grow residential video subscribers by 102,000 and wireless customers by 325,000. So far this year, Charter has added 1.4 million broadband customers (more than double last year’s gains) and is the only publicly traded cable operator to show positive video customer growth (32,000) for the first half of 2020.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

In a research note, Barclays Global media analyst Kannan Venkateshwar was impressed with Charter’s ability to grow video subscribers as other multichannel video programming distributors (MVPDs), including Comcast, are losing video customers at an accelerated pace. In Q2, Comcast lost about 427,000 video customers (up from a loss of 209,000 in Q2 2019), while other publicly traded operators like Altice USA and Cable One also saw video subs decline at an accelerated pace.

“It is also quite remarkable that in a world where every MVPD is managing the video business for cash, Charter is growing video subs, which is likely because of the revenue growth impact of video on overall cable and on headline broadband revenue growth,” Venkateshwar wrote in a note to clients.

Rutledge has a reputation of downplaying his own role in the success of the company, and that hasn’t changed. He gives all the credit to Charter’s 95,000 employees in the field and in the trenches, who’ve managed to steer the company toward record growth in the midst of a worldwide pandemic. At the Goldman Sachs Communacopia conference earlier this month, he pointed out that having the right product also is a big part of Charter’s success.

We do believe there is an economic model that works that we can build some of the underserved rural markets that we’re in.

Tom Adams, EVP of field ops, Charter

“The product is really valuable,” Rutledge said at Communacopia. “The product is valuable from a price perspective, relative to all the things you can spend your money on, particularly if you have nothing better to do. It’s a very attractive product — the ‘Giffen good,’ so to speak as an economic notion. It’s worth a lot of money, even in a down market. Our demand is up, our churn is down, and our ability to execute is pretty good.”

Cord-cutting will likely continue, Rutledge agreed, adding that future success across Charter’s product lines will depend in large part on the strength of the broadband service. And the operator is doing all it can to ensure that broadband growth continues on an upward slope for the foreseeable future.

“We look at our future in video as more of a video store of a whole range of kinds of products, including tiers, sports channels, traditional video products, linear products, AVOD products and making that an easy transaction for the customer, and making that part of the overall connectivity experience," Rutledge said at Communacopia. “We think we can continue to do that and that is the fundamental aspect of video that we’re interested in.”

The health of the video business will continue to depend on the sustained growth of broadband: As Rutledge noted, satellite-TV customers who switch to Charter’s Spectrum video offerings often buy a broadband connection, too. And broadband growth is showing no signs of letting up.

“As they come loose from their satellite relationships, they are reevaluating their broadband connections as well,” Rutledge said.

The COVID-19 Conundrum

The demand for broadband has become even more pronounced during the pandemic. When most states began implementing work-from-home orders and mandating remote learning for students, having a reliable, fast internet connection became a necessity.

Charter, like other operators, scrambled to make its workplaces safe and to switch call-center employees and field operations to remote working status. There were some hiccups: Some complained that call centers in some areas were slower than others in letting workers do their jobs remotely. Charter, as an essential employer, remained open and leadership continued to come into the office to support essential front-line workers. Employees who could work remotely have been doing so since March, including more than 50% of call center operators shifting to remote work. As regions across the country have begun to open up, Charter is moving to a hybrid schedule of remote and office work in accordance with CDC guidelines.

Charter raised hourly pay for frontline workers by $1.50 per hour and increased the minimum wage for hourly workers by $1.50 per hour from $15 per hour. It also pledged that in 2022 all hourly employees will have a starting wage of $20 per hour or more. Charter gave workers an additional 15 days of paid COVID-19 flex time — not including paid quarantine time — and continued to pay its direct sales team when they were not allowed to go door-to-door (wages plus six-month average commission). There were no furloughs or layoffs in that time.

At its retail operations, Charter was able to deal with the shift in customer needs: Demand for and questions about broadband service spiked as more and more communities fell under work-from-home orders. Senior VP of Spectrum Stores and retail Pattie Eliason said that Charter, which managed to keep most of its retail operations open during the pandemic, was up to the challenge.

The retail operations have been undergoing a massive overhaul. Charter currently has about 430 retail locations and plans to end this year with about 530 stores. The goal is to finish 2021 with about 685 retail locations.

It’s a refreshingly simple story: They told you what they were going to do, they’ve done it and it’s working.

Craig Moffett, analyst, MoffetNathanson

The idea is to make the retail stores a focal point for new customers, driving interest in new products and services. While customers were initially full of questions regarding broadband service, Eliason said, that has expanded into other areas such as wireless. The retail operations have helped with overall subscriber growth, she said.

“We’re very sales-focused,” Eliason said. “Consumers who have never thought about Spectrum are walking in the door and asking questions.”

In addition to mobile, broadband and video service, customers are asking about adding landlines, a product that in the past had been on the downswing, Eliason added.

“People want to have a solid landline in their homes,” she said. “It definitely has increased overall in what we’re doing. Honestly, with people in the pandemic and being home, they wanted the safety of an extra landline.”

Charter managed to keep most of its Spectrum stores open throughout the pandemic, Eliason said, which to many customers was a needed breath of fresh air.

“Customers were so thankful we were open, “ Eliason said. “They needed the service and they needed it now.”

That meant gearing up to get customers the equipment they needed to self-install the product and making sure there were answers to their questions. While traffic at the stores slowed during the pandemic’s first days — transactions were down about 50% early on — they have recovered to about 90% of what they were. In the meantime, Charter has significantly modified the way it does business in the retail locations.

“We have redone how we do everything,” Eliason added. “All of our employees wear masks, we have a social-distancing floor, so people know where they need to stand, we have plexiglass up, sanitizing at all times, making sure we’re following all the CDC guidelines. The biggest part is making sure the customers feel comfortable in all of the stores, as well as our employees.”

Charter also is limiting the stores’ capacity to about 50%, putting greeters outside each location to let customers know they can book appointments online and come back to the store later, rather than wait.

The importance of the broadband product was evident by the Federal Communications Commission’s initial reaction to the pandemic, creating the Keep Americans Connected pledge. Just about every U.S. cable operator, including Charter, agreed to the pledge, promising to not disconnect any broadband connection for lack of payment during the pandemic. Charter, like other operators, also extended its free broadband offering to low-income homes with school-age children to ensure kids were able to learn remotely.

While the KAC pledge may have skewed the broadband numbers a bit, the company and most analysts believe that the bulk of those customers will be retained.

In a research note, MoffettNathanson principal and senior analyst Craig Moffett said even without the KAC and Remote Education Offer-related customers, Charter added 588,000 broadband customers in the period, a record for the company. Charter’s broadband growth rate was an “extraordinary” 8.3%, including KAC and REO, and 7.2% without, still its highest level since Q4 2016, according to Moffett.

“The COVID crisis has shone a spotlight on the criticality of digital infrastructure and all cable operators have benefitted from the superiority of their broadband facilities,” Moffett said in an interview. “Charter, over the long term, is the best positioned cable operator because they have all the tailwinds of broadband’s ascendancy, but they also have a longer runway for margin expansion and free cash-flow growth.”

Maintaining the Growth Curve

But that leaves a question in every cable investor’s mind: Can Charter keep that momentum going? Analysts who follow the company said Charter is making moves to add more homes passed to ensure just that.

Like other operators, Charter has been extending its reach within its service territory, adding homes that are in the footprint but not receiving service. It has a lot of room to do that: Charter passes about 53 million homes in 41 states, and last month crossed 30 million customers, a major milestone but one that leaves room for growth.

As part of the conditions for approval of its Time Warner Cable acquisition, Charter agreed to build out about 2 million additional underserved homes across the country and has been adding between 850,000 and 950,000 homes passed per year since 2015.

The buildout program is just one of the many tasks that come under the purview of executive VP of field operations Tom Adams. Even in a pandemic construction continues, said Adams, who has overseen the buildout, adding more than 1.5 million homes in the last two years.

Adams said Charter learned a lot from those early buildouts. “We learned what the hurdles were, administrative requirements to get on the poles, the difference in the quality of the infrastructure in rural America.”

Adams said the pace of the buildout will rely on economics, which varies depending on the geography. While he wouldn’t say how many more homes the company plans to add to the footprint in later years, he said Charter is committed to the program.

“We would certainly like to build [out] more of rural America in the future,” Adams said. “We do believe there is an economic model that works that we can build some of the underserved rural markets that we’re in, and we’re going to make an effort to go after that in the future.”

According to Moffett, the popularity of broadband service has made the economics of extending the network even to the most sparsely populated rural areas attractive.

In a research note, Moffett said extending fiber into an urban area used to cost operators from $1,000 to $2,000 per home passed. For rural markets, where the runs are longer and the number of homes passed is lower, that figure could balloon to as much as $4,000 per home passed.

But rural markets, with fewer competitors, have much higher opportunity to sign up passed homes for service. Moffett wrote in his note that while 40% to 50% penetration rates could be assumed for urban builds, in rural markets 80% penetration rates are not unreasonable. That return on investment makes the higher costs more manageable. An urban market with a 50% penetration rate implies a cost of $4,000 per home, while a rural market with 80% penetration implies a cost that is just 25% higher, according to Moffett.

“Suddenly, secondary markets look in many ways more attractive than primary markets,” Moffett said in an interview. “Ten years ago, everybody thought that the densest urban markets were the place to be, with the best advertising revenue and the lowest cost to serve. Today, the exposure to secondary markets with lots of rural adjacencies that allow for insistent edge-outs are more attractive than urban markets. You tend to see less broadband competition, you tend to see better new household formation, particularly now that people are fleeing the densest urban areas, and you have the longest runway for broadband growth.”

Wireless Takes Hold

While broadband growth has grabbed all the headlines, Charter has also made huge progress on the wireless front, adding 325,000 customers to its Spectrum Mobile service in the quarter, well above analysts’ expectations. Charter’s footprint expansion program, which largely involves rural markets, could prove to be a big help to the wireless side of the business, as well.

Charter launched Spectrum Mobile in July 2018, part of a mobile virtual network operator deal with Verizon Communications. Spectrum Mobile debuted a few months after Comcast exercised the same MVNO, and in the last year and a half has grown strongly, ending the second quarter with 1.7 million subscribers.

Charter is participating in the federal Rural Digital Opportunity Fund (RDOF) auction, a long-term program encouraging wireless companies to expand into rural markets and close the digital divide. The first phase of RDOF includes $16 billion in funding over 10 years. The second phase is a $4 billion program to extend wireless into underserved areas.

Charter has acknowledged participating in the auction, but because of quiet-period restrictions, has had to limit its conversations about the program.

But Moffett expects Charter to be a significant player in the RDOF auction. He expects “the longer growth runway provided by RDOF participation to be a welcome development for investors increasingly focused on broadband subscriber growth as the single most important metric to watch.”

With that many growth irons in the fire, Wall Street has taken notice. This year, Charter’s stock is up about 30% to $630.07 each as of Sept. 16, and its share price has nearly tripled from $227.41 each just after the Time Warner Cable merger was completed.

That performance has got to feel like a bit of a vindication for the Charter team. As one analyst put it, it wasn’t that long ago when, after a light quarter or two and the impending threat of streaming video casting a dark cloud over the industry, many in Wall Street were calling for Rutledge to step down and the TWC merger a failure. That Rutledge — who said on Charter’s Q2 analyst call that he would like to remain chairman and CEO beyond 2021, when his contract expires — wants to stick around is a clear indication that he is confident the company’s run of good luck will continue.

“We think Rutledge’s desire to remain at the helm is a bullish fact in that it supports confidence in management’s conviction about the company’s ability to gain market share, efficiency and cash flow for the long term,” Supino said in a recent report. “Remember, it was only six quarters ago when some on Wall Street were calling Charter’s TWC acquisition a flop and calling for a new CEO.”

Most of that turmoil was due to what some investors believed at the time was an indifference to deals, to the detriment of Charter’s stock. Market chatter was heavy concerning possible interest from Verizon, Japanese wireless company Softbank and even Altice USA, all of which never materialized. Rutledge and the rest of the Charter family weathered the storm by keeping their heads down and executing the plan.

“Tom is one of these rare CEOs that is just as comfortable with high-level strategy and economics as he is with nuts-and bolts-operations,” Moffett said. “There was a time when he was viewed as the consummate operator, but I think what has become clear to investors over the past 10 years is he’s a remarkably thoughtful economist and has really good insights into the economics and broad strategic issues in front of the cable industry.”

To its credit, Charter has managed to keep the message uncomplicated in an increasingly complicated business.

“I don’t think they’ve done anything that differently than anyone else,” Moffett continued. “It’s a refreshingly simple story: They told you what they were going to do, they’ve done it and it’s working.”

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.