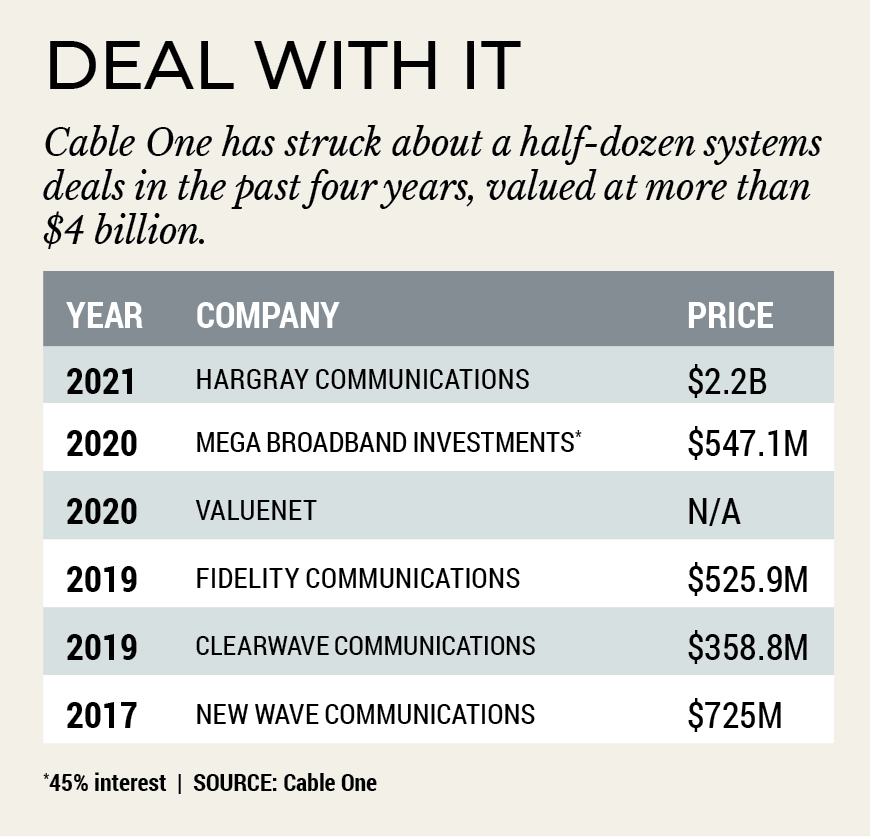

Cable One Buys Hargray in $2.2 Billion Deal

Transaction is sixth in four years for Arizona-based cable operator

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Cable One has agreed to buy the remaining 85% interest in Hargray Communications it didn’t already own in a transaction that values the company at about $2.2 billion.

Cable One, based in Phoenix, swapped its Anniston, Alabama, system to Hargray for a 15% interest in the company in October. With the most recent deal, Cable One will own 100% of Hargray, contributing a mix of cash, equity and debt financing for the remaining 85%. The deal is expected to be completed in the second quarter.

Publicly traded Cable One said the deal will give it an expanded presence in the Southeastern market — Hargray operates in 14 locations across Alabama, Florida, Georgia and South Carolina — and allows it to tap into Hargray’s fiber expertise.

“This transaction will also serve as a potential platform for future organic and inorganic growth in the region as we look to continue to expand our footprint,” Cable One CEO Julie Laulis said in a press release. Cable One said Hargray generated about $128 million in earnings before interest, taxes, depreciation and amortization (EBITDA, a measure of cash flow) on an annualized basis in Q4 and it expects to realize about $45 million in annual run-rate synergies within three years of the close of the deal.

The purchase price represents a robust multiple of about 17.2 times Hargrave’s annualized EBITDA, and 12.7 times cash flow assuming the synergies are realized immediately. Recent deals, like TPG’s sale of Astound Broadband to Stonepeak Infrastructure Partners, were valued in the 14 times range.

Cable One will fund the purchase with a combination of cash, debt and issuing new equity. The company said it has received a $900 million bridge loan from J.P. Morgan and Credit Suisse to finance a portion of the deal.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Cable One has been an aggressive buyer of properties over the past few years. In October, it said it would buy a 45% interest in Mega Broadband Investments, parent of Vyve Broadband, for about $547.1 million. The most recent deal would be its sixth transaction since 2017, when it purchased New Wave Communications for $725 million